Contents

Top 6 Procurement Software Solutions for Modern Businesses

Mohammed Ridwan

•

•

The traditional procurement process is time-consuming, prone to errors, complex, and challenging to implement efficiently. From raising a purchase request to making vendor payments, multiple stakeholders are involved. In addition, securing approvals through various channels of an organization leads to chaos. Hence, 77% of companies are shifting to procure-to-pay solutions, also known as procurement software.

What is Procurement Software?

Procurement software are tools that automate the procurement process.

Instead of relying on multiple platforms and different channels to procure goods and services, the process is automated and brought together on a centralized platform.

A powerful procurement solution helps you in:

- streamlining the request and approval process for purchases

- generating, tracking, and managing purchase orders

- creating, negotiating, and tracking supplier contracts

- managing and maintaining supplier relationships

- automating invoice validation, approval, and payment workflows

- integrating with other systems for seamless data flow and coordination.

What Are the Benefits of Procurement Software?

By automating your procurement process with a procurement management software, you can improve it in the following ways:

- Once you enter data, it is auto-populated throughout the procurement cycle. This minimizes the risk of errors due to manual data entry in purchase orders, invoices, and other documents.

- You get real-time visibility into the procurement process. You can also track the status of purchase requests, orders, deliveries, and payments.

- With built-in reporting and analytics tools, you can generate detailed reports on spending, supplier performance, and other key metrics. This data-driven insight enables better inventory planning and strategic decision-making.

- You can standardize workflows for purchase requisitions and approvals. Route the requests to the appropriate individuals for approval and reduce any delays. Notifications and reminders are automated, ensuring timely responses.

- Invoice processing and payment workflows are automated. This ensures that invoices are paid on time. This helps in taking advantage of early payment discounts and strengthens vendor relationships.

Top 6 Procurement Software

To help you select the procurement management software best suited for the needs of your organization, we have listed the top 6 procurement solutions:

