Contents

Procure-to-Pay Process: What it is, Benefits, and Steps Involved

Vlad Falin

•

•

The procure-to-pay process doesn’t mean the procurement process. It is a subset of procurement that integrates purchasing and accounts payable.

Traditionally, the procurement process is scattered across the business, and the procurement team needs help to gain visibility or control. The employees purchase from different vendors, the approval process is chaotic and delayed, the stakeholders are stuck in email threads to review the expenses, and the procurement team struggles to get an overview of the organization’s needs.

Procuring the best goods and services becomes problematic since the team is left with open information loops. As a result, it spends more time optimizing the procurement cost and improving the bottom line.

What is the Procure-to-Pay Process?

The procure-to-pay process streamlines the scattered procurement parts to combine purchases and payments. Instead of a process spread across different software, the procurement process shifts to a centralized platform.

The employees get a dedicated platform to raise purchase requests and obtain approvals. The platform notifies stakeholders, such as managers, legal teams, finance teams, IT teams, and other relevant decision-makers to review and approve the proposals. As a result, the procurement team seamlessly moves to the vendor evaluation and negotiation stage without worrying about approvals or delays. The finance team efficiently handles accounts payable since the purchase and payment process is integrated.

So, while earlier, the purchases were handled solely by the procurement team and payments solely by the finance teams, the procure-to-pay process gives both teams an overview of the process from start to finish. In this post, we will discuss how this procure-to-pay process helps you optimize your procurement function and improve your bottom line.

Why Do You Need a Procure-to-Pay Process?

The procure-to-pay process is not just for your finance team or procurement team. It helps the entire organization to gain resources efficiently. Here are eight ways that demonstrate how moving to a streamlined process benefits you:

1. Visibility

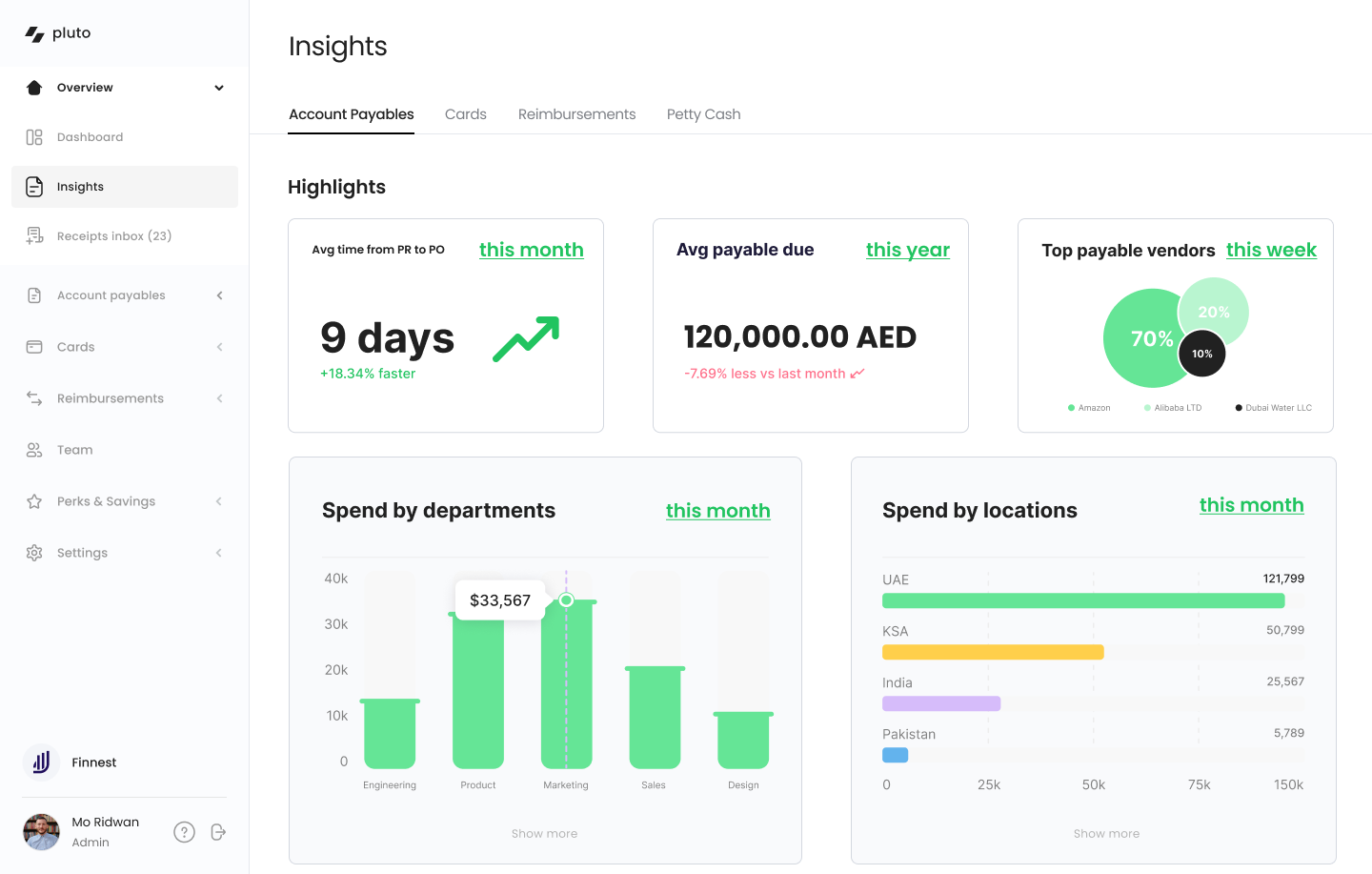

All the relevant stakeholders get visibility into the process and the status. Be it the employee, managers, finance team, legal team, IT team, or procurement team — each one can track the progress without delving into multiple email threads. Additionally, teams get insights that help procurement teams optimize costs with data-driven decision-making.

