Contents

Top 9 Procure-to-Pay Software for Enterprises

Mohammed Ridwan

•

•

You want a procure-to-pay (P2P) software that automates your procurement process and addresses issues like lack of visibility, double payments, and delayed approvals. However, since such a tool has multiple users at different hierarchies and a complex workflow, you often end up with a more complex process if you don’t choose the right software.

With ad-hoc processes, many issues pop-up: employees wait weeks for approvals, procurement teams have no real-time visibility over purchase requests and don’t know how to prioritize, finance teams get minimal control over expenses, and the entire process is chaotic. Hence, choosing the right procure-to-pay solution requires a focus on ease of use and flexibility.

In this post, we will share the best procure-to-pay software for businesses in the UAE. We will discuss how P2P software helps with procurement management and which tools are worth considering.

What is Procure-to-Pay Software?

Procure-to-pay software is a tool to automate the complete procurement process, which combines accounts payable (AP) software and procurement software.

Instead of having your procurement processes and data scattered across emails, Jira, different task management tools, and custom ERPs, you bring it onto a single platform.

By moving from your legacy tools to an automated P2P software, you can:

- automate approval workflows, making the purchase request (PR) process easier and faster. Flexible approval workflows enable all stakeholders to approve requests with a trigger-based flow.

- integrate with ERPs to maintain a preferred vendor list and manage order items. While most P2P software supports record-keeping only, some allow the conversion of PRs to purchase orders (PO) automatically after approval.

- match the goods received note (GRN) to enable two-way or three-way matching and ensure proper inventory and timely vendor payments.

- process payments with multiple payment options to avoid delays and foster vendor relationships. It also helps avoid double payments, underpayment, or overpayment.

- reconcile data faster via integrations with accounting software, enabling more visibility and control. Accounting teams get the right documents, and finance teams get visibility over expenses.

Since legacy ERPs aren’t enough to manage your entire procurement process, adding P2P software makes purchasing and payments easier.

Top 9 Procure-to-Pay Software

Here is a procure-to-pay software list for companies in the UAE:

1. Pluto

Pluto is an all-in-one procure-to-pay solution to transform your procurement and AP processes. It sits on top of your ERP as a layer to manage the multiple stages of the procurement process. From automating PRs to setting multi-layer approval workflows and managing vendors, it is the ultimate solution to transform a chaotic procurement process into a faster and more efficient one.

Key Features:

- Features fully customizable workflows for raising PR and POs, requiring no technical expertise

- Offers a flexible approval engine capable of managing intricate hierarchies

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images, eliminating the need to search for invoice details. Also facilitates invoice capture via emails directly to speed up the receipt capture process

