Contents

How to Take Control of your Employee’s Fuel Reimbursements

Leen Shami

•

•

Many companies require in-person meetings, site visits, or attending events. Whatever the business-related travel may be, fuel reimbursement comes into the picture.

What is Fuel Reimbursement?

In a nutshell, fuel reimbursement is when an employer reimburses you for the cost of fuel used for business purposes.

While other countries may consider this a travel expense or a mileage reimbursement, the UAE considers this a 'fuel reimbursement.'

{{take-control-banner="/components"}}

Why Did Reimbursing Travel Expenses Grow?

In a post-pandemic world, where many companies are going back to the norm of office work, it is common for travel reimbursement costs to increase.

The mileage reimbursement rate has risen with regular office hours, more in-person meetings, and less remote work. But that's not the only reason.

Due to the surge in fuel costs globally, it's no surprise that consumers are becoming more aware of their travel expenses.

The UAE alone has seen a significant spike of 74% in fuel prices and petrol prices over the last 7 months, indicating that reimbursing travel expenses grew.

Subsequently, UAE companies have seen a 38% increase in fuel reimbursements and travel reimbursement requests from their employees. Inflation alongside a post-pandemic world, fuel reimbursement expenses have become the most requested reimbursement category in the UAE.

A study by Bayzat has shown that fuel is among the most requested reimbursements category for UAE employees, with an increase of 18% in the average amount per reimbursement since January.

This indicates that companies and employees have spent more time managing and filing fuel reimbursement expenses.

Unsurprisingly, the cost of average travel reimbursements has increased with the significant spike in fuel prices and petrol prices these past few months.

With Pluto's corporate cards, companies can wave goodbye to everyday fuel reimbursement expenses' pain points by issuing their employees fuel cards to keep track of their fuel expenses and travel reimbursement costs.

{{cta-component}}

Why Use Pluto Fuel Cards For Fuel Reimbursement?

There are many advantages to using Pluto fuel cards for business travel expenses:

Create unlimited fuel cards

Create and distribute as many virtual or physical fuel cards as needed for your employees, so you won't have to worry about travel expenses, mileage reimbursement requests, or having to reimburse employees.

Set limits on fuel cards

Create fuel cards for employees with daily, weekly, or monthly spending limits to keep track of employees' fuel expenses.

.jpg)

Track fuel expenses in real-time

It's essential to keep track of what is being spent and where. With Pluto, you can:

- Get notified as soon as a fuel expense is made so you know who spends what, where, and when.

- Keep track of average travel reimbursements' costs, travel expenses, and employee expenditure data to avoid going over budget on fuel expenses.

No more end-of-month expense reports on fuel!

Digitized receipt reconciliation

Whether your employees are using personal vehicles or company vehicles, they can simply make a transaction with their personal card, snap a picture of the receipt and upload it to the Pluto dashboard for fuel reimbursement.

Alternatively, UAE companies can issue their employees virtual or physical cards, and the receipt can be attached to the business expense by dragging and dropping it onto the Pluto dashboard.

No more searching through piles of paper receipts!

Fill up your tank anywhere

Once you issue your UAE employees a virtual or physical fuel card, they can use it at any gas station in the UAE for business travel expenses.

While requested reimbursements for fuel expenses grew over five-fold over the past couple of years, there is a solution to make CFOs' and finance teams' lives easier; Pluto Card.

With Pluto, finance teams have an all-in-one integrated platform for fuel reimbursements, budget & spend control for business travel expenses, and fuel receipt reconciliation.

Fuel Reimbursement vs. Mileage Reimbursement

When looking for information about fuel reimbursement, another term that you may stumble on frequently is mileage reimbursement. While they are similar and sometimes interchangeable, they are not the same.

What is Mileage Reimbursement?

Mileage reimbursement refers to the practice of reimbursing employees for business-related travel expenses.

While it accounts for fuel, it also considers lease, vehicle depreciation, and other car-related expenses. This type of reimbursement is usually given per mile driven.

In some countries, mileage reimbursement refers to accounting rules and categories that help standardize expenses.

What is Fuel Reimbursement?

Fuel reimbursement, on the other hand, only covers the cost of fuel used for business travel. It doesn't take into consideration any other car-related expenses. This type of reimbursement is usually given based on receipts.

The difference between fuel reimbursement and mileage reimbursement is that mileage reimbursement takes into account all car-related expenses, while fuel reimbursement only covers the fuel cost.

How Does Fuel Reimbursement Work?

If you use your car for business purposes, you can be reimbursed for the fuel costs incurred. The reimbursement is usually calculated based on the number of kilometers traveled or miles driven.

However, to qualify for fuel reimbursement, you will need to keep accurate records of your travel expenses. This includes maintaining a logbook of your travels and keeping receipts for all fuel purchases.

To ensure that employees are reimbursed correctly, they need a receipt and an accurate logbook. Fuel and travel expenses can be included as costs, but you must show all travel logs if necessary.

What Counts as Business-Related Fuel Reimbursements?

Here are some examples of obvious and less obvious fuel expenses that you can get reimbursed for when you are an employee:

- Traveling for a client meeting;

- Driving to pick up anything on behalf of the company;

- Driving to the airport to pick up a client or a colleague;

- Going to another city for a business-related event;

Anything done to advance the business, big or small, is business related.

Is Commuting to Work a Business-Related Expense?

While some big corporations may reimburse you for commuting to and from work, typically, commuting is not considered a business expense.

What to Track For Fuel Reimbursement?

Keeping a gas log is one of the best ways to ensure employees are correctly reimbursed while companies have a clear overview of their travel expenses.

Last but not least, when you put fuel reimbursements into your profit and loss statement to apply them as costs (which you should), you must have a detailed log of travels - in case the tax authority wants a record.

Here is the main employee expenditure data that you should store in your fuel reimbursement logbook:

- Date of each journey

- Start time and end time of driving.

- Purpose of the trip.