2. Compliance and Control

You can implement advanced controls, such as customized approval workflows and spending budgets, without micromanaging the teams. You can successfully enforce internal control over financial reporting without creating unnecessary team resentment.

So, for instance, if any expenses or purchases beyond $50,000 require additional approval from the legal and IT team, you can easily configure those controls within the approval workflow.

3. Streamline Workflows

The traditional process demands the employees to go from one office to another or spend days on email and Slack conversations before the managers give the green signal. At times, approval of a critical stakeholder is missed, causing delays and disrupting the workflow.

With the procure-to-pay process, you can create custom workflows depending on the purchase category, department, amount, etc. This accelerates workflow, and all the relevant stakeholders get notified right away.

4. Centralized Management

The procure-to-pay process integrates purchases and payments to bring all the critical information on a single dashboard. As a result, any discrepancies in the procurement process are identified in minutes. The entire procedure accelerates the real-time visibility of each stage.

5. Reconciliation

A centralized management system makes collecting and storing documents easy; additionally, since it integrates purchases and payments, the information syncs across accounting systems and ERPs.

During the audit season, this becomes a blessing where the finance team doesn’t have to chase teams for complete records. Also, it becomes easier to store and lock all the transactions and share these records with external parties.

6. Risk Management

The procurement operation is prone to financial, operational, and reputational risks. With the procure-to-pay process, teams can efficiently manage the vendors, purchase requests, approvals, and payments on a centralized platform in real time. It reduces the risk of fraud, ensures policy compliance, and provides visibility into spending patterns without burdening any team.

7. Insights

You can easily see the inside out of your procurement process, whether you want to know how much the marketing team spends or which vendor costs you the most. It makes it more convenient to reduce procurement costs and optimize purchases to improve the bottom line. Also, as all the information is centralized, there are no gaps or missing loopholes, providing complete transparency of your expenses.

8. Invoice Management

The procure-to-pay process ensures that all the invoices are captured and extracted into a centralized platform. This facilitates two-way and three-way matching without causing delays. Moreover, the reconciliation process becomes easy as all the records are systematically recorded.

So, whether you receive an invoice via email, WhatsApp, or physical copy, you can easily add it to the system without risking losing an invoice.

What are the Stages in the Procure-to-Pay Process?

The traditional procurement process has over nine steps strewed across different platforms. These include identifying goods and services, purchase requests, vendor selection, negotiation, purchase orders, inspection of the goods received, three-way matching, approvals, and payment and reconciliation.

While the procure-to-pay process doesn’t alter these stages, it integrates them for a streamlined workflow. So, earlier, if the approvals took days or weeks, keeping employees and the procurement team on hold, now it only takes a few minutes or hours. You centralize the procurement process and save money and time.

Here are five key stages in the procure-to-pay process:

1. Purchase Request

Employees no longer need to travel from one office to another, seeking approvals manually from managers. The streamlined procure-to-pay process gives employees a centralized dashboard to raise requests and specify their needs. It helps the procurement team to understand what the employee needs as well as examine the purchase details. Moreover, the stakeholders can quickly approve or reject the requests from the dedicated platform.

Administrators add customized approval flows to enforce internal policies. They create trigger-based approval workflows based on the expense amount, category, and department to accommodate intricate hierarchies.

For instance, they have the option to create separate workflows for expenses below $5000 and those exceeding a certain budget. Similarly, they can add specific stakeholders to the custom workflows for minimum friction and delay.

2. Purchase Order

While the vendor evaluation, selection, and negotiation happen on dedicated ERPs, the procure-to-pay process enables you to bring all this information on a consolidated platform. You maintain a synced and consistent database to make purchases faster and more secure.

Pluto integrates with your ERPs and allows you to maintain a centralized vendor database. You can add the vendor directly to the platform and systematically record information. You can add a field in your approval workflow to determine whether the employees are purchasing from a vendor list or a new vendor.

A systematic list helps you consolidate expenses and optimize costs. Moreover, ordering becomes more accessible with a unified platform for raising and approving purchase requests and maintaining an ERP-synced vendor database.

3, Invoice Management

Traditionally, vendors send invoices to a dedicated email or an address. The employees send them for approval and payment. It takes days to clear the expenses. Additionally, the accounting team spends considerable time and energy on maintaining records.

The procure-to-pay strategy reduces this effort and streamlines the procedure. It captures and extracts the invoice from the emails and attaches to a dedicated purchase request and order. This helps the teams match the purchase order, invoice and goods received note (GRN) without juggling multiple platforms.

It pulls all the information with optical character recognition (OCR) technology, reducing manual data entry. Since this platform syncs with the accounting system, the accounting team spends minimal time on data entry.

4. Payment Processing

Processing payments becomes a task when the finance team has to chase employees for invoices and wait for approvals and verification. The procure-to-pay technique centralizes the entire process, giving real-time visibility and helping finance teams make timely payments.