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

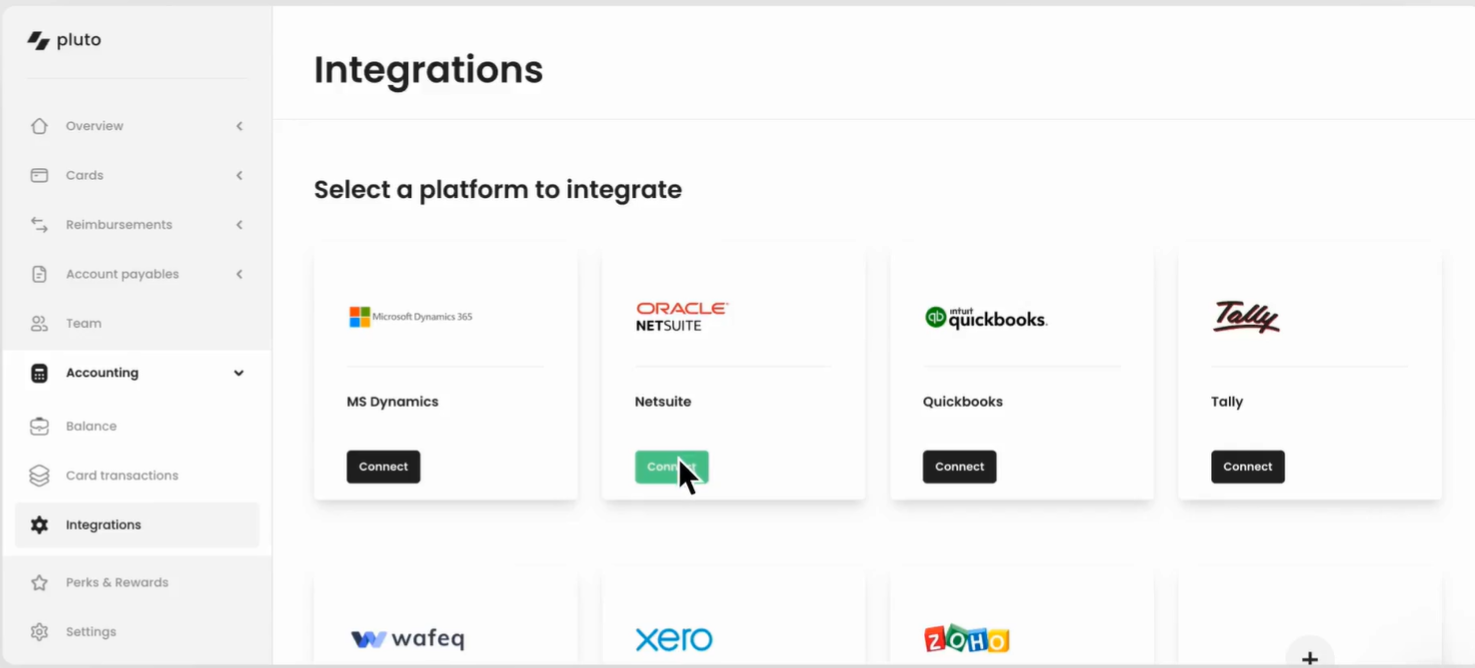

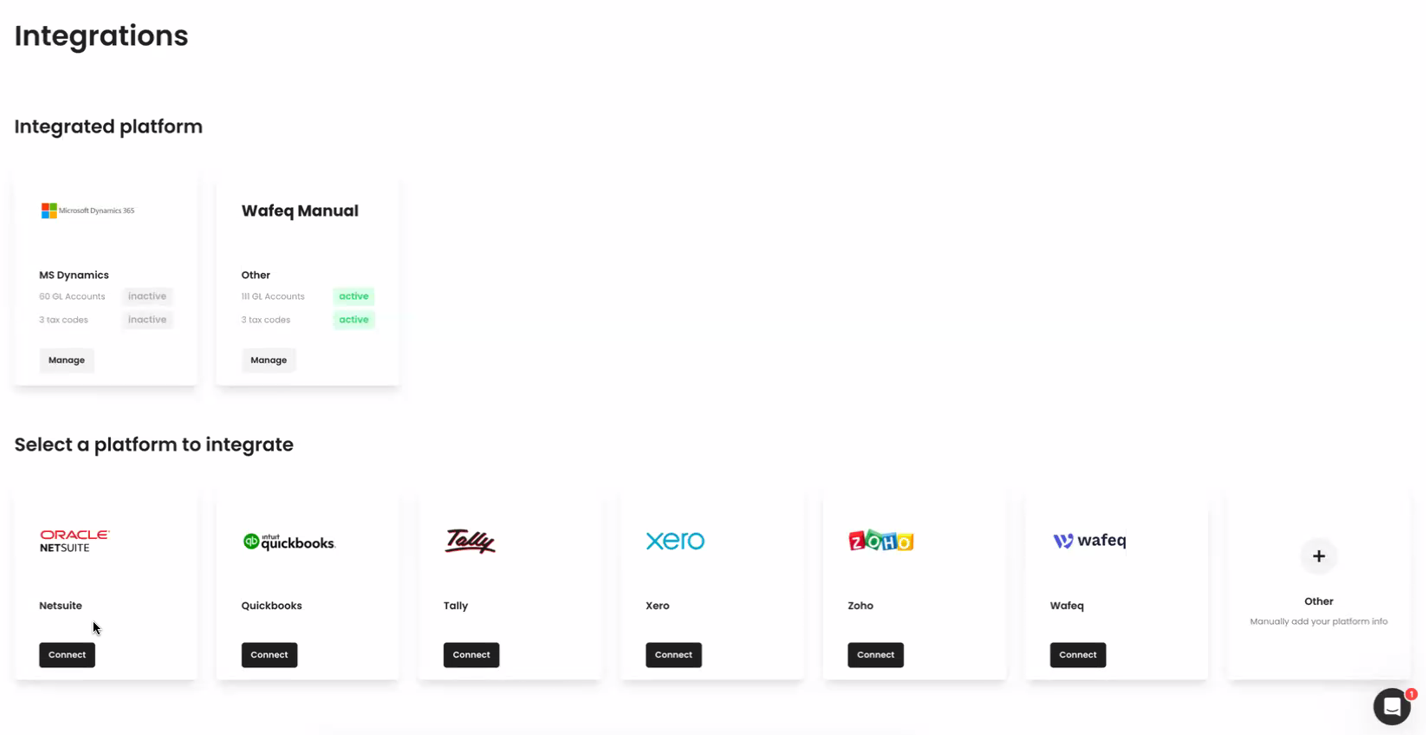

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software, such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Integrates with payment gateways and accounting software for seamless payments and reconciliation (a feature not available in other solutions)

- Raises alerts for upcoming payments and enables scheduling payments in advance and automate invoices

- Provides a complete audit trail of the process to ensure visibility at each step