- Kilometers driven.

If a company provides employees with company cars, this is all. But, if you're filing for fuel reimbursement while traveling with your personal vehicle, you will have to provide the following:

- Brand of the car and the year it was made.

- Average fuel consumption as per the car documentation.

- Engine size or engine capacity.

- Copy of car technical documentation.

Does an Employer Have to Pay For Fuel?

Most companies reimburse fuel expenses for employees who need to travel for business, but there might be some limitations. For example, a company may ask you to use its corporate Careem account for business travel.

Typically, if you incur the cost of fuel, your company will reimburse you as it is a cost tightly associated with the business.

Is Fuel Reimbursement Tax Deductible?

A massive shift for UAE companies will be the introduction of corporate taxes in 2023. With a corporate tax rate of 9%, UAE companies must keep track of all their spending. Fuel reimbursements fall under that category, as they can help reduce the amount of taxable income that a company has.

If you have a fuel reimbursement policy in place, it will help ensure that all of your employees are mindful of their spending on fuel and that they only claim back what they have spent.

Pluto allows UAE companies to issue unlimited fuel cards while centralizing the expense in one dashboard, so you can see in real-time how much is being spent and the number of tax-deductible costs your employees are making.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Leen Shami, Content Marketing Lead

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

How to Improve the Accounts Payable Management Process for Healthy Working Capital

Accounts payable (AP) is the money you owe vendors and creditors, i.e., short-term liabilities. These are the payments for goods and services you received that are yet to be cleared.

Companies struggle to manage accounts payable because the process involves multiple stakeholders, and the workflow isn't clearly laid out. The teams have to handle hundreds of documents, including purchase requests, purchase orders, goods received notes (GRN), invoices, etc. and ensure there isn't any discrepancy with the order received.

So, decentralized approvals and verifications make the process chaotic before the team can clear the final payment. If you find yourself in a similar situation, where accounts payable is hectic, and the working capital is messed up, read this post to discover the top strategies for effective accounts payable management.

{{less-time-managing="/components"}}

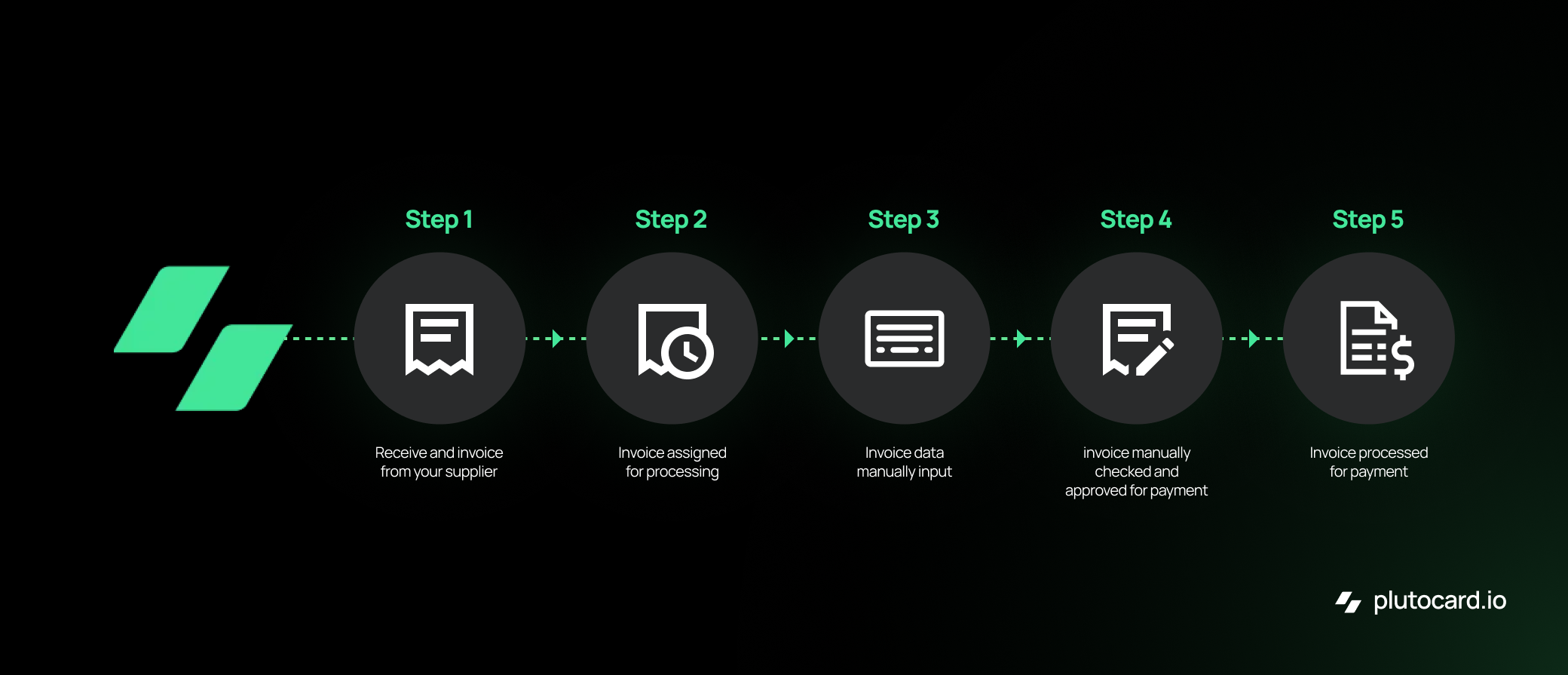

What is the Account Payable Process?

The AP process starts upon receiving goods and an accompanying invoice for payment processing. The next step involves verifying the accuracy of the invoice details. This verification process ensures that the goods received match the information provided in the invoice, including quantities, prices, and other relevant terms.

Following the confirmation, the invoice undergoes an approval workflow. It involves obtaining the necessary authorizations from various departments or individuals within the organization and ensuring compliance with internal policies and procedures before proceeding with the payment.

