Contents

Top 6 Expense Management Software for Global Businesses in 2024

Mohammed Ridwan

•

•

You have just received an OTP, and now you are guessing which one of your employees is spending this amount and why. You don’t have time to review it, nor can you delay the payment too much. You neither have control nor visibility. This is the problem of shared corporate cards.

If you want to make it simpler for your employees, invest in expense management software. It is an automation tool to streamline employee-related expenses—reimbursement, petty cash, and corporate cards. In addition, it offers a centralized platform with real-time visibility into how employees spend company money. As a result, the entire cycle of approval and accounting becomes simpler.

In this post, we share the top six expense management software to help you get started.

Top 6 Expense Management Software

Here are six options for expense management software to manage employee-related expenses:

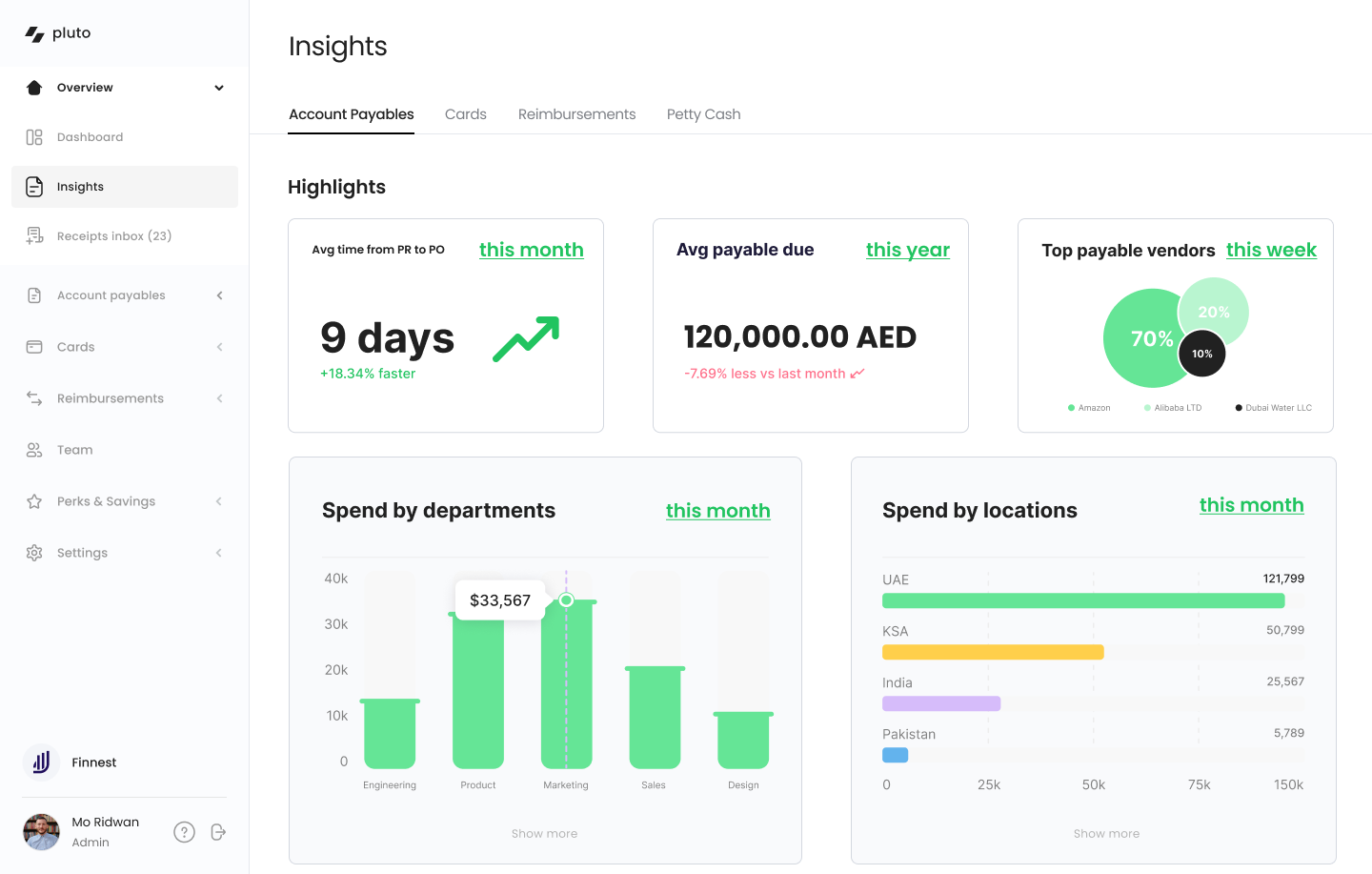

1. Pluto

Pluto is the best platform for managing employee expenses as it streamlines petty cash management, corporate cards, employee reimbursements and account payables. It is trusted by the largest finance and procurement teams in the Middle East, such as Tamara and Petrochem. With Pluto, you can transform reimbursements to get more control and visibility without causing delays or confusion.