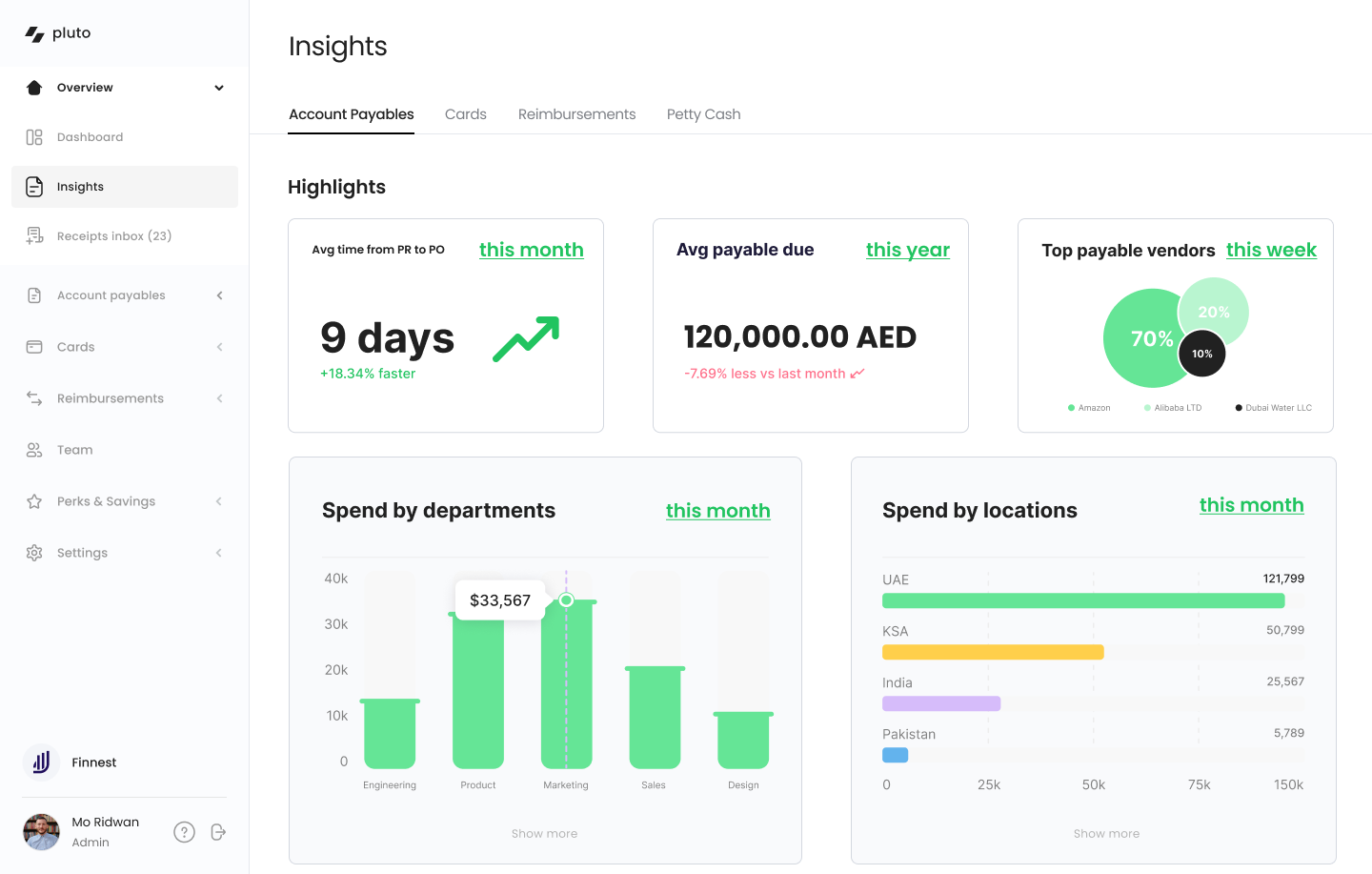

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote

Pros:

- More financial control with vendor-specific corporate cards

- Better Forex rates than most local banks

- Multiple integration options including Netsuite, Dynamics and more

Cons:

- Slightly longer on-boarding due to unlimited corporate purchasing card offering

- Directly integrates with all other major ERPs except Tally

2. Order.co

Order.co is a procure-to-pay platform that provides you access to over 15,000+ vendors in addition to your preferred vendors. It acts as an online marketplace like Amazon or eBay to help you procure items for your business. You add items to the cart, and it enables a rule-based approval system for POs with complete control and visibility.

Key Features:

- Provides a custom, pre-approved Order.co catalog, including your current vendors and a vast network of 15,000+ vendors

- Supports purchases from multiple vendors regardless of their ordering methods (API, website, email)

- Sources the best prices for your needs to automatically generate POs and set up recurring orders to save time and reduce manual errors

- Offers real-time budgeting and reporting insights by the user, location, cost center, or vendor

- Simplifies payment processing by consolidating all orders from multiple vendors into one monthly invoice

Pricing:

Dependent upon locations and usage; contact hello@order.co for pricing information

Pros:

- Customizable product lists for ordering

- Easy-to-create customizable workflows

- Ability to categorize purchases and run reports

Cons:

- Set up is confusing and requires customer support help

- Can not order from multiple vendors at the same time

3. Yooz

Yooz optimizes the procurement process by focusing on invoice management. It is suitable for mid-size companies of all sectors wanting to automate procurement with a cloud-based procure-to-pay solution. It uses artificial intelligence (AI) and machine learning (ML) technologies to enhance security and control in their account payable automation software.

Key Features:

- Enables online, real-time management of supplier relationships, improving communication and collaboration

- Provides mobile access for invoice approval and communication

- Maintains regulation-compliant traceability, ensuring adherence to relevant laws and standards

- Automates real-time general ledger (GL) coding and PO matching

- Captures all types of documents through various channels, such as email, drag and drop, mobile, scan, and secure file transfer protocol (SFTP)

- Integrates with accounting software and ERPs

- Allows users to approve and pay invoices in batches, offering multiple payment options, such as virtual credit card, ACH, e-check, and paper check

- Offers a range of services, including consulting, configuration, training, and user support

Pricing:

Free trial for up to 15 days followed by a "pay-as-you-use" model. Also offers “gold edition” subscription pricing (based on the volume of documents) for an unlimited number of users and 4 hours of complimentary service

Pros:

- Integrates with Sage Intacct

- Ability to tag people in the comments and email them directly from the invoice

- Numerous criteria available for setting up the approval workflows

Cons:

- Doesn’t offer payment services in the UAE, so you need to carry out payments on a different platform

- Doesn't have integrations with major vendors as a form of punchout

- Time-consuming to download and export files

- Hard for vendors to send the invoices through Yooz

4. Kissflow

Kissflow simplifies and enhances procurement processes while ensuring transparency and compliance. It helps users automate the entire process without requiring technical expertise or coding experience. It comes with 50+ ready-to-use applications, enabling unlimited automation applications.

Key Features:

- Offers fluid forms to enable easy capturing, approval, and tracking of PRs

- Allows users to register and maintain vendors with access to multilingual catalogs

- Integration with accounting systems, ERPs, and finance systems like Quickbooks, SAP, and Microsoft Dynamics

- Accelerates the invoice approval process with timely alerts and automated checks. Connect invoices to contracts, POs, and service entry sheets in a single dashboard

- Customizable reports to visualize data using charts, filters, and heatmaps

- Ability to define and manage budget restrictions with dynamic rules throughout the entire procure-to-pay lifecycle

- Customized approval workflows to ensure transparency with rule-based approval processes

- Smart alerts that provide real-time updates on the status of POs and invoices to keep stakeholders informed

Pricing:

Starts at $2499/month (billed annually). Pricing varies based on transaction volume and number of users

Pros:

- Intuitive interface with a relatively short learning curve

Cons:

- Does not support payment flows in the UAE

- Cost of its license is high (particularly for SMBs)

- Can not handle intricate processes that require a high degree of customization or involve multiple conditional branches

- Customization options are limited, including specific integrations, advanced business rules, or more sophisticated automation capabilities

5. Coupa

Coupa is a cloud-based automation platform to manage procurement processes. It facilitates supply chain optimization by providing visibility and control. It brings consumer shopping ease to the procurement process. With a focus on user adoption, it provides an intuitive shopping experience for employees, making it easier to adhere to pre-approved spending guidelines.