After completing the payment, the accounts payable team records the transaction in the financial system, updating the company's records. This step ensures accurate financial reporting and maintains an up-to-date overview of the company's financial position.

Challenges of the Decentralized Accounts Payable Process

Companies strive to maintain a seamless flow of goods and services while meeting financial responsibilities through timely and accurate AP management. However, relying on a manual process for these tasks introduces these bottlenecks:

- Managing documents manually raises concerns, particularly with paper-based documents that are susceptible to misplacement or damage. It not only hampers day-to-day operational efficiency but also poses a threat to data integrity.

- Similarly, a manual verification process increases susceptibility to mistakes. Achieving precise alignment between received goods and invoice information requires meticulous attention, heightening the possibility of overlooking crucial details such as terms and conditions.

- The manual handling in the approval workflow introduces risks of delays and potential oversights. Obtaining authorizations from different departments becomes time-consuming, and ensuring compliance with internal policies is prone to human errors.

- After completing the payment, the critical step of recording the transaction in the financial system becomes vulnerable to manual data entry errors, impacting the precision of financial reporting and the clarity of the company's financial standing.

- The manual process increases the likelihood of inadvertently paying the same invoice multiple times. Inaccurate data entry and a lack of robust authentication processes expose the organization to fraud, including the manipulation of invoices.

In summary, the manual accounts payable process detrimentally affects operational efficiency and financial stability. The lack of synchronization across different teams results in communication gaps and discrepancies. Failing to maintain a cohesive and streamlined process leads to errors in financial reporting, impedes effective decision-making, and strains interdepartmental collaboration.

Strategies for Efficient Accounts Payable Management

Effective management of the accounts payable process is possible when you optimize the human and technological aspects of the same.

On the human side, optimizing requires streamlining workflows, enhancing communication, and fostering a collaborative environment. Simultaneously, the technological part involves shifting to an accounts payable automation solution that provides a centralized platform for complete visibility and control.

Here are the strategies for efficient accounts payable management:

Strengthen Internal Control Over Financial Reporting

Internal control over financial reporting (ICFR) ensures the accuracy, reliability, and integrity of financial information within an organization. ICFR helps safeguard financial processes and mitigate risks as the intricate nature of accounts payable necessitates a robust control framework.

Strengthening ICFR for enhancing accounts payable management involves the following elements:

1. Segregation of Duties

With the segregation of duties, you ensure that no single individual controls all the stages of the accounts payable process. You divide the responsibilities among different staff members, which reduces the risk of errors, fraud, and mismanagement.

For instance, by assigning one team member to handle invoice approval and another to process payments, the segregation of duties minimizes the risk of errors or fraudulent activities and promotes accountability.

2. Audit Trail

Establishing a comprehensive audit trail involves recording and documenting every transaction in a chronological sequence of activities. It facilitates transparency and serves as a valuable tool for tracking and investigating discrepancies that arise during the accounts payable process.

For instance, in the case of an invoice mismatch, a comprehensive audit trail makes it easy to trace the exact steps in the transaction history, revealing where the error occurred. It speeds up the resolution process and enhances accuracy in financial reporting by promptly addressing issues.

3. Approval Policies

Clearly defined approval policies outline the hierarchy of authorizations required for various transaction amounts, ensuring that financial transactions undergo proper scrutiny before processing.

For instance, a clearly defined approval policy mandates that transactions under $1,000 require approval from a department head, while amounts exceeding $10,000 necessitate approval from top-level management.

4. Document Policies and Procedures

Clear documentation outlines specific steps for the accounts payable process. When a team member adheres to these guidelines, all required approvals are obtained, documentation is consistently retained, and errors are minimized.

In practical terms, this means that during an audit, the organization quickly and accurately traces the entire lifecycle of an invoice, showcasing compliance, reducing audit time, and enhancing financial transparency.

By strengthening ICFR, organizations systematically address challenges such as fraud, errors, and inefficiencies.

Employing Technology

AP automation optimizes the accounts payable management process beyond mere operational enhancements, enabling accuracy, efficiency, and informed decision-making. Automating AP management is a strategic approach with the following key elements:

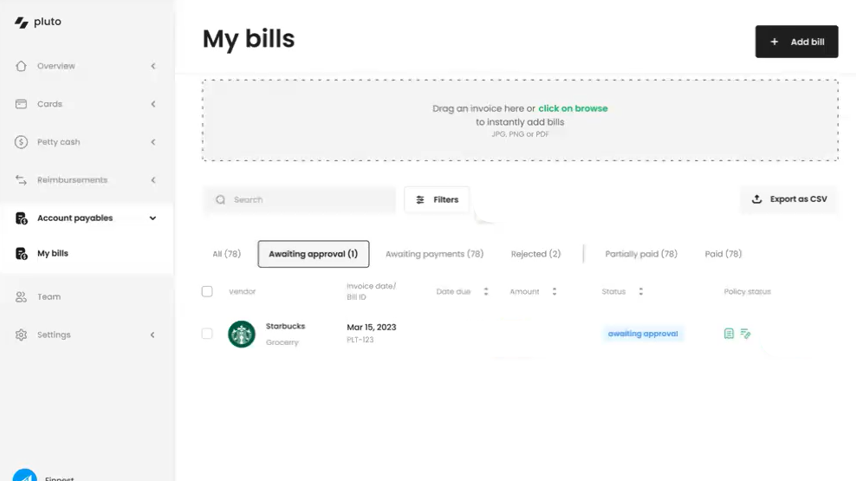

1. Centralized Collaboration

Automation involves centralizing AP management and creating a unified document storage and collaboration platform. Not only does it extract all the critical information, but it also stores them on a centralized dashboard for easy access and processing. This fosters seamless communication among team members, ensuring everyone can access real-time information and collaborate effectively.