Key Features:

- Provides custom no-code approval workflows that adapt to the company's hierarchy for timely and accurate approvals

- Automates receipt capture through optical character recognition (OCR), with the ability to support bulk upload via WhatsApp

- Supports unlimited corporate cards—virtual and physical, with budget controls to maintain expenses within corporate policies

- Offers zero-balance cards, which get funded once the expense is approved

- Ability to add comments and other transaction details to maintain a comprehensive audit log. View-only access is available for external accountants to review financial data without making changes

- Facilitates card-specific policies to make branch and subsidiary-level reimbursements easy

- Gives the option to make mass payments to reimburse employees

- Offers custom expense reports to overview business expenses and spending trends

- Alerts in case of duplicate receipt uploads to avoid fraud and compliance issues

- Integrates with accounting platforms like Netsuite for advanced general ledger (GL) coding and tax tracking

- Provides secure document storage with a five-year audit log and bank-grade encryption

Pricing:

Pros:

- Enables branch and subsidiary-level spend tracking (not offered by other platforms)

- WhatsApp integration to make receipt upload easy

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 Certification

Cons:

- Slightly longer onboarding due to a corporate card offering

- Integrates with all other major ERPS except Tally

2. Airbase

Airbase simplifies expense reporting with AI and ML and ensures quick, hassle-free, and smart corporate expense management. It is an automation solution for small to midsize businesses (SMBs) and large enterprises with 100-5,000 employees.

Key Features:

- Offers OCR to populate details, including GL category, date, amount, and purpose

- Ensures compliance by sending reminders and, if needed, locking cards until policies are met

- Facilitates reminders to upload receipts, eliminating the need to chase employees for receipts

- Offers a designated email address to send receipts of virtual card transactions

- Allows custom approval workflows and budget limits for physical cards

- Provides alerts for suspicious activity, enabling quick responses to potential fraudulent purchases

- Enables real-time audit trail with receipts, notes, and documentation for transparency

- Automates expense reimbursements to employees' bank accounts once the expenses are approved

Pricing:

Request the sales team for a custom quote

Pros:

- Flexible to accommodate varying team sizes and user base

- Intuitive and easy to use; no training or previous knowledge required

Cons:

- Slow mobile app; takes time to load pages

- Glitchy SSO-based login

- Not suitable for complex branch-level approvals and expenses

3. Ramp

Ramp is an integrated solution that streamlines expense management with corporate cards, automated expense tracking, and real-time reporting to help teams track expenses. It is a suitable solution for businesses of all sizes.

Key Features:

- Provides corporate cards with the ability to add spending policies to prevent unauthorized or non-compliant expenses

- Facilitates customizable workflows for expense approval

- Enables employees to submit expenses on the go through SMS, mobile app, and integrations with platforms like Gmail and Lyft

- Automates the capture and matching of receipts for every transaction, ensuring accurate expense tracking

- Flags non-compliant expenses, including weekend spend, excessive tipping, and alcohol purchases, reducing the need for manual review

- Provides instant access to real-time spending data, allowing businesses to make timely adjustments before exceeding budgets

- Identifies cost savings opportunities, such as duplicate subscriptions and unused solutions

Pricing:

Offers three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance.

Pros:

- Unlimited 1.5% cash back on credit card purchases made using their VISA branded cards

Cons:

- Only available to businesses registered in the US

- Doesn’t have a mobile app for Android phones

4. Bill.com

Bill.com simplifies employee expense tracking by providing real-time visibility and customization. It is an expense management solution for SMBs to control all corporate expenses. It streamlines a scattered expense management process with seamless syncing.

Key Features:

- Extends credit limits ranging from $500 to $5 million to control spending within constraints

- Provides custom approval workflows to speed up the approval process with minimal friction

- Offers multiple payment options, including ACH, credit card, check, international wire transfers

- Automates purchase order workflows with the ability to sync and automate two-way matching and three-way matching

- Enables quick coding and sync with accounting systems to streamline expense reconciliation

- Enables automated receipt matching, categorization, and expense reporting, reducing administrative workload

- Offers security features, including the ability to freeze and create corporate cards instantly

- Notifies administrators of each employee's transactions, ensuring timely oversight

Pricing:

Offers a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Glitches in the reimbursement process lead to pending approvals

5. Rydoo

Rydoo is a cloud-based expense management tool that streamlines reimbursement cycles, automates expense flows, and enhances team productivity. It combines the capabilities of an expense tracker and a travel service, enabling you to book flights and hotels. It is suitable for medium-sized businesses that are building international relationships with overseas offices as it supports multiple languages and currencies.