Key Features:

- Simplifies procurement by allowing organizations to track pre-approved spending and get real-time visibility into POs and order lifecycle

- Maximizes pre-approved spend to offer complete visibility over the purchase-to-pay processes

- Promotes user adoption at all levels with an easy-to-use interface, creating value for both employees and vendors

- Provides a centralized platform within Coupa Procure, allowing easy comparison of items across multiple vendors

- Offers real-time budget management with budget meters, allowing organizations to assess budget sufficiency before committing to spending

- Employs AI and machine learning to detect errors and fraud across business spend

- Enables quick notifications of disruptions and allows vendors to confirm availability, minimizing unplanned downtime

- Provides real-time visibility into inventory availability, helping organizations reduce redundant and wasteful spending

Pricing:

Request the sales team for a custom quote

Pros:

- Several categories and filters in the analytics section to streamline data

- Chat option enables approver and claimant to discuss issues with receipts

- Enables setting up of customized approval chains and including additional new approvers

Cons:

- Lots of unnecessary notifications, making it difficult to select the ones that need action or comment

- Low receipt searchability, making retrieval time-consuming

- Inconsistent syncing of remit-to address from NetSuite

- Complex to implement and not intuitive, forcing admins to spend more time resolving employees' queries

- Slow customer service

6. Esker

Esker is a cloud-based automation procurement software. It helps you optimize procurement processes and collaborate strategically with your vendors. With the ability to integrate across various company departments, it simplifies user adoption while facilitating visibility and control.

Key Features:

- Facilitates approval mechanism and GRN matching for each PR and invoice

- Offers real-time analytics, enabling you to maintain tighter budget controls

- Gives access to products from preferred vendors, aligning purchases with company procurement policies

- Provides a self-service portal, facilitating supplier onboarding, catalog management, and invoice status access

- Customizable dashboards to manage daily tasks, monitor productivity, and identify issues and opportunities as they arise

- Enables you to customize the interface with your company's corporate identity, enhancing the supplier's ability to identify and engage with your organization seamlessly

Pricing:

Contact sales for pricing

Pros:

- Contains filtered views to allow for focused priorities

- Auto-sends payment reminders

Cons:

- Gets expensive with each customization implemented

- Doesn’t allow unused/old customer accounts to be deleted

- Integration with accounting software isn't seamless

- Approval workflow requires a manual trigger to start

7. PayEm

PayEm offers a procure-to-pay solution, covering everything in one place to replace your traditional procurement process. With a core focus on processing PR, it simplifies the creation of POs with custom forms and approval workflows. It facilitates collaboration between procurement and finance teams to enhance visibility and control.

Key Features:

- Offers custom request forms equipped with conditional logic to ensure a user-friendly experience

- Provides fully customizable automated approval workflows based on factors like amounts, subsidiaries, and stakeholders

- Integrates with communication platforms like Slack and email, allowing request tracking and approvals

- Consolidates all the requests and approvals, simplifying discussions, document sharing, and creating an audit log

- Enables real-time updates and clear overviews of request statuses, minimizing the need for follow-up inquiries

- Offers OCR technology for invoice processing

- Syncs with your ERP and enables exporting reconciled transactions and uploading them to your ERP

- Automates vendor management with payment scheduling, funds transferring, and limits setting for each vendor

Pricing:

Pros:

- Multiple virtual credit cards for different vendors

- Supports global transactions

Cons:

- Some vendors don't accept PayEm cards

- High transaction clearing time

- Limits the user to either a virtual or physical card at one time

8. Pipefy

Pipefy is an automation procure-to-pay tool to manage end-to-end procurement processes, from PR to paying vendors, to create a frictionless experience. It aims to break silos between teams to simplify purchase and AP.

Key Features:

- Allows you to create and customize workflows, from purchase requisition to supplier management

- Provides secure portals where records and documents can be organized, ensuring that all information is easily accessible, especially during audits

- Ensures compliance with custom forms that include required fields to accelerate POs

- Enables access to real-time insights to help you forecast ideal quantities and vendors for requisitions

- Evaluates your processes, delivering reliable data to enable strategic and data-driven decisions

- Integrates with your existing ERPs and accounting systems, such as NetSuite, Oracle E-business Suite, QuickBooks, Sage Intacct, etc.

- Enables deadline alerts, approval flows, and information exchange to prevent late fees and cashing in on early payment discounts

- Offers a customizable dashboard to streamline vendor registration, updates, onboarding, and contract management

Pricing:

Offers three packages starting with a free option for smaller teams, and a subsequent model that costs $20 per month per user and $34 per month per user. Also, offers an enterprise plan with custom pricing

Pros:

- Offers templates for organizing processes

Cons:

- Complex sign-up process

- Workflows aren’t flexible with difficulty with respect to adding new users and making changes

- Difficult to import data and search in the database for information

9. Procurify

Procurify speeds up the procurement process, enhances internal communication, and reduces financial risks. It is an easy-to-implement tool that saves time for finance and operations teams. From catalog management to custom user controls, it helps to track the procurement process in real time.