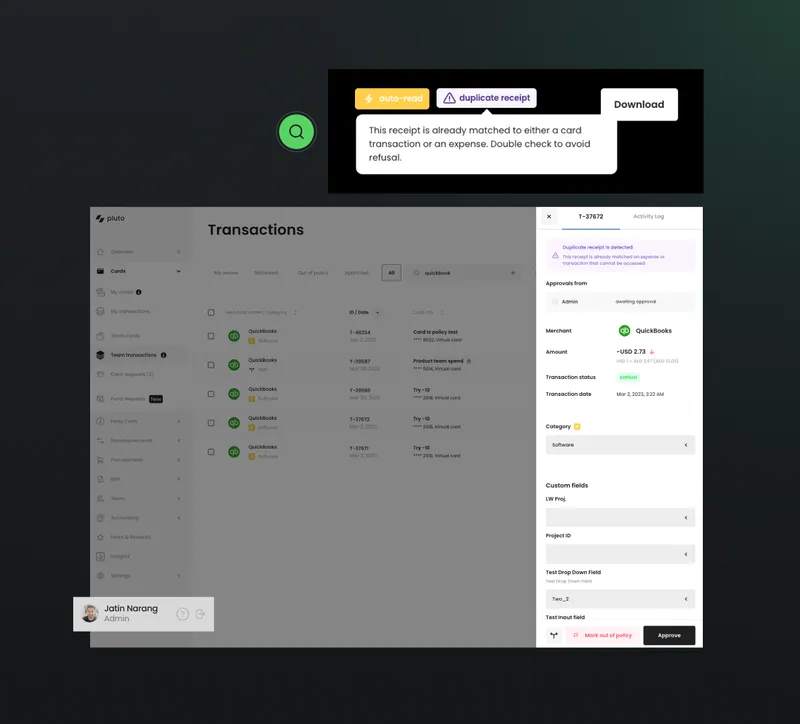

2. Safeguards for Duplicate Payments

Automation includes built-in safeguards to prevent duplicate payments. Automated systems employ checks and validation processes to flag duplicate receipts and eliminate the risk of paying the same invoice multiple times, reducing the likelihood of financial errors. Moreover, since the centralized platform acts as a single source truth, the possibility of double payments automatically reduces.

3. Streamline Workflow

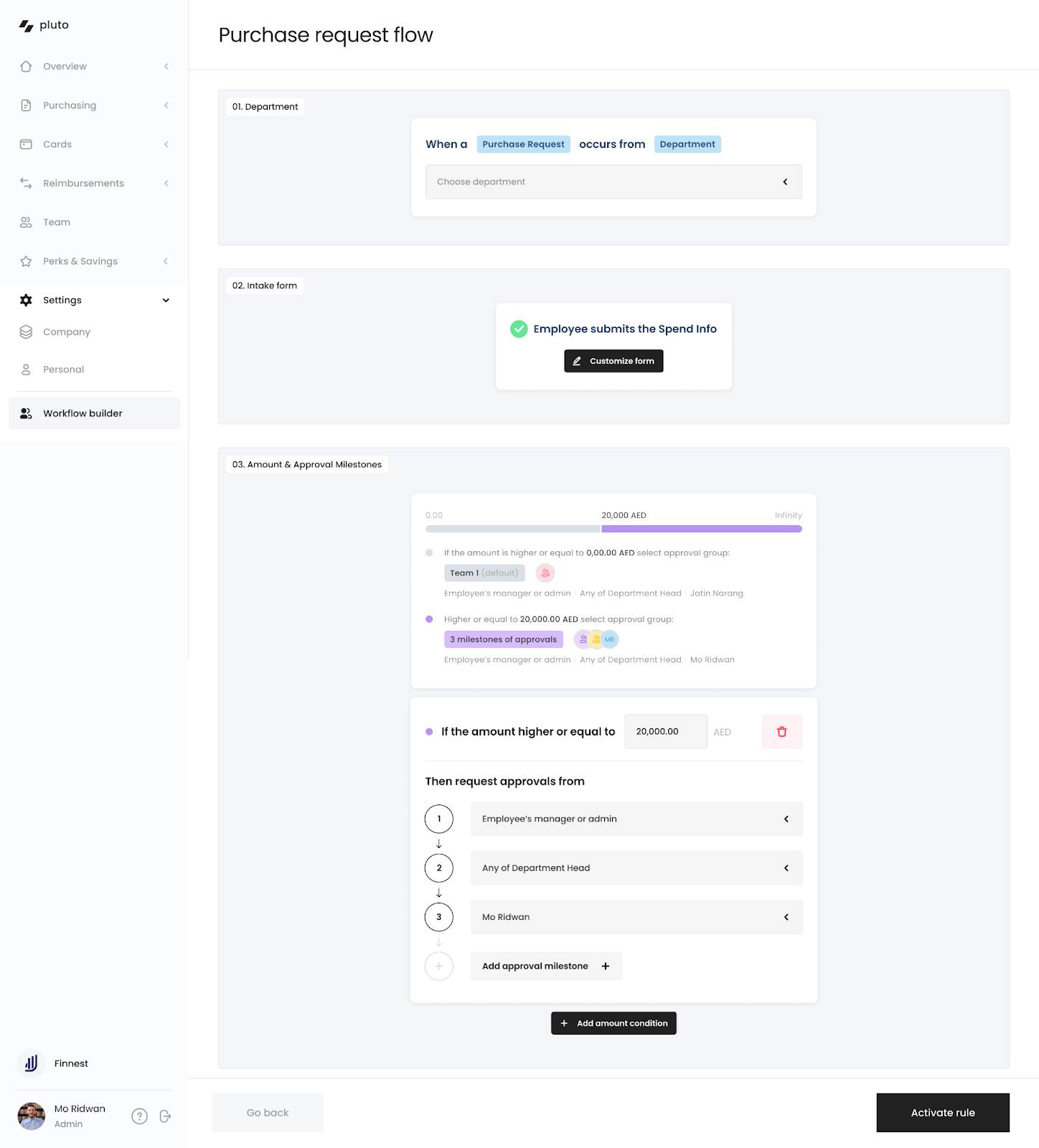

Automated workflows simplify and streamline the entire AP process. With simple if-then rules, you can create workflows for trigger-based approvals. By eliminating manual intervention at various stages, tasks such as invoice approval, payment processing, and data entry become more efficient, reducing processing times and enhancing overall workflow.