Key Features:

- Supports OCR scanning feature for receipt management

- Automates approval flows for expenses based on company policies

- Assures global compliance by setting up rules, mileage rates, per diems, and tax rates for specific countries and regions. Also provides an advanced rule engine for tailored policies in the admin panel.

- Reimburses employees in their local currency, supporting diverse international operations

- Integrates with popular third-party apps like Dropbox, Slack, Uber, Lyft, and SAP

- Supports accounting software widely used in the European Union, such as Exact Online and E-conomic

- Offers full audit trails for maintaining company policies, IRS compliance, and resource conservation with a 10-year data storage period

Pricing:

Offers a team plan at €8 per user per month with OCR scanning and integrations, growth plan at €10 per user per month adding controls and SAP/Oracle integrations, and enterprise plan with API support and custom pricing for ERP and HR

Pros:

- Makes it easier to add expenses in different currencies and get paid in local currency with multi-currency support

Cons:

- Increases in prices over time leading to significant cost jumps over the years (Source)

- OCR doesn’t work efficiently and requires manual entry

6. Zoho Expenses

Zoho Expense is a travel and expense management solution designed to cater to the needs of growing businesses. Trusted by thousands of businesses across 150+ countries, it is a customizable expense-tracking tool offering a mobile-first approach, automation, and integration capabilities. Its integration with the Zoho suite makes it suitable for SMBs seeking efficient travel and expense management.

Key Features:

- Provides complete control over all stages of employees' business trips—pre-travel approvals, bookings, and post-travel management with a powerful self-booking tool for efficient business travel

- Offers customization and multi-level pre-travel approval flows along with automated visa requests, documentation, and forms

- Supports expense reporting by auto-scanning receipts for automatic expense creation

- Enables simplified approval processes and timely reimbursements

- Integrates with company cards to offer direct card feed retrieval and automated reconciliation

- Facilitates budget creation and comparison with actual spending with customizable rules to restrict overspending

- Provides AI-driven fraud detection for expense audits with country-specific editions for local compliance and mileage rates

- Supports real-time communication with employees through chat, comments, and notifications

- Integrates with leading travel, HRMS, accounting, ERP, and collaboration solutions

Pricing:

Offers flexible pricing plans, starting with a free option and scaling up to $3 per active member per month, $5 per active member per month, and custom enterprise pricing

Pros:

- Adaptable to global taxation regulations

- Easy to set up and deploy, very affordable for SMEs

Cons:

- Limited payment gateway integration options

- Can be a little confusing to learn especially when transitioning from app to desktop

Finding the Right Expense Management Solution

Consider these three factors while choosing the right expense management software — ease of use, security, and flexibility. Choosing the right expense management software can help you start your journey towards a healthy financial ecosystem.

In the end, what matters are your internal policies and controls that govern the expenses. Because no matter what platform you choose, if there are gaps in your internal control systems, the software will not be able to do the heavy lifting.

If you want more clarity on how you can stop the chaos in your company and manage expenses better, read our detailed post on internal control over financial reporting (ICFR). You can also book a call, and our team will help you better understand the bottlenecks and how you can streamline your expense management.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Leen Shami

What is Pluto Card?

What is Pluto Card?

At Pluto, we believe better expense management should be within everyone's reach. We solve MENA finance teams' pain points by replacing their business credit cards with Pluto corporate cards to help manage their expenses, saving them time and money.

How do we do that?

- {{time-money="/components"}}

Create Unlimited Corporate Cards

When multiple employees have access to one company credit card, it can be difficult for finance teams and business owners to track how much is being spent and where.

The result: everyone texting the CEO or CFO for OTPs during important meetings.

Pluto makes it easy to create and distribute virtual and physical corporate cards to each employee. Not only does this minimize fraud risk, but it also makes expense tracking simpler for finance teams, CFOs, and CEOs.

With Pluto’s unlimited corporate cards, you’ll be able to:

- Create virtual cards in seconds.

- Receive physical cards in 1-2 days.

- Use cards for vendor-specific cases.

- Assign every employee a budgeted corporate card.

Spend Control

Are you running ads at a cost that exceeds your marketing budget? Are you providing new hires with an allowance to cover the costs of their office equipment and software, or do you offer employees additional perks such as a monthly gym stipend?

Pluto gives you the ability to set limits and take control of your company’s business expenses, hassle-free.

With Pluto’s all-in-one expense management platform, you’ll be able to:

- Assign virtual or physical cards with spend limits.

- Allocate a specific budget towards daily, weekly, or monthly expenditures.

- Create a single-use purchase card that automatically deactivates once it is used.

- Control spending for different departments by allotting a budgeted amount to be spent.