1. Pluto

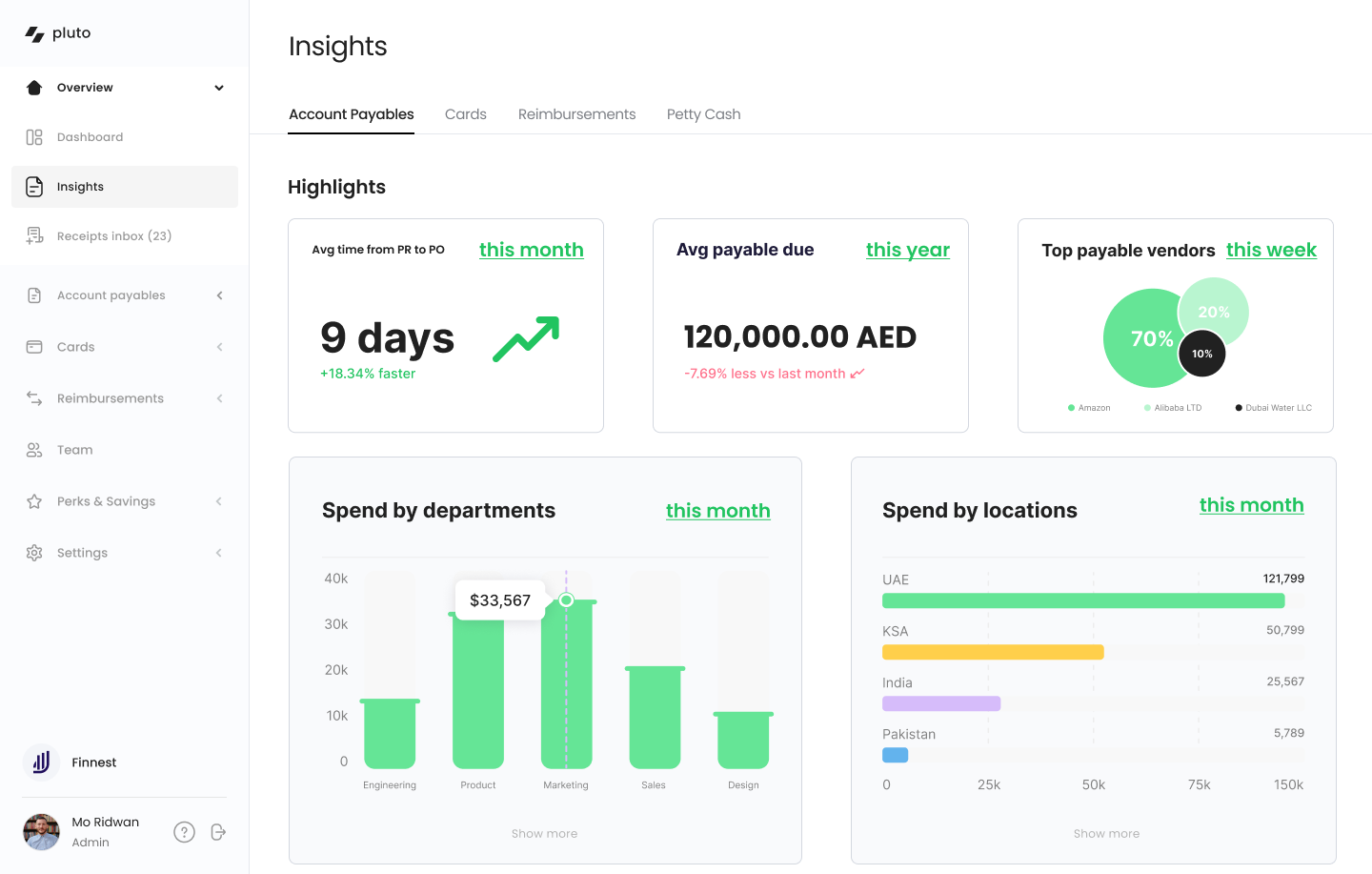

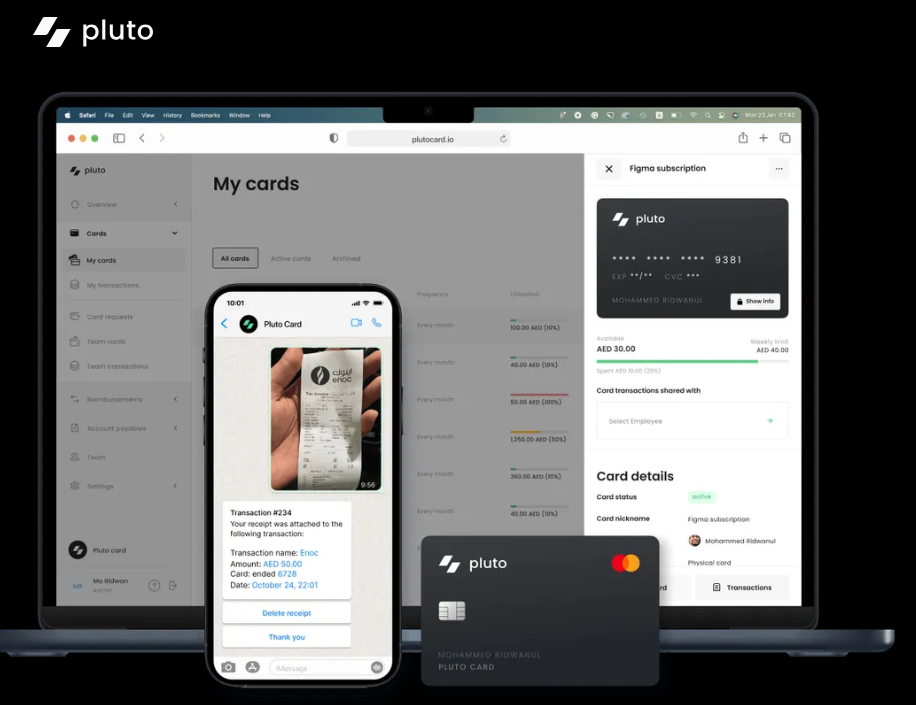

Pluto is an all-in-one procurement software designed to transform your accounts payable (AP) processes. It reduces your finance team's workload and makes procurement easy. From automating purchase requests to setting multi-layer approval workflows and managing vendors, it is the ultimate procurement solution to transform a chaotic procurement process into a faster and more efficient one.