Key Features:

- Tailors POs to match your internal processes and vendor expectations

- Creates, tracks, and maintains an audit trail of all procurement transactions for transparency and compliance

- Enhances financial controls by enabling PO-based purchasing

- Ensures that requested items are approved against budgets before procurement

- Syncs PO with your accounting system or ERP, whether via API, CSV, flat file, or direct integration

- Integrates with trusted vendors through punchout catalogs to streamline the ordering process

- Enables blanket PO, which involve making multiple purchases against a single PO, even when details of future purchases may be unknown

- Provides PO workflows to save on shipping costs, unlock vendor discounts, and reduce paperwork

Pricing:

Starts at $2000/month with a custom pricing tier

Pros:

- Easy-to-make amendments in the original PO

- Enables ordering from multiple websites for resources, including Amazon

- Makes it easy to upload documents to support expense and order reports

Cons:

- Doesn’t offer payment services in UAE, so you will need to carry out payments on a different platform

- Doesn’t cater to the UAE market, and does not support UAE-specific workflows such as VAT management

- Cannot edit orders once they are approved

- Cannot see the order history for a catalog item without running a report

- Physical inventory has to be tracked outside Procurify

Which Procure-to-Pay Software Should You Pick?

Don’t choose a platform that offers the maximum functionality. Instead, choose the one that is user-friendly and flexible.

Procurement is already a complex process that requires visibility by different stakeholders. Choosing a tool that offers visibility and accommodates complex business needs will help you transform your chaotic procure-to-pay process.

If you want to get started, book a demo, and our team will help you identify the bottlenecks and make the entire process simpler and manageable.

Disclaimer: The comparisons and rankings of procure to pay software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

Procure-to-Pay Process: What it is, Benefits, and Steps Involved

The procure-to-pay process doesn’t mean the procurement process. It is a subset of procurement that integrates purchasing and accounts payable.

Traditionally, the procurement process is scattered across the business, and the procurement team needs help to gain visibility or control. The employees purchase from different vendors, the approval process is chaotic and delayed, the stakeholders are stuck in email threads to review the expenses, and the procurement team struggles to get an overview of the organization’s needs.

Procuring the best goods and services becomes problematic since the team is left with open information loops. As a result, it spends more time optimizing the procurement cost and improving the bottom line.

What is the Procure-to-Pay Process?

The procure-to-pay process streamlines the scattered procurement parts to combine purchases and payments. Instead of a process spread across different software, the procurement process shifts to a centralized platform.

The employees get a dedicated platform to raise purchase requests and obtain approvals. The platform notifies stakeholders, such as managers, legal teams, finance teams, IT teams, and other relevant decision-makers to review and approve the proposals. As a result, the procurement team seamlessly moves to the vendor evaluation and negotiation stage without worrying about approvals or delays. The finance team efficiently handles accounts payable since the purchase and payment process is integrated.

So, while earlier, the purchases were handled solely by the procurement team and payments solely by the finance teams, the procure-to-pay process gives both teams an overview of the process from start to finish. In this post, we will discuss how this procure-to-pay process helps you optimize your procurement function and improve your bottom line.

Why Do You Need a Procure-to-Pay Process?

The procure-to-pay process is not just for your finance team or procurement team. It helps the entire organization to gain resources efficiently. Here are eight ways that demonstrate how moving to a streamlined process benefits you:

1. Visibility

All the relevant stakeholders get visibility into the process and the status. Be it the employee, managers, finance team, legal team, IT team, or procurement team — each one can track the progress without delving into multiple email threads. Additionally, teams get insights that help procurement teams optimize costs with data-driven decision-making.

2. Compliance and Control

You can implement advanced controls, such as customized approval workflows and spending budgets, without micromanaging the teams. You can successfully enforce internal control over financial reporting without creating unnecessary team resentment.

So, for instance, if any expenses or purchases beyond $50,000 require additional approval from the legal and IT team, you can easily configure those controls within the approval workflow.

3. Streamline Workflows

The traditional process demands the employees to go from one office to another or spend days on email and Slack conversations before the managers give the green signal. At times, approval of a critical stakeholder is missed, causing delays and disrupting the workflow.

With the procure-to-pay process, you can create custom workflows depending on the purchase category, department, amount, etc. This accelerates workflow, and all the relevant stakeholders get notified right away.

4. Centralized Management

The procure-to-pay process integrates purchases and payments to bring all the critical information on a single dashboard. As a result, any discrepancies in the procurement process are identified in minutes. The entire procedure accelerates the real-time visibility of each stage.

5. Reconciliation

A centralized management system makes collecting and storing documents easy; additionally, since it integrates purchases and payments, the information syncs across accounting systems and ERPs.

During the audit season, this becomes a blessing where the finance team doesn’t have to chase teams for complete records. Also, it becomes easier to store and lock all the transactions and share these records with external parties.

6. Risk Management

The procurement operation is prone to financial, operational, and reputational risks. With the procure-to-pay process, teams can efficiently manage the vendors, purchase requests, approvals, and payments on a centralized platform in real time. It reduces the risk of fraud, ensures policy compliance, and provides visibility into spending patterns without burdening any team.

7. Insights

You can easily see the inside out of your procurement process, whether you want to know how much the marketing team spends or which vendor costs you the most. It makes it more convenient to reduce procurement costs and optimize purchases to improve the bottom line. Also, as all the information is centralized, there are no gaps or missing loopholes, providing complete transparency of your expenses.

8. Invoice Management

The procure-to-pay process ensures that all the invoices are captured and extracted into a centralized platform. This facilitates two-way and three-way matching without causing delays. Moreover, the reconciliation process becomes easy as all the records are systematically recorded.

So, whether you receive an invoice via email, WhatsApp, or physical copy, you can easily add it to the system without risking losing an invoice.

What are the Stages in the Procure-to-Pay Process?

The traditional procurement process has over nine steps strewed across different platforms. These include identifying goods and services, purchase requests, vendor selection, negotiation, purchase orders, inspection of the goods received, three-way matching, approvals, and payment and reconciliation.

While the procure-to-pay process doesn’t alter these stages, it integrates them for a streamlined workflow. So, earlier, if the approvals took days or weeks, keeping employees and the procurement team on hold, now it only takes a few minutes or hours. You centralize the procurement process and save money and time.