Goodbye overspending 👋🏼

Reimburse In Record Time

Reimbursements can be a painful process when the end of the month rolls in. Whether you’re scrambling to find lost receipts, trying to match receipts to their expenses, or organizing them in a document, there’s no easy way.

Drag & drop receipts

Pluto makes it easy for employees to list receipts.

Once a business expense is made by an employee, they’ll be able to drag & drop an image or screenshot of the receipt onto the Pluto dashboard.

Yes, as simple as that.

Easily reconcile receipts

Pluto allows you to seamlessly submit your receipts onto the platform. With Pluto, reconciliation is a breeze.

Once a business expense is made:

- Attach receipts to card transactions with just a few clicks.

- Transactions will automatically be categorized.

Add a memo to every transaction.

Get reimbursed in minutes

Waiting till the end of the month to get reimbursed for out-of-pocket business expenses is no longer necessary!

Pluto gives you the opportunity to get reimbursed in minutes.

Once a reimbursable out-of-pocket expense is made, head to the Pluto dashboard to log the expense and get reimbursed as soon as it is approved.

Get Real-Time Data

Your month-end expense report comes in—and you find that you've spent more money than budgeted. Again.

With Pluto, you can stay on top of your expenses at any given moment.

By getting real-time data, you can view reports of your company’s spending and ensure that your company’s finances are in check.

It's simple, Pluto helps you avoid overspending and keep track of your company's finances in real-time.

So what does this mean for you?

- See transactions happening on your cards in real time.

- Receive notifications about every single card transaction, if needed.

- Collect information on which vendors your company is spending the most money with.

- Identify which employees or departments are spending the most.

- Get an overview of the expenses you have incurred daily or month-to-month.

Pluto allows you to adjust if spending has gone off course—and plop some celebratory balloons if it hasn't 🎊!

Integrate With Other Platforms

Every business has multiple platforms, and we know how important it is for them to talk to each other. Pluto's integrations make it easy to get started and ensure you have all the data you need in one place.

Accounting Integration

Pluto syncs your company's transactional data to the most popular accounting platforms through direct integrations so you can automate your accounting and close books faster.

No more end-of-month mayhem! 😅

Mobile Wallet Integration

With Pluto, you can add your virtual or physical cards to your digital wallet to make transactions seamless and easy.

We support Google Pay, Android Pay, and Samsung Pay.

What Else Does Pluto Offer?

Pluto gives you the opportunity to scale your business, without having to worry about the smaller details.

No FX Fees

Pluto doesn't charge you any foreign transaction fees for using your Pluto corporate card outside of the UAE.

If your business is expanding rapidly and your team is traveling more frequently, you won't have to worry about those pesky charges eating into your profits.

Or if your company needs to pay for subscriptions, contractors, or freelancers in a different country, you can do so without racking up a bill in FX fees.

Remote teams, frequent flyers, or big spenders, we've got you covered!

Accepted Worldwide

Whether your team is distributed, travels a lot, or makes international payments, Pluto’s corporate cards are accepted worldwide.

Advanced Security & Privacy

Pluto is PCI DSS Compliant. We take the safety of your information very seriously; all your data is stored and processed following the highest data protection standards in the industry.

Get Started in Minutes

Pluto's sign-up process takes minutes, not hours. By adopting a KYB and KYC process that can be done within a few clicks, you’ll be making transactions in no time.

- Simple application process.

- No credit history is required.

- Fast approvals.

- Instant card access once approved.

Let us take the hassle out of managing your expenses. Start Using Pluto Today - For Free.

•

Vlad Falin

The Role of Accounts Payable Automation in Modern Accounting Practices

From receiving goods to clearing payments, it is not a single-click process. Multiple steps in between make the accounts payable process tedious and time-consuming.

You receive goods, match them with purchase orders and invoices, send the invoices for approval, make the payment, and finally, maintain records for bookkeeping. This process alone takes weeks and creates confusion when multiple stakeholders are involved.

Think about purchases above $50,000. There are multiple approvals, and each purchase triggers a unique workflow. Documents are not consolidated, and no one has a clear idea of the payment status.

Thus, accounts payable become chaotic.

Can You Automate Accounts Payable?

To streamline your accounts payable process, you can use tools to automate it. This will simplify bill payments and give you more visibility and control over money.

While it will take time for stakeholders and employees to embrace automation, you can consolidate your scattered pieces on a centralized platform. If you are looking for suitable AP automation tools for your company, check out our list of the top accounts payable automation software.

This post will delve deeper into how you can automate the accounts payable process and how it will help your business.

{{less-time-managing="/components"}}

What is the Accounts Payable Automation Process?

Accounts payable automation uses tools to automate invoice verification, approval workflow, payment processing, and bookkeeping.