Moreover, with Pluto, you can integrate your procurement software with the payment gateways to ease the payment process further. Also, you get better Forex rates than banks, helping you save more money. Overall, with the approvals and invoices streamlined, payment processing becomes easy.

5. Reconciliation

Reconciliation is the hardest part, even when you perform the data entry and data sync monthly. You risk losing documentation and creating gaps in the records.

The procure-to-pay process consolidates the entire procurement cycle to bring all the critical information on a single platform. There are minimal gaps; records are up-to-date due to real-time tracking and recording.

With Pluto, you can integrate with platforms like MS Dynamics, Oracle Netsuite, QuickBooks, etc. So, with your ERPs and accounting software synced, you can easily record all the transactions digitally and securely.

Pluto further enables you to lock the transactions to avoid fraud once approved. Moreover, you can create view-only access for your records to simplify auditing for external parties.

Improve Your Bottom Line With the Right Procure-To-Pay Solution

Overall, the procure-to-pay process helps you automate your procurement process without changing your approach too much. You just need to find the right solution that assists your procurement process.

We discussed more about this in our procure-to-pay solutions post, where you will find what procure-to-pay software does and how to pick the right one.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Vlad Falin, Finance Writer

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

Best Virtual Corporate Card For Business [2024]

In modern business, cash and checks have gone the way of the horse and buggy: they’re simply too inefficient. But even their replacements – traditional payment methods like debit and credit cards – are overdue for an upgrade.

Welcome virtual corporate cards.

These digital payment methods offer numerous perks, from faster payments and reconciliation to greater control and security. They’re quicker, safer, and easier to integrate and use for accounting and operational teams alike.

Plus, the industry is on the cusp of an explosion, which could send innovation through the stratosphere. Between 2021 and 2026 alone, virtual card spending is predicted to skyrocket from $1.9 trillion to $6.8 trillion.

Here’s what to know.

Key Takeaways

- Virtual corporate credit cards pave the way for the future while addressing a multitude of modern business pain points.

- They hand companies greater control over their spending, simplify accounting across the board, and even help protect employees.

- Plus, with so many nuances and use cases, it’s incredibly easy to personalize virtual cards to meet your unique needs

First, A Brief Refresher on Corporate Cards

Corporate credit cards are credit cards issued to a business entity – not a person – as the responsible party.

In most other respects, corporate cards are like regular credit cards. They require a credit check to apply, charge a regular interest rate, and even come with reward systems. Corporate purchase cards are also unique in that the business can issue dozens of employee cards on the same account.

Pluto corporate cards come with specific controls to help your business manage spend. Real time tracking, setting limits on the go and quick reconciliations are just a few of the things that Pluto can provide.

But there is more. For companies who need to act quickly and require flexibility in their card issuing, there are virtual cards.

{{gain-control-banner="/components"}}

What is a Virtual Corporate Card?

Virtual corporate cards, like regular corporate cards, are linked to the business’ budget. Employees can use these cards to pay for business expenses without using their own personal cards or cash.

But unlike physical cards, virtual credit cards reside solely in the digital realm. These cards are essentially unique, digitally-generated 16-digit card numbers that tie to a specific spending account. (In this case, the business’ account.) Each virtual card contains other essential card details, too, like the following:

- Cardholder’s name

- Company’s billing address

- Card number

- Expiration date

- CVV

Virtual cards are also unusual in that they can be generated and destroyed in moments. They can be designed to permit one-off charges, expire same-day, or hold only a specific dollar amount. Some virtual cards can even be linked to a particular vendor for one-time or recurring payments, perhaps with weekly or monthly spend limits.

Virtual cards can be accepted anywhere that online payments, and even some in-store payments, are accepted. Due to their ability to generate new numbers on demand, they offer additional security and control for business accounts. Plus, they can’t be lost or stolen like a regular credit card.

{{cta-component}}

Virtual Credit Card vs. Virtual Corporate Card

A virtual corporate card is simply a digital credit card issued to a corporation. For the most part, you can use virtual cards the same way you could use regular cards. However, like corporate cards, these virtual equivalents allow the issuing firm and receiving businesses to set particular spend and monitoring controls.

Because virtual credit cards are 100% digital and able to generate new 16-digit numbers on demand, they’re optimized for safety and flexibility. They also make it easier to reconcile books and otherwise manage spending.

What are virtual cards used for?

Virtual cards have gained significant traction due to their adaptability and security features. They are commonly used for:

1. Online Purchases

Virtual cards serve as a secure and convenient payment method for ecommerce transactions. They allow businesses to conduct online transactions without exposing sensitive primary card or bank details. This enhances security and reduces the risk of fraud, making virtual cards a preferred choice for digital transactions.

2. Subscription Management

Businesses utilize virtual cards to manage subscriptions to various software or online services. Virtual cards offer the flexibility to set spending limits and deactivate cards easily, providing control over recurring expenses. If a service is no longer required, businesses can deactivate the virtual card associated with it, preventing further charges.

3. Travel Expenses

Virtual cards are issued to employees for specific travel-related expenses, offering precise control over spending and simplifying expense reconciliation. By providing virtual cards for travel expenses such as accommodation, transportation, and meals, businesses streamline the reimbursement process and ensure compliance with travel policies.