Here are five key stages in the procure-to-pay process:

1. Purchase Request

Employees no longer need to travel from one office to another, seeking approvals manually from managers. The streamlined procure-to-pay process gives employees a centralized dashboard to raise requests and specify their needs. It helps the procurement team to understand what the employee needs as well as examine the purchase details. Moreover, the stakeholders can quickly approve or reject the requests from the dedicated platform.

Administrators add customized approval flows to enforce internal policies. They create trigger-based approval workflows based on the expense amount, category, and department to accommodate intricate hierarchies.

For instance, they have the option to create separate workflows for expenses below $5000 and those exceeding a certain budget. Similarly, they can add specific stakeholders to the custom workflows for minimum friction and delay.

2. Purchase Order

While the vendor evaluation, selection, and negotiation happen on dedicated ERPs, the procure-to-pay process enables you to bring all this information on a consolidated platform. You maintain a synced and consistent database to make purchases faster and more secure.

Pluto integrates with your ERPs and allows you to maintain a centralized vendor database. You can add the vendor directly to the platform and systematically record information. You can add a field in your approval workflow to determine whether the employees are purchasing from a vendor list or a new vendor.

A systematic list helps you consolidate expenses and optimize costs. Moreover, ordering becomes more accessible with a unified platform for raising and approving purchase requests and maintaining an ERP-synced vendor database.

3, Invoice Management

Traditionally, vendors send invoices to a dedicated email or an address. The employees send them for approval and payment. It takes days to clear the expenses. Additionally, the accounting team spends considerable time and energy on maintaining records.

The procure-to-pay strategy reduces this effort and streamlines the procedure. It captures and extracts the invoice from the emails and attaches to a dedicated purchase request and order. This helps the teams match the purchase order, invoice and goods received note (GRN) without juggling multiple platforms.

It pulls all the information with optical character recognition (OCR) technology, reducing manual data entry. Since this platform syncs with the accounting system, the accounting team spends minimal time on data entry.

4. Payment Processing

Processing payments becomes a task when the finance team has to chase employees for invoices and wait for approvals and verification. The procure-to-pay technique centralizes the entire process, giving real-time visibility and helping finance teams make timely payments.

Moreover, with Pluto, you can integrate your procurement software with the payment gateways to ease the payment process further. Also, you get better Forex rates than banks, helping you save more money. Overall, with the approvals and invoices streamlined, payment processing becomes easy.

5. Reconciliation

Reconciliation is the hardest part, even when you perform the data entry and data sync monthly. You risk losing documentation and creating gaps in the records.

The procure-to-pay process consolidates the entire procurement cycle to bring all the critical information on a single platform. There are minimal gaps; records are up-to-date due to real-time tracking and recording.

With Pluto, you can integrate with platforms like MS Dynamics, Oracle Netsuite, QuickBooks, etc. So, with your ERPs and accounting software synced, you can easily record all the transactions digitally and securely.

Pluto further enables you to lock the transactions to avoid fraud once approved. Moreover, you can create view-only access for your records to simplify auditing for external parties.

Improve Your Bottom Line With the Right Procure-To-Pay Solution

Overall, the procure-to-pay process helps you automate your procurement process without changing your approach too much. You just need to find the right solution that assists your procurement process.

We discussed more about this in our procure-to-pay solutions post, where you will find what procure-to-pay software does and how to pick the right one.

•

Mohammed Ridwan

How to Improve the Expense Reconciliation Process to Close Books Faster

For every expense, teams maintain extensive documents like purchase orders, goods received notes (GRN), invoices, etc. With each increasing expense, the finance team has to spend more and more time on spend management — maintaining these documents, syncing data across accounting systems, ensuring proper approval, categorizing accurately, etc.

This manual process is time-consuming and prone to errors like missing receipts, employee fraud, unrecorded expenses, data entry typos, etc.

As a result, teams have inconsistent data across company systems and spend more time fixing these issues than focusing on their core activities. So, when finance teams strive to improve budget allocations, streamline expense tracking, and enhance financial reporting, they find themselves dedicating substantial time to addressing discrepancies among different financial databases and systems.

This blog will cover improving the expense reconciliation process and replacing manual and old methods with an improved solution.

What is Expense Reconciliation?

Expense reconciliation is a process that matches the actual expenses with the corresponding book entries. It involves comparing two sets of financial records, such as bank statements, credit card statements, receipts, etc., to identify and rectify discrepancies between them.

So, for every expense, you have an entry at an external source and in the internal systems. You match them together to ensure the accuracy of financial reporting, compliance with accounting standards, and prevention of errors or fraud.

However, companies rely on outdated systems — entry-level accounting tools, spreadsheet-based solutions, or legacy ERPs, which cannot handle end-to-end reconciliation processes. These compel finance teams to spend valuable time on manual tasks like data entry and receipt management, hindering reconciliation efficiency and increasing the risk of errors in financial data.

Hence, submitting and tracking expenses becomes cumbersome for employees, while finance teams face manual verification and reconciliation challenges. Managers struggle with delayed approvals, and the overall process becomes susceptible to errors, affecting accuracy and compliance.

How to Reconcile Expenses Faster

Invest in spend management software to reconcile expenses faster. With spend management software, you can track and monitor each transaction on a centralized platform in real time.

The automated process makes reconciliation simpler and faster by providing a single source of information and enabling advanced controls. You can create customizable approval workflows and specify spending rules to suit complex hierarchies and ensure compliance with company policies.

Especially with Pluto, each expense triggers the approval workflow and notifies employees to upload the receipt through WhatsApp. The accounting system integration syncs data across the financial systems to provide a consistent and accurate database.

Here is how switching to Pluto helps you reconcile efficiently and close your books of accounts ten times faster:

1. Easy to Identify Discrepancies

In a traditional manual reconciliation process, identifying discrepancies involves sifting through piles of paperwork or navigating complex spreadsheets.

With Pluto's automated system, this cumbersome task is simplified. The platform's alert system actively flags potential issues, promptly notifying users of duplicate receipts. It not only streamlines the identification of irregularities but also introduces a proactive layer of fraud prevention.