Instead of manually organizing, matching, approving, and clearing invoices, the entire process goes on a digital platform to provide visibility and control at each step. So, earlier, employees would spend hours getting approvals and days clearing payments, but now, an automation tool reduces the invoice processing time.

The platform captures and extracts the invoice from emails via optical character recognition (OCR). The invoice goes to the platform with all the critical information, such as purchase order and simplifies three-way matching. A trigger-based approval workflow notifies the stakeholders to approve invoices. The admin gets complete visibility of each step and clears the payment without going through a variety of software.

How to Automate Accounts Payable

Automating accounts payable is as simple as choosing and integrating the right automation software with your existing accounting and procurement software.

The automation software offers visibility into where the money is going and control over the entire process. You can customize the approval workflows and payment gateways and create an ecosystem that supports your procurement process. You can accommodate manual processes and integrate them with other software without going through a complete flip.

With the right automation software, you bring all the critical stages of accounts payable on a centralized platform. Here are the five key steps you can automate:

1. Invoice Management

Manual: The vendor sends an invoice to a dedicated email or a physical copy via fax or mail. The employee receives it and moves from one stakeholder to another for approval. The process is delayed for days if any manager is unavailable. Once the approval is complete, all the documents go to the accounting team, who clears the payment.

Automated: Depending on how the vendor sends the invoice, the automation platform captures the invoice from email or WhatsApp. If you receive a physical invoice, you can upload the invoice, and the system extracts all the vital information via OCR. There's no need to manually enter details or add a general ledger (GL) and taxation code. The system captures, extracts, and consolidates all the invoices.

2. GRN Matching

Manual: The dedicated team receives goods along with the goods receipt note (GRN) and must match it with the invoice and purchase order. This ensures that the specified goods are received as per the purchase order. Manually, this process is prone to errors, leading to discrepancies. It demands accuracy to ensure you receive the correct items in specified quantities.

Automated: Automated software makes this easy by combining all the relevant documents on a single platform. The dedicated team has the invoice and purchase order side by side, making it easy to compare items, purchase orders, and invoices for three-way matching. As a result, spotting discrepancies becomes more manageable, reducing the chances of errors.

3. Approval Workflow

Manual: Once the invoice is received, the employee gets it approved by dedicated managers. Based on the invoice amount, they need more than a single approval. Manually, this means going from one office to another or delving into long threads of email or Slack conversations. It becomes difficult for accounting teams to track approval and clear payments.

Automated: With automated software, each invoice triggers an approval workflow for relevant stakeholders to approve the payments. The admin can create custom no-code workflows based on different if-then rules. For instance, marketing purchases above $50,000 will have more approvals than expenses of $5,000. Also, all the relevant teams will have visibility into the approval status, making it easier to clear payments on time without confusion.

4. Payment Processing

Manual: Once the invoice is approved, the accounting team determines the details and pays via checks, cards, or other payment methods. It takes a few days before the payment is cleared, and the teams need to sync all the information across the accounting software for reconciliation.

Automated: With automation, accounting teams and employees enjoy more flexibility. For instance, Pluto offers corporate cards, payment gateway integration, and a digitization platform for bookkeeping.

- With corporate cards, you can create custom vendor-specific cards with advanced controls to ensure payments are made only for approved vendors.

- Pluto integrates directly with your payment gateways to facilitate payment within the platform.

- If you make payments via checks or other physical modes, Pluto will act as a digital bookkeeping platform. You can enter the payments made on the centralized platform and ensure that all the information is streamlined.

5. Reconciliation

Manual: Reconciliation is the messiest part of accounts payable. Teams must maintain records, manually enter all the details, and sync them across the accounting platforms and ERPs. It is time-consuming, prone to errors, and tricky in case of purchases where one invoice invites multiple tax and GL codes.

Automated: Automation consolidates all the information on a single platform without manual data entry. It uses OCR to extract all the critical information with a feature to upload the invoices in bulk. Further, you can split the transactions to add multiple tax and GL codes to address the audit season rush.

How Accounts Payable Automation Simplifies the Procurement Process

Accounts payable automation is not just for the procurement or the accounting department. It also makes it easier for stakeholders to approve the payments and employees to get timely resources.

Overall, it assists you in bringing together scattered parts of the procurement process. Here are reasons why you must invest in accounts payable automation:

1. Improve Compliance

You get complete visibility and control over your accounts payable. You can create custom workflows to ensure that any purchase that goes against the company policy is rejected. You can also accommodate intricate hierarchies to suit your organization's needs and get timely approvals.