4. Vendor Payments

Virtual cards are used to make payments to vendors and suppliers, offering a secure and efficient payment solution. Businesses can generate virtual cards with set limits for individual vendors, enabling better management of payments and tracking of expenses. Virtual cards also reduce the risk of fraud associated with traditional payment methods.

5. Single-Use Scenarios

For transactions requiring heightened security, businesses utilize single-use virtual cards. These cards are generated for one-time use and become invalid after the transaction is completed, minimizing the risk of unauthorized or fraudulent use. Single-use virtual cards are ideal for online purchases from unfamiliar vendors or for specific transactions where security is paramount.

6. Employee Expenditures

Instead of issuing physical corporate cards, businesses provide employees with virtual cards for business-related purchases. Virtual cards can be customized with predefined spending limits, allowing businesses to control and monitor employee expenses effectively. By using virtual cards, businesses streamline expense management processes and reduce the administrative burden associated with traditional reimbursement methods.

Why Use Pluto Virtual Corporate Cards?

Pluto virtual cards offer tons of perks and use cases. With more control and yet unparalleled flexibility, your business can remain nimble as you grow.

At the same time, department heads can keep an eye on expenses, spending, and accounting practices.

1. Flexible Setup and Spending

Modern companies need to be nimble, able to make purchases on the fly and reconcile their books in minutes, not days. Virtual cards let your business do so –without breaking their budgets.

Virtual cards provide unprecedented levels of flexibility to businesses of all sizes. After signing up, cards can be generated and issued to individuals with just a few clicks.

They also permit companies to limit available vendors, set a specific spending limit, expiration dates, and even the specific department budget the card should link to.

2. Unlimited cards

One of the biggest perks of Pluto's cards is that you can create as many as you need in a matter of seconds.

The times when an employee had to wait several days for the approvals and the card details to arrive are over.

For example - at 9:00, we had a team discussion about additional performance marketing activities.hile we were on the call, the department head created 3 virtual corporate card numbers for us to use.

It took him roughly 2 minutes to create them. All that without missing a beat on the call itself.

Right after we finished the call, we could start setting up ads.

3. Spend Control

Once you’ve generated a card – either for your team or by employee request – you can quickly personalize them for added constraint.

These controls are admittedly extensive, allowing your business to:

- Lock cards to a particular merchant or vendor

- Ensure cards can only pay to specific accounts

- Generate cards with set one-time, monthly, or recurring expenditure limits

- Institute purchase approval practices for individual cards, persons, or teams

Companies can use these various limits to prevent overspending, surprise fees, and unnecessary surcharges. Plus, with specific cards linked to individual employees or vendors, compartmentalized spend management becomes even easier. For many businesses, this is a welcome alternative to issuing high-limit cards to every employee that requires one.

In the example above, you can see one of the popular uses of Pluto virtual cards - employee benefits.

When a new employee joins, how much time does it usually take your HR department to get wellness or children's educational benefits to that employee?

With Pluto, it’ll take you leess than 2 minutes.

4. Higher Accountability

Another perk of virtual cards is that they can be generated for and linked to a single individual or team.

That makes purchase tracking easier, which increases personal and departmental accountability.

By using built-in accountability and analysis tools, your business can better track how and when money is spent at every level.

5. Streamlined Accounts Payable

Enhance your finance team's efficiency with Pluto, featuring virtual corporate cards and integrated accounts payable software. Pluto can integrate with your accounting software, making it easy to sync your chart of accounts, automate mapping your GL accounts, and bulk verify & export your expenses so you can close your books 10x faster.

From there, settlements can happen immediately rather than taking days or weeks. This eliminates the slow, potentially error-riddled manual accounting process with a faster, cheaper, and more efficient digital alternative.

6. Better Security

Pluto's virtual cards can help greatly reduce your overall card risk profile. Their increased security is due to their unique design, including their:

- Digital nature, which precludes them from being physically stolen.

- Set spending limits to prevent overcharging.

- Ability to block vendors and retailers from storing personal or card information long-term, helping to prevent fraud

- Ability to include one-time or vendor-specific expenditures and other spending controls, limiting financial hemorrhaging

- Auto-lock features to freeze cards instantly

- Ability to delete and regenerate virtual cards in seconds rather than days

7. Real-Time Reporting

Pluto's virtual cards feed their data directly into a centralized interface, allowing all data to show up in real-time reports, simplifying the analytical process. The spend management systems also offer real-time notifications.

Together, these features offer companies greater real-time visibility over their expenditures. This level of transparency can inculcate a healthier spending culture within a company beyond merely increasing accountability.

Plus, real-time reporting means that accounting teams and department heads can immediately respond to budget requests, verify receipts, and manage card limits.

Pluto expense management dashboard allows you to see everything and makes spend control a breeze.

8. Simple Reconciliation

Virtual credit cards provide an easy approval system to allow finance teams to take advantage of automatic reconciliations whenever possible.

Accounting teams can set codes for recurring transactions and tag controls to identify transactions before posting them to the general ledger. Each card can be linked to a specific employee to link specific transactions to each employee.

With the right card and accounting integrations, it’s possible to automate the bulk of manual data entry and reconciliation out of the gate. Plus, you’ll increase the accuracy of your data and insights.

9. Efficient Vendor Payment and Management

You can also use virtual cards to simplify vendor management.

You can link specific cards to particular vendors, allowing you to track which teams use them regularly and how their prices change over time.