You can visualize and interact with discrepancies directly on the centralized platform, turning what used to be a tedious task into a more intuitive and efficient process.

2. Speed and Accuracy

Automation, real-time tracking, receipt capture (via optical character recognition (OCR)), approval workflows, and robust controls accelerate reconciliation cycles on Pluto.

You need not spend a minute on a manual redundant task. The platform captures and extracts invoices from emails and WhatsApp on a centralized platform. The trigger-based workflows ensure prompt approvals without any friction. Matching documents for three-way and four-way matching simplifies with all the documents on a single tool.

Therefore, the inherent accuracy of financial data, coupled with efficient discrepancy identification, ensures speed and reliability in the reconciliation process.

3. Real-Time Tracking and Visibility

Unlike conventional tracking methods, Pluto offers real-time insights through its centralized dashboard. This furnishes internal teams with immediate visibility into transactions, guaranteeing proactive adherence to company policies.

The agility provided by real-time tracking enables timely data-driven decision-making based on the latest and most accurate data.

4. Better Data Sync for a True Picture

Manual data entry is prone to errors and delays, leading to discrepancies in financial records. Pluto's seamless integration with major accounting systems like Xero, Zoho, QuickBooks, Netsuite, and Dynamics ensures that the financial data is up-to-date and aligns with the organization's accounting records. This synchronization eliminates the need for manual adjustments and corrections, providing a true and accurate picture of the organization's financial status.

5. Enhanced Controls Over Processes

Building intricate approval workflows is simplified with Pluto. You can set up approval processes using simple if-then rules without the need for complex coding. Devise custom workflows that align perfectly with your company policies, creating a seamless and controlled process.

6. Traceable Audit Trail

Pluto maintains a traceable audit trail of all financial transactions and activities. It provides a comprehensive record of changes made to financial data. From the initiation of a transaction to any subsequent modifications, the traceable audit trail ensures transparency and accountability. This trail helps you avoid fraud and trackback discrepancies without friction.

Also, you can lock transactions post-approval, which adds an additional layer of security and integrity, facilitating smoother audits.

7. Save Time and Money

Automating financial processes, including procurement, expenses, and payables, significantly reduces manual steps in reconciliation.

Pluto's ability to capture general ledger and tax codes from expenses automates data entry. It reduces the time spent on routine reconciliation tasks. This efficiency allows finance teams to allocate resources more strategically, focusing on higher-value initiatives rather than repetitive manual tasks.

Timely financial insights help finance teams support decision-making processes with precision and confidence, fostering a data-driven financial ecosystem.

Internal Controls Strengthen Expense Reconciliation

Expense reconciliation burdens finance teams with time-consuming manual efforts and the constant threat of challenges like duplicate receipts and policy violations. These complexities lead to prolonged reconciliation cycles, hindering financial efficiency.

However, the actual progress happens when you strengthen internal control over financial reporting (ICFR), which is the anchor for successful automation in finance.

When you embrace ICFR strategically, it bolsters internal controls, protects against risks and fraud, and sets the stage for smooth automation. The impact goes beyond just easing manual work; it promotes precision, reliability, and transparency in financial workflows.

In simple terms, ICFR mitigates risks tied to financial inaccuracies. Read how to improve your ICFR framework for enhanced reconciliation processes.

•

Mohammed Ridwan

Corporate P-Cards: How to Use Them for Maximum Advantage

P-cards can replace your corporate credit cards.

If you rely on credit cards, you would have 2-3 cards issued to the executives, which are shared with the employees. Though it seems a great method to ensure approval and budget control, it has many loopholes.

The finance teams are running after employees for receipts, employees are waiting on OTPs and approvals, and the CFO is not satisfied with the numbers.

You look for alternatives and land on p-cards.

P-cards (or purchase cards) are corporate cards you issue to your employees for business expenses. Then, be it purchasing a SaaS or making vendor payments, employees use it for all work-related spending.

What are Corporate P cards?

Corporate P cards are company purchase cards that employees can use to make business purchases without going through the traditional purchase request and approval process. Corporate P cards make it easy for companies to manage account payables & automate expense accounting while staying in complete control of their spending.

What Is the Difference Between a Credit Card and a P-Card?

While both cards are used exclusively for business expenses, there are many differences.

Credit cards make expense management difficult, with no visibility into where the money is going. An executive shares a single card with their team, creating a chaotic financial situation.

The card owner struggles to manage a constant stream of payment requests. Employees are left hanging with delayed payments, waiting for approvals. Especially in bigger companies, finance teams struggle with reconciliation and zombie spending (which is when a company continues to pay for something that isn’t used anymore, or when it pays for services that former employees had used).

On the flip side, if you use p-cards, you can issue each employee a separate card for corporate expenses. Each card has a specific budget and restrictions to ensure control and facilitate approval without delays.

For instance, you issue a card with a $500 monthly limit, restricted to office supply vendors like "Office One."

In this way, you manage budget control and approvals without losing visibility or having to micromanage.

How can Businesses use Corporate P Cards for Employee Expenses?

Moving from a credit card to a P-card isn’t complicated. Here is a step-by-step process of how you can provide your employees p cards and start using them:

Step 1: Generate Corporate Cards

The first step is to choose the type of card you want for your employees: physical or virtual. While a virtual card can be set up in under a minute, a physical card takes about 2-3 days to get delivered.

Physical cards work well for those who travel or have on-site jobs, making petty cash management easy. Contrarily, virtual cards support secure online purchases, such as buying SaaS tools or paying for digital advertising campaigns.

Once you decide whom to give a card and what type, set the budget and policies. You can incorporate the following policies to customize the cards:

- Specify the budget and replenishment frequency of the budget on the card- daily, monthly, or yearly.

- Define the purpose of cards by enabling only specific general ledgers (GL), labels, and tax codes.

- Switch on/off the ATM withdrawal option.