2. Avoid Double Payments

It is usual for teams to end up paying the same invoice twice as no one has visibility into the payment status. It happens when the same invoice is paid twice by different team members or when vendors send the same invoice twice, and both get paid. You can avoid this as the software detects duplicate invoices and gives visibility into the status of invoices. The main dashboard highlights the pending invoices and the ones awaiting approval. It becomes easy to stay on top of all the invoices and avoid errors.

3. Faster Approvals and Matching

You get a trigger-based no-code approval workflow engine where you can create customized workflows to accommodate intricate hierarchies. The software notifies the stakeholders to review and approve the invoices. Since all the information is available on a single dashboard, two-way or three-way matching is a matter of a few minutes. This accelerates the approval process, and payments are disbursed much faster. It improves the vendor relationship without risking over, under, or delayed payments.

4. Better Reconciliation

You get all the relevant documents consolidated on a single platform with the appropriate purchase. Additionally, the software automates the coding and categorization, simplifying the reconciliation process. In case of discrepancies, spotting errors becomes easy. Moreover, with features like locking the approved payments and restricted access for auditing, you can eliminate the chances of fraud or manipulation.

5. Accuracy

You improve the accuracy of your records and GRN matching with all the information streamlined on a single platform. Moreover, as the software relies on OCR, you eliminate the need for manual data entry, reducing the chances of errors. Also, you can integrate the automation software with your accounting platform and ERPs to sync data and ensure consistency across the platforms.

6. Centralized Dashboard

You get a centralized dashboard with all the key information available in a unified place, acting as a single source of truth. Additionally, you get insights that can help in data-driven decision-making to facilitate procurement cost savings. Further, you can view all the awaiting payments and approvals on a dedicated dashboard. You no longer need to run from one platform to another for information as the software integrates with your accounting system.

7. Accessibility

The unavailability of a single person can create bottlenecks in the approval process and block the supply chain. With all the information streamlined on a single platform, each stakeholder can access relevant data for decision-making. So, whether the CEO is traveling or the CFO is not at the office, they can access the details from any corner of the world and avoid disruption in the supply chain.

8. Visibility

You get visibility for each step, each document, and each purchase. You can bring the entire procurement automation on a single platform and track the status in real time. Whether an employee raises a request, gets an invoice, or needs to clear payment, you will stay on top of the information without creating any delays or friction.

Automation is Easy With the Right Software

Adopting automation software isn’t easy, especially for critical processes like accounts payable, which also involve external stakeholders. The top three factors to look for in appropriate software are flexibility, visibility, and integration.

Choose one that integrates with your existing processes and systems and is flexible enough to accommodate complex hierarchies. Instead of focusing solely on the accounting or procurement team, it should cater to all the key stakeholders and make automation easier to adopt.

At Pluto, we aim to bring a balance among the spenders (employees), the savers (finance teams), and the sourcers (procurement teams). Each stakeholder gets visibility, and decision-makers get flexibility. Pluto integrates with your current system and enables you to automate accounts payable without affecting the supply chain.

You can also automate your entire procurement process with Pluto and improve your bottom line. Read more in our procurement automation post.

•

Mohammed Ridwan

Top 7 Accounts Payable Software in 2024

Processing bills is the most difficult part of procurement.

Bill payments are often mistakenly duplicated, goods aren’t received as per purchase orders, or there are delays in the approval workflow.

An accounts payable software makes the process hassle-free by automating approvals and payments and giving more visibility and control over your accounts payable (AP). It also enhances reconciliation and improves vendor relationships.

While the core job to be done by an AP manager is to ensure good vendor relationships, manage between timely payments & cash flow, ensure compliance in payments, what you need is a solution that supports your organization’s finances in one place and ends the chaotic back and forth.

{{less-time-managing="/components"}}

What is Accounts payable software?

Accounts payable (AP) software is a tool that helps businesses automate invoice and vendor payments via a centralized platform. An accounts payable automation software brings together all the key information into a single source of truth and enables teams to do the following:

- Tracks bills and their statuses to avoid double payments

- Enables two-way and three-way goods received note (GRN) & PO matching

- Supports customizable approval workflows for complete visibility

- Supports local and international payments via various payment methods

Thus, AP software simplifies the payment processes and reduces unnecessary friction between finance, procurement & other teams.

Top 7 accounts payable software in 2024

Here are the top 7 AP platforms for businesses.

Based on your company size and needs, you can pick one of these to support your accounts payable.

1. Pluto

Pluto is an accounts payable software that transforms your AP processes by simplifying bill processing. From enabling GRN matching to setting fully customizable multi-layer approval workflows, it is the best accounts payable solution to manage your vendor payments and relationships.

Key features:

- Facilitates three-way GRN matching with purchase orders and item-based matching

- Consolidates approved invoices in a single window to highlight pending bills and avoid delays

- Offers a flexible approval engine capable of managing intricate hierarchies without requiring technical expertise

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images and emails directly to speed up the receipt capture process

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Enables creation of a preferred vendors list for quick payments

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Raises alerts for upcoming payments, enables scheduling payments in advance and automates invoices

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote.