By setting limits and expiration dates to your specifications, you can prevent teams from “forgetting” about upcoming auto-renewals.

10. Reward Options

Pluto virtual corporate card offers a wide range of perks and benefits!

Instead of giving you Starbucks gift cards, we formed partnerships with some of the most critical services for the day-to-day operations of your business.

11. Reduce the Risk of Fraud

When multiple employees and vendors share a high-limit physical card, you run the risk of operational problems and fraud.

The more people who can access a single 16-digit number, the more likely unauthorized expenses can slip through the cracks.

Virtual credit cards don’t come with the same fraud and data loss risks that physical cards do.

- They’re impervious to hacks that come with swiping physical cards at in-person terminals.

- You can create cards for a particular purchase, vendor or project.

- You can easily link cards to specific employees and/or vendors, offering full control while minimizing risk.

Virtual Corporate Card Use Cases

Due to their innate flexibility and unprecedented control, virtual credit card programs offer multiple potential use cases. There are too many to go over here – but we’ll address a few of the most common or impactful.

Agencies

Digital agencies need to be able to make payments on behalf of their clients. This can be done using virtual cards, which allows the agency to keep track of spending and ensures that funds are used for the intended purpose.

With Pluto, you can create virtual cards for every PPC campaign or bigger project and keep track of your agency's spending in one place.

Not only does this allow you to scale the clients' performance marketing efforts, but the spend control dashboard shows you exactly how much was spent. You can go as far as naming and tagging your virtual cards, so you can see how much was spent per PPC channel on individual clients.

Event Organizers

Catering, lights, music, production, venues, drivers so many things that even organizers have to keep in the air! If you are an event organizer, chances are you understand how important it is to keep your spending in one place. That way when the time comes to file taxes or show ROI, everything is itemized and accounted for.

With a virtual card, all your charges will be automatically filed under the right categories. You can also set limits on how much can be spent per vendor, so you don't have to worry about overspending.

And if you have a team working on the event with you, you can give them each their own virtual Pluto card (or physical) with their own spending limits. That way, you can see at a glance who is spending what and where.

Startups

When you are a startup, your want to fully focus on your product and leave the rest to someone else. With a virtual card, you don't have to worry about setting up a corporate credit line or dealing with complex expense reports.

Just set up your team with Pluto virtual cards and let them manage their own expenses. You can see what they are spending in real-time and track progress against your budget.

Also, when you are at your early phase, there is no time for lengthy approvals. SaaS, ads, tools, plugins - virtual card can service them all.

E-Commerce

You business is digital and so should be your payment tools. With a virtual card, you can make payments online without ever having to worry about the security of your information.

Worried about that Alibaba supplier? Create a virtual card with a limit just for that vendor and you're good to go. Put a spending limit on it, and you limited any potential risks as well.

- Need your team to buy TikTok ads? -> Done. TikTok Ads Virtual Card

- Need to pay an Upwork freelancer? -> Done. Upwork Specific Virtual Card

You see where we are going with this. Create as many virtual cards as you need for as many occasions as you need.

Consulting

Consultants are on the road most of the time, and when they are not - they are seated in the client premises, helping to grow the business.

Employee travel is one of the most commonly-cited reasons for individuals requiring their own corporate cards. Travel expenses may include hotel rooms, a food allowance, or additional budgeting to purchase essential materials while they’re away from home, so to speak.

However, even in your own teams, it’s possible for employees to get carried away. An expensive dinner, unexpected expenses, and hotel room upgrades may all be well within your budget. But if you want to prevent excessive spending on your dime, virtual card controls hand you that power.

Fleet Management

Any company that have a vehicle fleet knows that a lot of time can go into fuel cards management.

Pluto can provide both virtual and physical corporate cards which makes it a perfect solution for efficient fleet management.

You can issue fuel cards to the drivers as needed, and scale up and down depending on the current business situation.

In addition to that you see the fuel expenses real-time and can set limits and approvals where required.

•

Vlad Falin

5 Strategies For Cost Reduction in Procurement To Improve Bottom Line

It’s challenging to always be on your toes, looking for ways to cut costs. Be it negotiation or automating manual, time-consuming processes, your main focus is always to optimize expenses and improve the bottom line. This comprises 36% of CPOs whose top priority is delivering bottom-line savings.

Hence, in this post, we will discuss the top 5 procurement cost reduction strategies. We’ll also discuss the process of getting started and ways to improve the procure-to-pay process to ensure procurement cost savings

5 Cost-Saving Strategies in Procurement

Here are the top 5 cost reduction techniques in procurement that you can implement in the short and long run:

1. Reduction in Maverick Spending

Maverick spending refers to expenses beyond the established policy and procurement process. It involves unauthorized purchasing that is either not approved or doesn't adhere to the pre-approved vendors or negotiated contracts.

Such expenses impact financial and operational efficiency, leading to budget overruns and supplier relationship strain. For instance, an employee purchases office supplies from a non-approved vendor. It can lead to higher costs due to a lack of negotiated discounts and impact the organization's ability to leverage consolidated spending for better terms and conditions.

To reduce maverick spending, you must actively communicate procurement policies to avoid such expenses. You must monitor all the transactions and address any such instances. This requires greater visibility into the spending at each stage and an analysis of how company resources are being used. You will also need to set spending controls based on the company policies to avoid constant monitoring.