4. Integrate

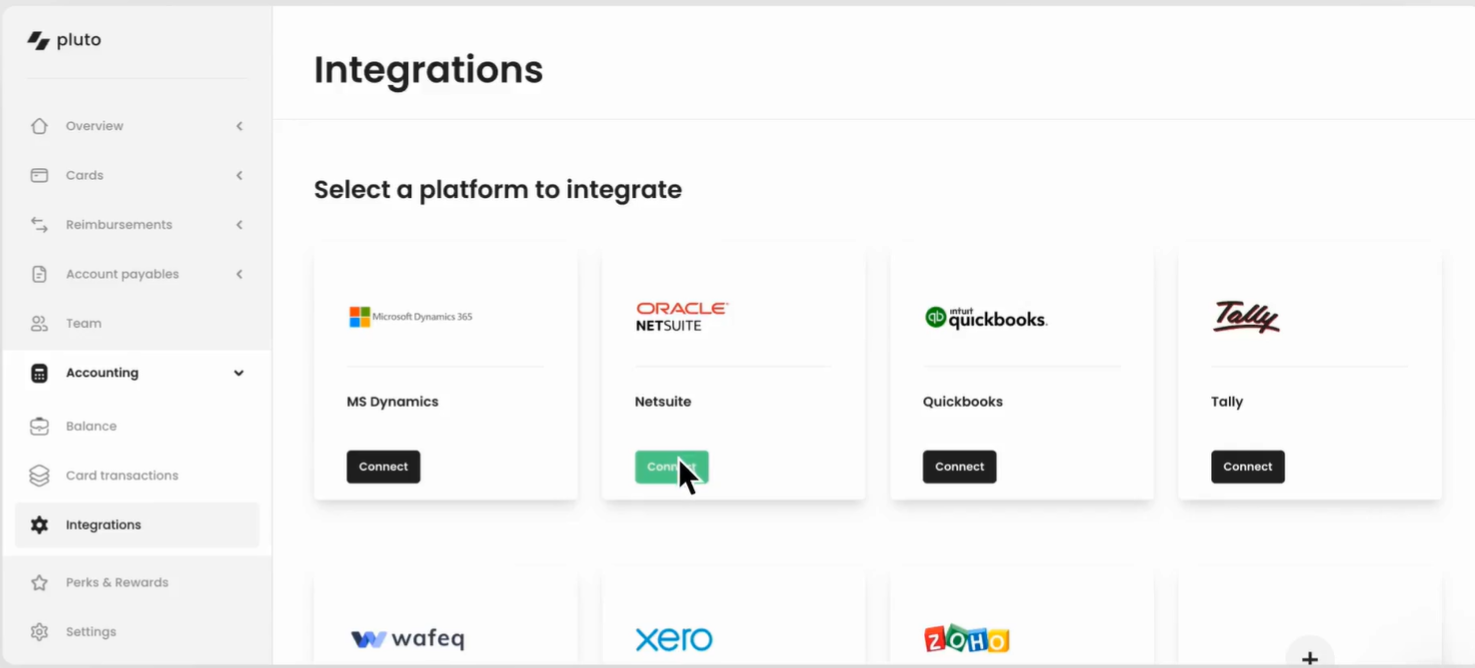

The accounts payable software integrates with other financial systems. This integration ensures a cohesive flow of information across departments, reducing data silos and enhancing accuracy in financial reporting.