Key Features:

- Features fully customizable and automated workflows for raising purchase requests and purchase orders, requiring no technical expertise

- Offers flexible approval engine capable of managing intricate hierarchies

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images, eliminating the need to search for invoice details. Also, facilitates invoice capture via emails directly to speed up the receipt capture process.

- A centralized dashboard to gather bills in one place and track the status to avoid double payments

- Vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Supports local and international wire transfers to make payments

- OCR technology minimizes manual data entry by creating and populating bills from invoices

- Supports ERP integration to synchronize your vendors, POs, and bills and integrates with accounting software, such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Raises alerts for upcoming payments and enables scheduling payments in advance and automate invoices

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Request the sales team for a custom quote

Pros:

- More financial control with vendor-specific corporate cards

- Better Forex rates than most local banks

- Multiple integration options

Cons:

- Slightly longer on-boarding due to corporate card offering

- Integrates with all other major ERPs except Tally

2. Yooz

Yooz optimizes the AP process, specifically focusing on invoice management. It is a cloud based software that uses artificial intelligence (AI) and machine learning technologies to enhance security and control in AP automation. It is suitable for mid-size companies of all sectors wanting to automate procurement with a cloud-based procurement solution.

Key Features:

- Enables online, real-time management of supplier relationships, improving communication and collaboration

- Provides mobile access for invoice approval and communication

- Maintains regulation-compliant traceability, ensuring adherence to relevant laws and standards

- Automates real-time GL coding and purchase order matching

- Captures all types of documents through various channels, such as email, drag-and-drop, mobile, scan, and sFTP, supporting multiple formats, including PDF, Factur-X, UBL, CII, and EDIFACT

- Integrates with accounting software and and ERPs

- Allows users to approve and pay invoices in batches, offering multiple payment options, such as Virtual Credit Card, ACH, eCheck, and Paper Check

- Offers a range of services, including consulting, configuration, training, and user support

Pricing:

Free trial for up to 15 days followed by a "pay-as-you-use" model.

Pros:

- Integration with Sage Intacct

- Ability to tag people in the comments and email them directly from the invoice

- Numerous criteria available for setting up the approval workflows

Cons:

- Doesn’t offer payment services in UAE, so you need to carry out payments on a different platform

- Doesn't have integrations with major suppliers as a form of punchout

- Time-consuming to download and export files

- Hard for vendors to send the invoices through Yooz

3. Procurify

Procurify speeds up the procurement process, enhances internal communication, and reduces financial risks. It is an easy-to-implement tool that saves time for finance and operations teams. From catalog management to custom user controls, it helps to track the procurement process in real-time.

Key Features:

- Tailors purchase orders to match your internal processes and vendor expectations

- Creates, tracks, and maintains an audit trail of all procurement transactions for transparency and compliance.

- Enhances financial controls by enabling purchase order-based purchasing

- Ensures that requested items are approved against budgets before procurement.

- Sync purchase orders with your accounting system or ERP, whether via API, CSV, flat file, or direct integration

- Integrates with trusted suppliers through PunchOut catalogs to streamline the ordering process.

- Enables blanket purchase orders, which involve making multiple purchases against a single purchase order, even when details of future purchases may be unknown.

- Purchase order workflows to save on shipping costs, unlock vendor discounts, and reduce paperwork

Pricing:

Starts at $2000/month with a custom pricing tier

Pros:

- Easy to make amendments in the original purchase order

- Enables ordering from multiple websites for resources, including Amazon

- Makes it easy to upload documents to support expense and order reports

Cons:

- Doesn’t offer payment services in UAE, so you will need to carry out payments on a different platform

- Isn’t catered to the UAE market, and does not support UAE specific workflows such as VAT management

- Cannot edit orders once they are approved

- Cannot see the order history for a catalog item without running a report

- Physical inventory has to be tracked outside Procurify

4. Precoro

Precoro is a cloud-based solution designed to streamline operations, automate tasks, and centralize purchasing procedures. It enables tracking discounts, monitoring corporate expenses, and enhancing cash flow transparency. It also provides analytics and reports for strategic procurement planning.