As a result, you gain better control over the procurement process, negotiate better contracts with preferred suppliers, and leverage volume discounts without disrupting the supply chain. This will help you maintain compliance with established procurement policies and save costs by avoiding unauthorized expenses.

2. Contract Management

Contract management involves reassessing the existing contracts and negotiating supplier agreements. This includes negotiation, execution, and ongoing monitoring to ensure cost optimization.

To ensure strong contract management practices, regularly revisit contract terms, assess performance metrics, and proactively identify areas for improvement. Prioritize negotiation preparation by investing in training for procurement professionals, ensuring they possess the skills to secure favorable terms and adapt agreements to evolving business needs.

Contract management aids in maximizing the value of agreements, minimizing risk, and ensuring that suppliers deliver as per the agreed terms. It also promotes better relationship management and identifies opportunities for cost optimization.

3. Request Specification

Request specification involves creating clear and detailed specifications for the goods or services that the organization intends to procure. This involves detailing purchase requests and understanding the needs of the teams to deliver what they need and not spend money on unnecessary features and misfit products. This helps ensure suppliers understand the exact requirements, leading to more accurate quotes and better value for money.

To ensure detailed request specifications, involve all the stakeholders in the approval process and get buy-in from each of them. Follow a standardized approval workflow to raise purchase requests. This ensures consistency and gets the maximum information possible. However, it is important to implement customized workflows to suit your business hierarchies.

This reduces the risk of feature overlap and better consolidates the purchases for negotiating more favorable deals. Moreover, the specificity of needs lowers the chances of cost overruns or disputes during the procurement process.

4. Spending Consolidation

Consolidating spending means automating procurement processes to achieve economies of scale. This includes consolidating purchases, standardizing suppliers, and leveraging bulk buying power. Doing so lets you negotiate better terms with suppliers, reduce administrative overhead, and achieve cost savings through volume discounts.

For instance, if you consolidate spending on packaging materials by sourcing from a single supplier, you negotiate bulk discounts, streamline procurement processes, and benefit from standardized materials. This approach reduces costs through economies of scale, simplifies logistics, and enhances overall operational efficiency.

To consolidate spending, conduct a thorough spend analysis, identify opportunities for consolidation, and negotiate with suppliers for better terms. Additionally, implement procurement software to streamline procurement processes. This will give you insights into your spending behaviors and help you identify optimization opportunities. Also, create a cross-functional procurement team to promote collaboration and standardization across the organization. Moreover, ensure proper cross-functional workflows to get stakeholders involved at each stage.

5. Vendor Diversity

Vendor diversity involves engaging with various suppliers to reduce dependency on a single source. This strategy ensures increased competition, better negotiation opportunities, and improved risk management.

For instance, having vendor diversity enables you to source materials from multiple suppliers rather than relying solely on one. This creates competition among suppliers, encouraging competitive pricing and service levels to mitigate risks associated with potential disruptions from a single supplier. Hence, in the event of supply chain challenges or fluctuations, you get the flexibility to maintain production and minimize the impact on operations.

To ensure vendor diversity, adopt a global sourcing strategy and conduct thorough market research to identify potential suppliers across the globe with clear criteria for supplier selection. Additionally, actively seek partnerships with businesses that bring unique strengths to your supply chain. Moreover, it is important to also regularly reassess and diversify your supplier portfolio to ensure adaptability to changing market dynamics. Fostering open communication to build strong, collaborative relationships with various suppliers is a must

As a result, you get better pricing, quality, and innovation. It also provides a safety net if one supplier faces disruptions or fails to meet expectations.

Three-Step Process for Cost Reduction in Procurement

Before implementing these strategies, go through this strategic process each time you have to hunt down expenses for cost savings:

1. Analyze Spend

Start by conducting a comprehensive spending analysis to understand where the money goes. Use financial records, invoices, and procurement data to categorize and analyze spending patterns. In such cases, having procure-to-pay software helps a lot in getting insights and real-time visibility.

This step provides a clear overview of the organization's spending habits, allowing identification of areas for potential cost savings. It serves as a foundation for informed decision-making in subsequent cost-reduction strategies.

2. Identify the Biggest Expense

Compare across departments or suppliers to identify the largest expenses or categories and spot any unusual expenses. This step allows for targeted efforts in cost reduction.

Discuss these insights with relevant stakeholders to understand why these costs exist and their impact. Also, align the understanding of ‘savings’ with them to avoid unnecessary delays and rejections. It is advisable to align it with something measurable to make it easier to sell the business case and implement the necessary changes.

For instance, the information technology (IT) department proposes investing in new software that, in the long run, promises increased efficiency and reduced maintenance costs. However, the finance team, focused on immediate budget constraints, may interpret ‘savings’ as strictly short-term cost reductions rather than considering long-term benefits.

To align understanding, the IT team can quantify long-term savings through reduced downtime, improved productivity, and potential scalability benefits. This ensures both departments share a common definition of ‘savings’ and facilitates a collaborative decision-making process.

Additionally, you can target the smaller spend or tail-end spend as well. It is easier to cut people from making one-off purchases or buying small items on Amazon that another department may have.

3. Conduct Market Research and Maintenance

Conduct market research to understand current pricing, trends, and available alternatives for the identified major expenses. Based on your research, you can optimize these expenses without impacting the supply chain. This includes incentives such as:

- Use spending data analysis to negotiate improved terms with suppliers. Seek discounts or bundled services to reduce costs without disrupting the supply chain.