5. Insights

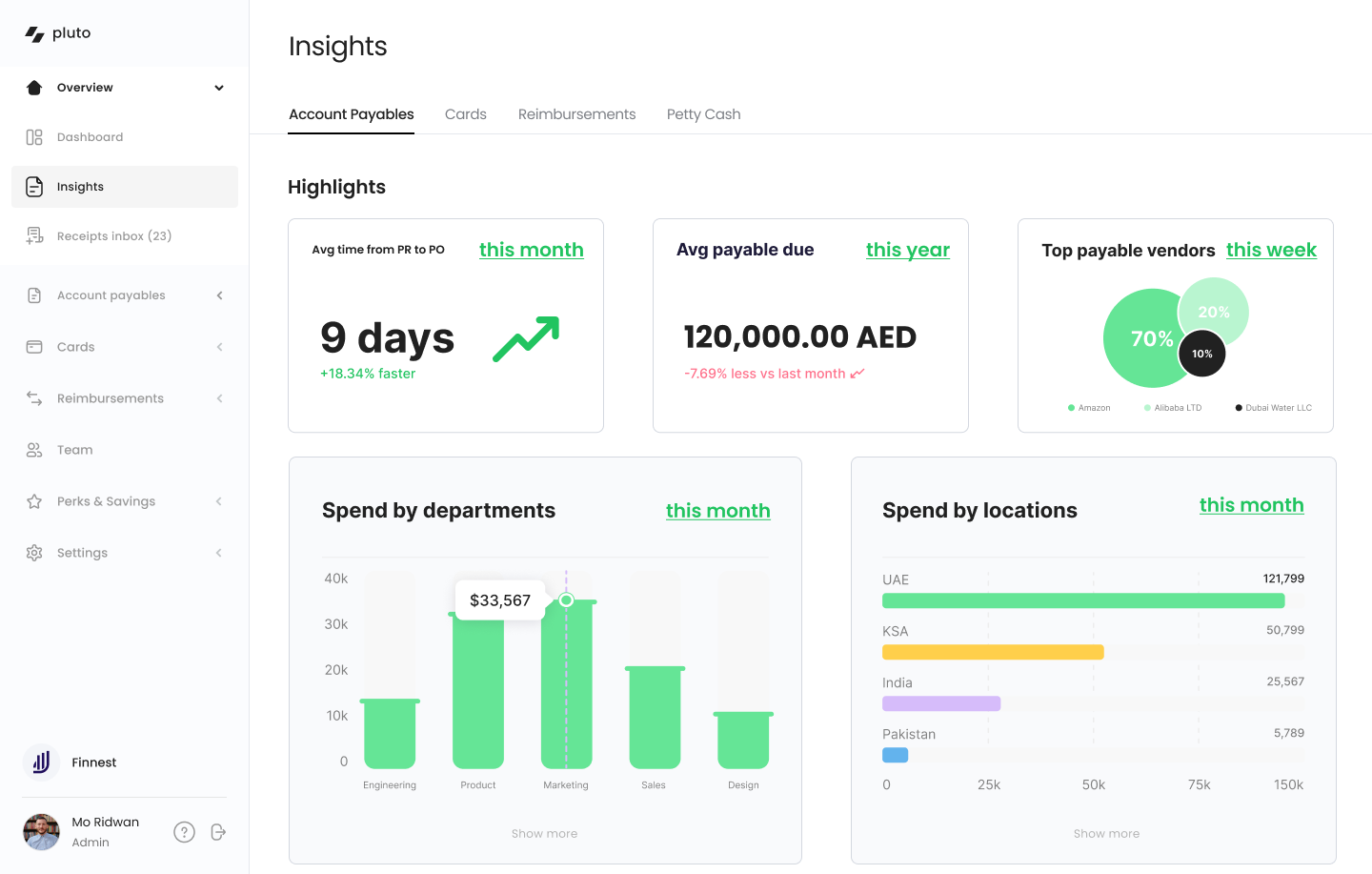

Automated AP systems provide valuable insights through analytics and reporting tools. These insights enable businesses to track key performance indicators, identify trends, and make data-driven decisions. This analytical capability contributes to strategic financial management and planning.

Improve Vendor Relationships

Vendor relationships are not just about successful transactions. Healthy partnerships bring many benefits, such as streamlined processes, minimized disruptions, and a collaborative atmosphere that enhances the overall effectiveness of the accounts payable function within the organization.

Improving accounts payable management involves the following components:

1. Negotiate With Vendors

Initiating negotiations with vendors involves engaging in open discussions about terms, pricing, and contractual agreements till both parties arrive at mutually beneficial arrangements. Compelling negotiation ensures favorable terms for the company and establishes a foundation of trust and collaboration.

For instance, when negotiating with a key supplier for raw materials, the company secures favorable terms such as bulk purchase discounts and extended payment periods. This not only reduces costs but also builds a positive, long-term relationship.

2. Timely Payments

Adhering to agreed-upon payment schedules fosters goodwill and reliability, positioning the company as a trusted and preferred partner. Timely payments strengthen vendor relationships and contribute to smoother transactions and potential benefits such as early payment discounts.

3. Transparent Communication

Keeping vendors informed about payment timelines, potential delays, or any changes in the process contributes to a positive working dynamic. Open lines of communication facilitate problem-solving, creating an environment where both parties feel comfortable addressing concerns and finding resolutions.

4. Streamline Onboarding Process

Simplifying the onboarding procedure by providing clear guidelines, efficient documentation processes, and transparent communication ensures that vendors can seamlessly integrate into the accounts payable system. It saves time and lays the groundwork for a cooperative and efficient long-term partnership.

By implementing these strategies, businesses cultivate vendor relationships that go beyond transactional interactions, fostering a collaborative environment.

End Result: Optimized Accounts Payable Management Process

For storing and retrieving documents, you get optical character recognition (OCR) technology that extracts invoice information accurately. All the information goes on a centralized digital platform, reducing the chance of misplacement and improving accessibility.

For verification, you get all the necessary information on a unified dashboard. This centralized database enables accurate cross-referencing of received goods with invoice details, minimizing errors and making the process more efficient.

You get a no-code trigger-based approval workflow builder for approvals, where you can create workflows with simple if-then rules. These preset rules and automated notifications make authorization seamless across departments, reducing delays, ensuring policy compliance, and lowering the risk of human errors.

For recording transactions, you get integration facilities, where your accounts payable software syncs data across your accounting systems for consistent records, minimizes errors, ensures precise financial reporting, and offers a real-time, accurate view of the company's finances.

Next Steps for Efficient Accounts Payable Management

After establishing transparent processes and policies and adopting the right automation tools, plan an AP audit.

An AP audit involves reviewing and assessing the existing procedures to pinpoint areas that can be improved. By doing so, you identify inefficiencies or bottlenecks in the accounts payable management system. It provides insights into how well the established processes align with the intended goals and whether adjustments are needed.

This proactive approach helps enhance the overall efficiency and effectiveness of accounts payable management, ensuring that the system operates smoothly and aligns with the company's objectives.

Read more about AP audits in our post to understand how they help and how you can prepare for them in advance.

•

Vlad Falin

Procure-to-Pay Process: What it is, Benefits, and Steps Involved

The procure-to-pay process doesn’t mean the procurement process. It is a subset of procurement that integrates purchasing and accounts payable.

Traditionally, the procurement process is scattered across the business, and the procurement team needs help to gain visibility or control. The employees purchase from different vendors, the approval process is chaotic and delayed, the stakeholders are stuck in email threads to review the expenses, and the procurement team struggles to get an overview of the organization’s needs.

Procuring the best goods and services becomes problematic since the team is left with open information loops. As a result, it spends more time optimizing the procurement cost and improving the bottom line.

What is the Procure-to-Pay Process?

The procure-to-pay process streamlines the scattered procurement parts to combine purchases and payments. Instead of a process spread across different software, the procurement process shifts to a centralized platform.