Pros:

- Enables branch- and subsidiary-level spend tracking (not offered by other platforms)

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 certification

- SSO/SAML Capabilities for Enterprises

- Integrates with Netsuite, Microsoft Dynamics

- Better Forex rates than most local banks

- Multiple integration options

Cons:

- Integrates with all other major ERPs except Tally

- Slightly longer on-boarding due to corporate card offering

{{less-time-managing="/components"}}

2. Tipalti

Tipalti is an automation tool that supports end-to-end AP processes. It helps you streamline accounts payables and make global payments in local currencies for various recipients, from suppliers to freelancers. The cloud-based platform helps finance teams manage payments without losing visibility and control.

Key features:

- Supports supplier onboarding and vetting to ensure supplier reliability and trustworthiness

- Integrates with ERP and accounting systems to help with reconciliation reporting

- Uses OCR to scan, capture, match, and process invoice data to reduce manual errors

- Provides built-in approval workflows and payment scheduling

- Offers invoice processing, including two-way and three-way PO matching and approval to avoid overpayments

- Assists AP processes for subsidiaries and entities

Pricing:

Starts at $129 per month per user for the platform fee and charges for additional features separately.

Pros:

- Can manage supplier bank account details in a secure environment

Cons:

- Cannot use it for prepayment invoices on inventory purchases with the ERP system

- High foreign currency exchange fees

- Tax forms can be difficult to fill out and very difficult if you do not speak English

3. Airbase

Airbase is an automation solution for managing global AP processes. It focuses on ensuring compliance and syncing with your accounting tool to streamline the payment process.

Key features:

- Offers OCR to populate details, including general ledger (GL) category, date, amount, and purpose

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Has a centralized dashboard with all key information about the invoice to avoid friction

- Accepts invoices from email or vendor portal across all subsidiaries

- Offers automated approval workflows based on multiple parameters, such as vendor, amount, GL category, etc.

- Enables three-way invoice matching to ensure compliance and reduce wasted spend

- Facilitates payments and approvals, including multi-subsidiary support, international currency, and real-time GL sync

- Real-time audit trail with receipts, notes, and documentation for transparency

Pricing: Request a custom quote.

Pros:

- Intuitive and easy to use; no training or previous knowledge required

- Seamless approval workflows

Cons:

- The mobile app is slow and takes time to load pages

- SSO-based login is not smooth

- Not suitable for complex branch-level approvals and expenses

4. Ramp

Ramp is an accounts payable solution designed to manage payments and business expenses. It automates bill entries, approvals, and payments while offering complete visibility and control. By tracking each AP step from data recording to approvals, it simplifies payment processing and takes the burden off teams.

Key features:

- Uses AI to automatically extract key details from invoices to offer accuracy and eliminate data-entry errors

- Identifies duplicate invoices and helps with two-way matching to purchase orders

- Offers custom approval workflows to minimize errors and ensure timely payments

- Provides a unified dashboard with visibility into the status of invoices

- Consolidates multiple payment options, such as check, card, same-day ACH, or international wire

- Integrates with accounting solutions, such as QuickBooks, Xero, Oracle NetSuite, Sage, etc. for auto-sync bill pay transactions

- Supports international payment processing in multiple currencies

- Tracks vendor data and transactions for easy reporting and data-driven decisions

Pricing:

Three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance.

Pros:

- Works with multiple subsidiaries

- Offers cash back on credit card purchases made using VISA cards

Cons:

- Can’t unmatch an incorrectly matched invoice (invoice to credit card)

- Approval routing can only be set on the vendor level, not department level

- Limitations in syncing repayments

5. Bill

Bill is a spend management solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Key features:

- Enables tailored approval processes to facilitate approvals with minimal hassle

- Automates purchase order workflows with the option for automated two-way and three-way matching

- Simplifies expense reconciliation through quick coding and integration with accounting systems

- Automates receipt matching, categorization, and expense reporting, decreasing administrative tasks

- Syncs with all major accounting systems like QuickBooks, Sage, Intacct, and NetSuite

- OCR auto-populates invoices for data entry

- Provides bulk payments of approved invoices with payment choices, such as ACH, credit cards, checks, and international wire transfers

- Offers audit trail of any changes or actions related to the invoice on a single page

Pricing: Provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

- Limited customization options for reporting

6. Melio

Melio is a bill payment tool that enables businesses to pay via bank transfer and debit cards. Even when the vendor accepts only checks, it pays checks on your behalf to facilitate bill processing. It processes payments and issues checks without the payee having to use the platform. It is a tool suitable for small businesses to process payments without hassle.