- Enable auto-lock for cards in case of receipt policy violation, where if the receipt isn’t attached in 7 days, the card is frozen.

All these customization options offer you better control without having to chase employees later. Deciding the budget, frequency, and vendors ensures that the card is used rightfully.

For instance, you would switch off ATM withdrawal for virtual cards that are meant for buying SaaS tools. Likewise, you can establish a monthly replenishment schedule to maintain sufficient funds while preventing excess spending.

Apart from this method, your employees can also request to activate the P-cards. They explain the card's purpose, after which the admin can approve/reject the request.

Now that the employees have cards in their hands, let’s see how you can better manage corporate spending with them.

Step 2: Manage Expenses Via Centralized Dashboard

Every expense on the corporate p-card is visible in real time on a centralized transactions dashboard. You get key information such as merchant name, expense category, card information, amount, and approval status.

Along with this dashboard, you get a dedicated tab for each expense where all its information is available.

You can review the key information such as receipt, department, merchant, date/time, expense category, etc. you can also download the receipt, approve/reject the expense, and check the activity log.

The activity log keeps track of all the conversations that have been happening with a particular transaction. Traditionally, companies use email and Slack, which makes communication messy. With this log, they can keep all their conversations and important information in one organized place.

Step 3: Create Approval Workflows

Approval workflows ensure that each expense follows a defined hierarchy for approval by the right stakeholders. You can customize them depending on different amounts, departments, and other factors.

It is a simple no-code system where you create workflows based on if-then rules.

A custom approval workflow ensures timely and effective approval without having to run after dedicated team members. Each of them receives a notification as soon as the expense takes place, and they can approve it easily.

Approvals and employee reimbursement become easy with a frictionless workflow like this.

Step 4: Report and Reconcile Expenses

Integrating your cards with your accounting systems becomes the last step to facilitate reporting and reconciliation.

Once you integrate with your accounting software, you can enjoy complete visibility and control over your corporate expenses.

You get a dedicated insights window to track expenses and identify trends. You can add custom filters and export these for further analysis.

To understand the entire process better, book a demo and see how you can benefit from switching to a corporate p card.

Why Shift From Traditional Methods to Corporate P Cards?

Credit cards seem simpler, where a bank gives a few credit cards to share among the teams. But here’s why it doesn’t work:

- It is difficult to track who spends what, how much, and why.

- Employees wait for OTPs and approvals, delaying payments and reimbursements.

- The chances of zombie spending increase because the same card is shared. This also becomes one of the loopholes which leads employees to misuse the cards.

- The admins have to chase employees for receipts during reconciliation.

While these are just a few, relying on credit cards can cause chaos in expense management. Here are some reasons corporate p-cards are a more suitable option today:

No More Shared Cards

You ditch the whole system of sharing credit cards, which is the root cause of limited visibility. With corporate p cards, you can issue any employee a dedicated card for specific expenses.

So, if you issue Rashid from the marketing department a virtual corporate card for running Ads, he can not use it otherwise. He will be accountable for any unnecessary expenses beyond the specified budget.

This means more visibility and control over corporate expenses.

Easy Receipt Management

Corporate cards make receipt management easier with OCR technology in the following ways:

- Submitting expense reports at the end of the day becomes easier as it auto-populates all the information

- Uploading receipts in bulk upload with OCR handling the rest makes the process faster

- Detecting duplicate receipts becomes simpler as OCR eliminates the risk of manual errors

Apart from OCR, you also get the option to split the transactions to make the accounting process easier. Here, for each transaction, you can split the amount into a separate category, GL account, tax code, etc.

For instance, a $300 expense can be split into $200 for software purchases and the remaining $100 as consulting fees. Each will have a specific category, GL account, and corresponding tax code.

Budget Control

Corporate cards give more visibility and control over finances.

Although both credit cards and p-cards can have specific budgets, p-cards enable you to set specific policies and rules.

For instance, you give an employee a $1,000 monthly budget but restrict them to using the card only for office supplies purchases.

Similarly, you can set a $500 monthly limit for marketing expenses and restrict the card to "Ad Campaigns" and "Promotions," ensuring focused spending.

Another benefit is to assign monthly, yearly, and weekly budgets.

For instance, you can allocate an annual budget of $500,000 for the marketing department but assign a weekly budget of $10,000 for ad campaigns.

This facilitates flexibility for the teams to function better and gives the finance team more control over resource planning and allocation.

WhatsApp Integration

Receipt uploading becomes simpler when all you have to do is click a picture on WhatsApp and hit send.

After each transaction, employees get a notification to upload the receipts via WhatsApp. With this simple integration, receipt capturing becomes simple and fast.

Not only is the receipt captured, but stored under the relevant transaction tab with all its information intact. OCR makes it easier to extract key details and populate expense reports.

Admins can approve these expenses, and reconciliation becomes a breeze.

Eliminate Corporate Card Fraud

P-cards give you more control and security. From setting custom policies to raising alerts in case of duplicate receipts, p-cards ensure that employees don’t misuse the cards.

Additionally, the custom approvals workflows and dedicated activity logs reduce the chances of oversight. This system helps prevent unauthorized spending.

For instance, an employee tries to use the card for a personal expense, like an expensive dinner.

The custom approval setup will alert the admins. The active activity log with documented conversations will further ensure that no personal expense is charged on corporate cards.

Get the Most Out of Your Corporate Cards

Transitioning from credit cards to corporate p cards can be an exciting move. But to make the most of it:

- Set an expense policy outlining the guidelines that will govern the corporate cards. This practice will also become the pillar for a healthier financial environment to support internal control over financial reporting (ICFR) efforts.

- Understand the hierarchies in the company to create approval workflows accordingly. Find a balance between control and micromanagement. Managers should be informed about expenses without being excessively involved in them.

Do this right, and you will have better visibility and control over your finances. The employees will not be left hanging for approvals. The finance team will be at peace, and the CFO will have more faith in the numbers.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use