The employees get a dedicated platform to raise purchase requests and obtain approvals. The platform notifies stakeholders, such as managers, legal teams, finance teams, IT teams, and other relevant decision-makers to review and approve the proposals. As a result, the procurement team seamlessly moves to the vendor evaluation and negotiation stage without worrying about approvals or delays. The finance team efficiently handles accounts payable since the purchase and payment process is integrated.

So, while earlier, the purchases were handled solely by the procurement team and payments solely by the finance teams, the procure-to-pay process gives both teams an overview of the process from start to finish. In this post, we will discuss how this procure-to-pay process helps you optimize your procurement function and improve your bottom line.

Why Do You Need a Procure-to-Pay Process?

The procure-to-pay process is not just for your finance team or procurement team. It helps the entire organization to gain resources efficiently. Here are eight ways that demonstrate how moving to a streamlined process benefits you:

1. Visibility

All the relevant stakeholders get visibility into the process and the status. Be it the employee, managers, finance team, legal team, IT team, or procurement team — each one can track the progress without delving into multiple email threads. Additionally, teams get insights that help procurement teams optimize costs with data-driven decision-making.

2. Compliance and Control

You can implement advanced controls, such as customized approval workflows and spending budgets, without micromanaging the teams. You can successfully enforce internal control over financial reporting without creating unnecessary team resentment.

So, for instance, if any expenses or purchases beyond $50,000 require additional approval from the legal and IT team, you can easily configure those controls within the approval workflow.

3. Streamline Workflows

The traditional process demands the employees to go from one office to another or spend days on email and Slack conversations before the managers give the green signal. At times, approval of a critical stakeholder is missed, causing delays and disrupting the workflow.

With the procure-to-pay process, you can create custom workflows depending on the purchase category, department, amount, etc. This accelerates workflow, and all the relevant stakeholders get notified right away.

4. Centralized Management

The procure-to-pay process integrates purchases and payments to bring all the critical information on a single dashboard. As a result, any discrepancies in the procurement process are identified in minutes. The entire procedure accelerates the real-time visibility of each stage.

5. Reconciliation

A centralized management system makes collecting and storing documents easy; additionally, since it integrates purchases and payments, the information syncs across accounting systems and ERPs.

During the audit season, this becomes a blessing where the finance team doesn’t have to chase teams for complete records. Also, it becomes easier to store and lock all the transactions and share these records with external parties.

6. Risk Management

The procurement operation is prone to financial, operational, and reputational risks. With the procure-to-pay process, teams can efficiently manage the vendors, purchase requests, approvals, and payments on a centralized platform in real time. It reduces the risk of fraud, ensures policy compliance, and provides visibility into spending patterns without burdening any team.

7. Insights

You can easily see the inside out of your procurement process, whether you want to know how much the marketing team spends or which vendor costs you the most. It makes it more convenient to reduce procurement costs and optimize purchases to improve the bottom line. Also, as all the information is centralized, there are no gaps or missing loopholes, providing complete transparency of your expenses.

8. Invoice Management

The procure-to-pay process ensures that all the invoices are captured and extracted into a centralized platform. This facilitates two-way and three-way matching without causing delays. Moreover, the reconciliation process becomes easy as all the records are systematically recorded.

So, whether you receive an invoice via email, WhatsApp, or physical copy, you can easily add it to the system without risking losing an invoice.

What are the Stages in the Procure-to-Pay Process?

The traditional procurement process has over nine steps strewed across different platforms. These include identifying goods and services, purchase requests, vendor selection, negotiation, purchase orders, inspection of the goods received, three-way matching, approvals, and payment and reconciliation.

While the procure-to-pay process doesn’t alter these stages, it integrates them for a streamlined workflow. So, earlier, if the approvals took days or weeks, keeping employees and the procurement team on hold, now it only takes a few minutes or hours. You centralize the procurement process and save money and time.

Here are five key stages in the procure-to-pay process:

1. Purchase Request

Employees no longer need to travel from one office to another, seeking approvals manually from managers. The streamlined procure-to-pay process gives employees a centralized dashboard to raise requests and specify their needs. It helps the procurement team to understand what the employee needs as well as examine the purchase details. Moreover, the stakeholders can quickly approve or reject the requests from the dedicated platform.

Administrators add customized approval flows to enforce internal policies. They create trigger-based approval workflows based on the expense amount, category, and department to accommodate intricate hierarchies.

For instance, they have the option to create separate workflows for expenses below $5000 and those exceeding a certain budget. Similarly, they can add specific stakeholders to the custom workflows for minimum friction and delay.

2. Purchase Order

While the vendor evaluation, selection, and negotiation happen on dedicated ERPs, the procure-to-pay process enables you to bring all this information on a consolidated platform. You maintain a synced and consistent database to make purchases faster and more secure.

Pluto integrates with your ERPs and allows you to maintain a centralized vendor database. You can add the vendor directly to the platform and systematically record information. You can add a field in your approval workflow to determine whether the employees are purchasing from a vendor list or a new vendor.

A systematic list helps you consolidate expenses and optimize costs. Moreover, ordering becomes more accessible with a unified platform for raising and approving purchase requests and maintaining an ERP-synced vendor database.

3, Invoice Management

Traditionally, vendors send invoices to a dedicated email or an address. The employees send them for approval and payment. It takes days to clear the expenses. Additionally, the accounting team spends considerable time and energy on maintaining records.

The procure-to-pay strategy reduces this effort and streamlines the procedure. It captures and extracts the invoice from the emails and attaches to a dedicated purchase request and order. This helps the teams match the purchase order, invoice and goods received note (GRN) without juggling multiple platforms.

It pulls all the information with optical character recognition (OCR) technology, reducing manual data entry. Since this platform syncs with the accounting system, the accounting team spends minimal time on data entry.

4. Payment Processing

Processing payments becomes a task when the finance team has to chase employees for invoices and wait for approvals and verification. The procure-to-pay technique centralizes the entire process, giving real-time visibility and helping finance teams make timely payments.