- Research alternative suppliers or vendors for the identified major expenses. Assess their offerings, pricing, and reliability to diversify options and secure more cost-effective alternatives.

- Invest in automation to optimize procurement processes, reducing administrative overhead without disrupting the supply chain.

- Analyze inventory levels and adjust ordering practices based on demand forecasts to prevent overstocking or stockouts.

- Regularly monitor the expenses and supplier performance and reassess strategies to adjust optimization efforts based on changing market conditions and organizational needs.

Keep updating this information to stay informed about changes in the market. This ensures that you are well-informed about competitive pricing and industry trends. Additionally, you get the necessary data to negotiate better terms with suppliers, explore cost-effective alternatives, and adapt to market fluctuations, contributing to more strategic and informed decision-making.

How to Ensure Maximum Procurement Cost Reduction

Most companies have procurement processes running on autopilot with standard operating procedures. However, this leads to inconsistent efforts of procurement teams in reducing costs. They have to dedicate hours to analysis and optimization, which can be changed with intentional efforts to ongoing cost savings practices in procurement.

However, with traditional manual processes, getting real-time visibility and comprehensive insights is impossible. To streamline the process and consolidate the expenses, you must adopt tools that support your cost savings initiative. This means centralizing all the information to build a unified platform for complete visibility and control.

Pluto simplifies this for you. Not only do you get insights and controls, but you can also create cross-functional workflows to facilitate the collaborative procurement process. You can integrate your entire accounting and accounts payable system onto a single platform and streamline the entire process. As a result, you get real-time visibility and can optimize expenses in time.

Book a demo to know more about how Pluto fits into your business and helps you streamline your procurement process for collaborative cost-saving efforts.

•

Leen Shami

Expense Management; Definition, Types & Tips

Effective expense management is a critical aspect of any organization's financial health, ensuring smooth operation through controlled employee spending. Employees frequently incur various business expenses, from travel and entertainment to office supplies. To facilitate reimbursement, these expenses must be meticulously reported with detailed descriptions and receipts, subsequently reviewed and approved by line managers and finance teams. This process, central to expense management, not only streamlines how employees pay for business expenses but also provides a comprehensive track of their spending through organized expense reports.

What is expense management?

Expense management is the process of tracking, processing, and reimbursing employee spending. This involves scrutinizing expense reports, evaluating reimbursement claims, and enforcing company policies on permissible expenses. It is a key practice in ensuring adherence to the organization's expense policy while maintaining accurate financial records.

{{transform-expense-banner="/components"}}

Why is expense management important?

As an essential part of any business, expense management is vital for various segments of a company, such as the following:

1. Finance teams

An expense management process is the most important to a finance team or accounting department. Their main goal is to sustain accurate business financial records and analyze past trends to determine future business decisions.

Additionally, it can help identify cost-saving opportunities and risks by providing insights into the company's financial health.

2. C-level executives & managers

Owners, managers, or C-levels are more concerned about growing revenue, managing risk, reducing expenses, satisfying employees, and having a productive business.

3. Employees

Having reimbursements processed quickly creates a feeling of trust and satisfaction among employees. This greatly influences the productivity of your employees and your company.

4. Compliance

Maintaining detailed records of your business expenses ensures that your company stays compliant and assists companies in audit activity in case of fraudulent behavior.

Nevertheless, with the corporate income tax being introduced in 2023, expense management makes it simpler for businesses to file their taxes.

Expense management process

The expense management process is designed to safeguard against policy violations and mishaps, and it typically follows a uniform sequence across most businesses:

- Employee Expenditure: An employee makes a purchase for business purposes.

- Reimbursement Claim Submission: The employee submits a claim for reimbursement of the incurred expense.

- Claim Review: The submitted claim is reviewed and either approved or rejected.

- Payment Processing: Upon approval, the reimbursement is scheduled, often aligning with the employee's End-of-Month (EOM) salary.

Types of expense management

Approaches to expense management may differ from company to company. Here you'll find the different ways in which expenses are managed:

1. Paper tracking

Employees collect paper receipts and submit them to the accounting department for approval monthly or quarterly. This is the traditional (and outdated) method of managing expenses.

2. Spreadsheets

Businesses, especially in the UAE, usually use spreadsheets to manage their expenses and reduce dependency on paper receipts. Some common spreadsheet software is Microsoft Excel, Google Sheets, and Zoho Sheets.

3. Expense management software

An expense management software simplifies the process for companies by automating it. After an employee makes an expense, the managers are alerted to either accept or reject the expense. If the expense is accepted, it is usually scheduled to be reimbursed with the employee's EOM salary.

4. Pluto: Automated expense management software

Pluto is an expense management software that helps accounting teams save time by automating reimbursements, expense reporting, expense tracking, and budget control.

When a business expense is made, a Whatsapp notification is sent to the employee, prompting them to upload their receipt by snapping a photo; this also simplifies the reconciliation process. When that is done, the admin/manager is notified to accept or reject the expense. If the expense is accepted, it is reimbursed to the employee's bank account in seconds.

On the other hand, Pluto gives you the ability to create unlimited corporate cards with spend limits so you won't have to go through an approval workflow.

Real-time expense reports are also one of the many benefits Pluto offers, helping finance teams, CFOs and accountants make informed decisions. Learn how to improve internal control over financial reporting on our new post.