Key features:

- Enables payments via credit card even when the vendor doesn’t accept the card to support deferred payments

- Allows inviting additional users (such as accountants) to set up roles and permissions and manage approvals easily

- Supports two-way sync with QuickBooks and Xero

- Facilitates bulk payments and split payments (splitting bills into multiple payments)

- Offers international payments across the border

- Raises duplicate payment alerts to assist in fraud detection

Pricing:

Free to process ACH payments to vendors; charges a fee for other payment modes (check Melio pricing)

Pros:

- Offers a free-to-use payment module (only with QuickBook)

Cons:

- Lack of integration with accounting software

- Turnaround time on a check is three business days

- Support is very limited

- Limits payments to two checks per month

7. Spendesk

Spendesk automates the AP process by bringing together purchase orders and invoices to facilitate budgets, payments, and approvals. It creates a single source of truth to cut hours of manual work and detect errors better. It is a cloud-based software that improves budget control and financial reporting.

Key features:

- Offers a centralized platform for tracking payments right from the purchase order stage

- Supports invoice capture via email and image/file upload

- Uses OCR to extract key information from the invoice, such as supplier name, amount, dates, and purchase details

- Enables budget changes in real time without a manual data-entry system

- Allows scheduling of payments and matching of purchase orders with the invoice for effective GRN matching

- Provides customizable and built-in approval workflows and controls to monitor spending

- Raises alerts for duplicate invoices to enable teams to avoid overpayments and defect frauds

Pricing:

Pros:

- Super convenient for ad-hoc expenses

- Intuitive and interactive interface

- Easy manual upload in case OCR doesn’t support receipt capture

Cons:

- Glitchy virtual card payments with delayed notifications and declined transactions

- OCR-based receipt capture only works for emails

- Basic features like memorizing accounting patterns for vendors are only available in the paid module

What are the benefits of accounts payable software?

Adopting AP software helps you in the following ways:

- Gives real-time visibility into the status of invoices and payments

- Provides insights into spending patterns, vendor performance, etc.

- Streamlines payment and approval workflows, leading to smoother payment processes and vendor relationships

How to choose a good accounts payable Software

Ease of use

The AP software must be flexible to accommodate complex hierarchies without making it difficult to follow the workflows. It should offer trigger-based workflows and a clean user interface. Your team shouldn’t struggle to learn how to use the product and rely on the support team to get basic invoices cleared.

Multiple payment options

From local transactions to international wire transfers and other digital payment options, AP software must support multiple payment options. It becomes easier with vendor-specific cards that make payments safe and fast. Pluto helps you set up vendor-specific cards, even for public relations officers. This is something most platforms on the market do not support.

Accurate data capture

AP software with OCR capabilities makes invoice processing faster and reduces errors. The ability to process invoices from different platforms and sources, such as emails, Slack, and WhatsApp, is required. Moreover, moving these captured invoices into the centralized database and syncing with accounting software eliminates the manual data entry task.

Approval workflow

Approval workflows are key for timely and accurate payments. An AP software must have a simple no-code workflow builder, even for complex hierarchies. This is especially useful for large organizations where this process can be intricate and long.

Integration

Vendor payments need to be recorded across accounting systems for effective reconciliation. The AP software must integrate with your accounting systems and platforms to automate data entry and facilitate a synchronized record-keeping system.

Centralized dashboard

The AP software should offer a dedicated dashboard with all the key information such as vendor, invoice number, status, description, etc. Also, it must give a separate centralized view for expense tracking. This gives you visibility into where you spend the most and helps you optimize resource allocation.

Supports GRN matching

The AP software interface must be designed in such a way that it supports GRN matching, both two-way and three-way matching. Be it in the form of OCR invoice capture or offering item-based matching capabilities. This will avoid any under- or over-payments and support a healthy vendor relationship. Also, this eliminates complications in the reconciliation process.

Reporting

Reporting capabilities of AP software help to identify the spending patterns and other key insights related to department-specific expenses, budgeting, etc. Hence, AP software must provide a dedicated reporting dashboard with the option to export the reports for enhanced analytics and reporting.

Transforming Accounts Payable with the Right Software

Accounts payable is not just about clearing bills and vendor payments. It is the basis for vendor relationship management and proper order in financial processes. From getting approvals to matching GRN, you need software that offers ease of use with the right blend of functionality.

Too complex of a product will leave your employees confused, leading to double work. Lack of customization will have teams work harder to adopt the product. Limited integration will have the accounting department working twice as much on data entry and syncing.

Make the right decision and choose software that gives you control, customization, security and speed, all while embracing automation capabilities.

Book a demo and discover how a simple automation tool transforms your AP process.

Disclaimer: The comparisons and rankings of accounts payable software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use