Moreover, with Pluto, you can integrate your procurement software with the payment gateways to ease the payment process further. Also, you get better Forex rates than banks, helping you save more money. Overall, with the approvals and invoices streamlined, payment processing becomes easy.

5. Reconciliation

Reconciliation is the hardest part, even when you perform the data entry and data sync monthly. You risk losing documentation and creating gaps in the records.

The procure-to-pay process consolidates the entire procurement cycle to bring all the critical information on a single platform. There are minimal gaps; records are up-to-date due to real-time tracking and recording.

With Pluto, you can integrate with platforms like MS Dynamics, Oracle Netsuite, QuickBooks, etc. So, with your ERPs and accounting software synced, you can easily record all the transactions digitally and securely.

Pluto further enables you to lock the transactions to avoid fraud once approved. Moreover, you can create view-only access for your records to simplify auditing for external parties.

Improve Your Bottom Line With the Right Procure-To-Pay Solution

Overall, the procure-to-pay process helps you automate your procurement process without changing your approach too much. You just need to find the right solution that assists your procurement process.

We discussed more about this in our procure-to-pay solutions post, where you will find what procure-to-pay software does and how to pick the right one.

•

Vlad Falin

How IT & Procurement Teams Should Evaluate Spend Management Products

In today's fast-paced business world, managing expenses can be a daunting task for IT and procurement teams.

To help you out, we compiled a list of features and functionalities that you should consider when picking your spend management platform.

Spoiler alert, Pluto has them all.

PCI DSS Level 1 Provider

One of the essential features that should be given high importance is the product's PCI DSS Level 1 compliance.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of guidelines and security requirements designed to safeguard payment card data.

The standard was developed by major credit card companies, including Visa, Mastercard, American Express, Discover, and JCB, to ensure that all companies that handle payment card data maintain a secure environment. PCI DSS compliance helps to prevent fraud and data breaches, protecting both the company and its customers.

PCI DSS Level 1 is the highest level of certification a company can achieve for PCI compliance.

It requires companies to undergo a rigorous independent audit to ensure compliance with all 12 of the PCI DSS requirements, including network security, access control, and vulnerability management.

Achieving PCI DSS Level 1 certification demonstrates that a company has a comprehensive and effective security program in place to protect payment card data.

When evaluating corporate spend management products, IT and procurement teams should look for products that have achieved PCI DSS Level 1 compliance to ensure that the product meets the highest security standards.

This will help to ensure that the company's payment card data is adequately protected and that the company is meeting its compliance obligations. By prioritizing PCI DSS Level 1 compliance, IT and procurement teams can help to safeguard their company's reputation and financial well-being.

Being PCI DSS Level 1 compliant is essential for any organization that handles corporate card information, as it provides a high level of security and assurance that the organization is taking all necessary measures to protect its customers’ data.

Pluto Card is proud to be PCI DSS Level 1 compliant. This means that our customers can trust that we have taken all necessary measures to secure their data and protect it from unauthorized access.

We also partner with vendors who are held to the highest security standards, such as PCI or SOC2 compliance.

Passwordless Login

Passwordless login is a secure and convenient way for users to access their accounts without the need for a password. It is an effective way to protect against unwanted access to your account, as passwords can be easily compromised or stolen. By tying your Pluto access with a company email account provided by your organization ensures that when your employees lose access to their company email address they also lose access to Pluto.

At Pluto Card, we understand the importance of passwordless login, and we offer this feature to our customers. With our passwordless login feature, our customers can access their accounts quickly and securely, without the need for a password.

Activity Log And Audit Trails

Activity logs and audit trails are crucial for ensuring strict auditing everywhere. An activity log records all user activity within an application or system, while an audit trail provides a record of all changes made to data within the system.

Pluto Card offers a 7-year audit log, which means that our customers can track critical changes made to their data over a seven-year period.

Data Access

Employees that are using our platform have only as much access as they need, and we have infrastructure redundancy built into Pluto, which means that all compute and data is run in multiple geographies.

Business continuity is paramount at Pluto - to this end, we ensure data redundancy with redundant backups in multiple geographies as well.

In addition, at Pluto, your application data is always encrypted in transit, and at rest.

Continuous Security Scans

Pluto also provides a continuous security scan, which tackles multiple dimensions, including code or dependency vulnerabilities, infrastructure, and public endpoint scans.

Our customers can be assured that we take security very seriously and are always on the lookout for any potential security threats.

In the event of a security incident, we have an immediate incident response plan in place and will notify impacted customers without undue delay of any unauthorized disclosure of customer data.

24x7 Customer Support and Dedicated Account Manager

In addition to these security features, Pluto Card also provides 24x7 customer support.

We understand that our customers need support around the clock, and we are always available to help with any questions or issues that may arise.

Data Infrastructure, Redundancy and E2E Encryption

We also provide infrastructure and data redundancy, which means that our customers’ data is highly available and secure, even in the event of a system failure or outage.

Data is always encrypted in transit, which means that it is always protected during transmission between servers or devices.

Finally, another crucial feature that IT and procurement teams should consider when evaluating corporate spend management products is data residency and retention policies.

Pluto Card offers an audit trail for changes to customer data, so we can track who did what.

Additionally, we have a data residency promise of 7 years, which means that we retain customer data for that period of time.

This can be important for compliance with regulatory requirements, such as tax or financial reporting.

Conclusion

In conclusion, when evaluating corporate spend management products for your enterprise, it’s essential to consider the security features that the product offers.

PCI DSS Level 1 Compliance, passwordless login, activity logs and audit trails, and data residency and retention policies are all critical features that can help ensure the security and integrity of your organization’s financial data.

Pluto Card offers all of these features, along with 24x7 customer support and infrastructure and data redundancy, making it an excellent choice for organizations looking for a secure and reliable corporate spend management solution.

For more information visit Pluto and book a demo.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use