Key Features:

- Simplifies the approval by allowing users to approve from any device via email or Slack notifications.

- Supports customizable approval workflows with multi-step and role assignment

- Facilitates creating, approving, and tracking purchase orders and transfer orders from Amazon Business via Punch-in

- Connects with various ERPs and business tools like NetSuite, QuickBooks, and Xero, or its API

- Ensures data security through Single Sign-On (SSO) and 2-factor authentication

- Offers an intuitive interface and guidance from a dedicated customer success manager whenever needed

- Gives a risk-free 14-day free trial with access to all features

Pricing:

Starts at $35 per user per month billed annually for teams with under 20 members and offers custom pricing for enterprises

Pros:

- Provides flexibility for enterprise needs

- Works well for budgeting procurement

- Allows tracking invoices in a centralized environment

Cons:

- Requires training to customize complex workflows

- Invoice processing is slow

- Isn’t suitable for manufacturing industries

- Difficult to collaborate on invoice drafting

5. Kissflow

Kissflow simplifies and enhances procurement processes while ensuring transparency and compliance. It helps to automate the entire process without requiring technical expertise or coding experience. It comes with 50+ ready-to-use applications, enabling unlimited automation applications.

Key Features:

- Offers fluid forms to enable easy capturing, approval, and tracking of purchase requests

- Allows to register and maintain vendors effortlessly with access to multilingual catalogs

- Integration with accounting systems, ERP, and finance systems like Quickbooks, SAP, and Microsoft Dynamics

- Accelerates the invoice approval process with timely alerts and automated checks. Connect invoices to contracts, purchase orders, and service entry sheets in a single dashboard

- Customizable reports to visualize data using charts, filters, and heatmaps

- Ability to define and manage budget restrictions with dynamic rules throughout the entire procure-to-pay lifecycle

- Customized approval workflows to ensure transparency with rule-based approval processes

- Smart alerts that provide real-time updates on the status of purchase orders and invoices to keep stakeholders informed

Pricing:

Starts at $2499/month (billed annually). Pricing varies based on transaction volume and number of users.

Pros:

- Intuitive interface with a relatively short learning curve

- Allows automated workflows to be created with limited technical expertise

Cons:

- Not built specifically for procurement teams

- Does not support payment flows in UAE

- Cost of its license is high (particularly for SMBs)

- Can not handle intricate processes that require a high degree of customization or involve multiple conditional branches

- Customization options are limited, including specific integrations, advanced business rules, or more sophisticated automation capabilities

6. Vendr

Vendr is a practical solution for streamlining SaaS procurement. It simplifies the entire process, from intake requests to contract management. It provides essential SaaS insights, negotiates expert advice, and integrates with core business tools for procurement and vendor management.

Key Features:

- Buyer guides to provide negotiation insights and gain the upper hand in software purchases

- Negotiation advisory to provide personalized guidance on negotiating like a pro and enter negotiations with confidence

- Simplified intake forms to ensure company-wide compliance and visibility

- Integration with different accounting and finance tools, such as Oracle, NetSuite, Intuit, Quickbooks.

- Integrates with platforms like Rippling Workday to include correct stakeholders. Additional integration with SSO providers such as onelogin.

- Comprehensive renewal dashboard to receive early alerts and streamline the renewal preparation process to maximize savings.

- Vendr Slack integration for quick answers and timely notifications to collaborate in real time with your team, minimizing approval cycle times

Pricing:

There are 2 packages—the basic one starts at $15,000/year and the pro package starts at $20,000/year.

Pros:

- Offers assisted buying with a team who negotiates on your behalf

- Comprehensive database of vendors in one place

- Helps standardize procurement workflow

- Provides insights about fair market value

Cons:

- Restricted to SaaS procurement only

- Multilingual services are limited

- Navigating multiple workflows is not as fluid as desired

- Doesn't support multiple currencies

Find the Right Procurement Software

When choosing procurement software, focus on user-friendliness, scalability, and integration capabilities. Make sure the software aligns with your specific needs.