Traditional vs. automated expense management

Despite the benefits of automated expense management, a large percentage of organizations in the UAE still perform manual expense management. This leads to expense reports that are time-consuming and prone to error.

Traditional expense management

Traditional expense management is one expense management process that relies on several steps to manage spending and ensure the process for an expense claim is correct. As an expense management solution, expense tracking is usually in the form of paper tracking or excel sheets, as mentioned above.

Typically, once employee-initiated expenses are made, the employee must store the expense receipts and file them as reimbursable expenses at the end of the month when the accounting department is doing the end-of-month closing. After the expenses are submitted, the approval process begins. The employee's manager either accepts or rejects the reimbursable expense; if it is accepted, it is sent to the accounting team for reimbursement.

This is considered a nightmare for accounting departments, as they will have to go through manual data entry and spend countless hours on expense reporting at the end of month closing.

Automated expense management

Unlike traditional expense management, automated expense management software reduces time spent on processing expense reports, managing the business's cash flow, reconciliation processing, and controlling expenses incurred for finance teams.

Automated spend management software, such as Pluto, eliminates the manual process and automates the process for finance teams from A-Z. With expense management software like Pluto, you can automate different flows.

Benefits of using an expense management software like Pluto

1. Automate Reimbursements

Pluto helps you manage expenses incurred by digitizing the reimbursement process. Once an expense is made, Pluto sends you a Whatsapp notification prompting you to upload your receipt by replying to the Whatsapp or by uploading it onto the Pluto app. Once that is done, the expense record is saved, so employees don't lose it, and the expense is submitted for approval.

As an added perk, Pluto also auto-categorizes expenses made so employees and finance teams won't have to worry about categorization!

2. Streamline expense reporting

With Pluto, all expense records are in one place, meaning expense reports are automated; this helps accounting departments save hundreds of hours on manual work.

Additionally, expense reports are trackable in real-time, giving managers, finance teams, and accounting departments complete visibility over the business's finances.

3. Accounting automation

Close your books 5x faster!

Whether you use Zoho expense, SAP Concur, or Quickbooks, your accounting software can integrate directly with Pluto's platform.

Through our integration, you can also sync your chart of accounts and your GL codes to automate bookkeeping.

4. Smart budget control

Pluto allows you to issue your employees unlimited corporate cards with spend control. If you have daily allowances, weekly budgets, or travel expenses, you can get better control over your employee spending by setting custom limits on their corporate credit cards.

Expense management advantages for business

If you've reached this far, you might already know the advantages of automated expense management.

1. Accurate expense reporting

- Real-time, automated expense reports

- Sort reports by day, week, month, or by department, or category

2. Quick reimbursements

- Faster approval process for employees and finance teams

- Auto-categorization when uploading receipts

3. Monitor employee spending

- See what is being spent and where in real-time

- Set daily, weekly, or monthly allowances

4. Close books faster

- Integrate with all major accounting software to close your books 5x faster

- Sync your GL codes

What is an expense management policy?

Employee spending can be controlled by implementing an expense management policy. The policy can function as grounds for rejecting or questioning expenses and help determine whether they should be reimbursed.

In every expense management policy, the following items should be included:

Types of expenses

A complete list of everything employees may purchase and what they may not purchase.

Budgets

The current budget should be disclosed to everyone, and those with questions should be able to contact those responsible.

Reimbursements

A reimbursement policy must specify the reimbursement method, such as online, by credit card, or by other payment methods.

Key features to look for in an expense management software

If you're purchasing an expense management solution, make sure it fills your company's unique needs, offers the right level of functionality, and comes with a dedicated account manager.

Some of the key features you should be looking for are:

1. Real-time expense tracking and reporting

Having real-time expense reports is vital, as it helps finance teams monitor employees' expenses and manage them on the go.

For example, if the company's marketing department uses 70% of its monthly budget in the first two weeks of the month, the finance team can notify them that 70% of the budget has been used so they can plan and budget for the remaining 30%.

With Pluto, you can:

- Get notified as soon as an expense is made, so you know who spends what, where, and when

- Keep track of all business expenses, such as reimbursement, travel, and employee expenditure data, to avoid going over budget

2. Quick reimbursements

End-to-end reimbursements are crucial for a business to operate seamlessly. With quick end-to-end reimbursements, employees no longer have to wait till payroll to get reimbursed.

With Pluto, you can:

- File a reimbursement request through Whatsapp or the Pluto app

- Get reimbursed in seconds

3. Approval flows

Approval processes should be hassle-free. It's essential to have automated approval flows to ensure employee expenses and expense claims are approved by the right managers.

With Pluto, you can:

- Automatically assign expenses to the right reviewer

- Create your own customized approval flow

4. Integration with accounting software

Integrating your accounting platform with your expense management software reduces the time spent on bookkeeping.

With Pluto, you can:

- Integrate most major accounting platforms

- Sync your chart of accounts

- Sync your GL codes

- Close your books 5x faster

5. Customizable budget control

Setting limits and budgets is essential to control your company's financials fully. This helps your company stay within its budget and avoid mishaps with company spending.

With Pluto, you can:

- Create unlimited corporate cards with set limits

- Increase limits on corporate cards in seconds

- Issue vendor-specific cards

Pluto combines the above features with easy integrations, complete visibility, and total control over every aspect of your company's expense management.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use