Finding the right software for accounts payable automation will be crucial for your business. For instance, if you frequently deal with multiple suppliers and have a complex approval process, ensure the software can accommodate these intricacies. Similarly, if you're in the healthcare industry, look for procurement software that complies with industry regulations like UAE Healthcare Law and the Dubai Health Authority (DHA) regulations. This ensures the privacy and security of patient data and adheres to local data protection standards. Moreover, check if the vendor offers active support and training. In case of a technical issue, having an unresponsive support team can disrupt the process and create bottlenecks.

Don't rush the decision. Thoroughly evaluate multiple options. Investing in an appropriate solution will save you money and headaches in the long run.

Want a tool that is safe, fast, and transforms your chaotic procurement process into an automated solution? Book a demo today and see how Pluto can simplify procurement for your team.

Disclaimer: The comparisons and rankings of procurement software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Vlad Falin

5 Strategies For Cost Reduction in Procurement To Improve Bottom Line

It’s challenging to always be on your toes, looking for ways to cut costs. Be it negotiation or automating manual, time-consuming processes, your main focus is always to optimize expenses and improve the bottom line. This comprises 36% of CPOs whose top priority is delivering bottom-line savings.

Hence, in this post, we will discuss the top 5 procurement cost reduction strategies. We’ll also discuss the process of getting started and ways to improve the procure-to-pay process to ensure procurement cost savings

5 Cost-Saving Strategies in Procurement

Here are the top 5 cost reduction techniques in procurement that you can implement in the short and long run:

1. Reduction in Maverick Spending

Maverick spending refers to expenses beyond the established policy and procurement process. It involves unauthorized purchasing that is either not approved or doesn't adhere to the pre-approved vendors or negotiated contracts.

Such expenses impact financial and operational efficiency, leading to budget overruns and supplier relationship strain. For instance, an employee purchases office supplies from a non-approved vendor. It can lead to higher costs due to a lack of negotiated discounts and impact the organization's ability to leverage consolidated spending for better terms and conditions.

To reduce maverick spending, you must actively communicate procurement policies to avoid such expenses. You must monitor all the transactions and address any such instances. This requires greater visibility into the spending at each stage and an analysis of how company resources are being used. You will also need to set spending controls based on the company policies to avoid constant monitoring.

As a result, you gain better control over the procurement process, negotiate better contracts with preferred suppliers, and leverage volume discounts without disrupting the supply chain. This will help you maintain compliance with established procurement policies and save costs by avoiding unauthorized expenses.

2. Contract Management

Contract management involves reassessing the existing contracts and negotiating supplier agreements. This includes negotiation, execution, and ongoing monitoring to ensure cost optimization.

To ensure strong contract management practices, regularly revisit contract terms, assess performance metrics, and proactively identify areas for improvement. Prioritize negotiation preparation by investing in training for procurement professionals, ensuring they possess the skills to secure favorable terms and adapt agreements to evolving business needs.

Contract management aids in maximizing the value of agreements, minimizing risk, and ensuring that suppliers deliver as per the agreed terms. It also promotes better relationship management and identifies opportunities for cost optimization.

3. Request Specification

Request specification involves creating clear and detailed specifications for the goods or services that the organization intends to procure. This involves detailing purchase requests and understanding the needs of the teams to deliver what they need and not spend money on unnecessary features and misfit products. This helps ensure suppliers understand the exact requirements, leading to more accurate quotes and better value for money.

To ensure detailed request specifications, involve all the stakeholders in the approval process and get buy-in from each of them. Follow a standardized approval workflow to raise purchase requests. This ensures consistency and gets the maximum information possible. However, it is important to implement customized workflows to suit your business hierarchies.

This reduces the risk of feature overlap and better consolidates the purchases for negotiating more favorable deals. Moreover, the specificity of needs lowers the chances of cost overruns or disputes during the procurement process.

4. Spending Consolidation

Consolidating spending means automating procurement processes to achieve economies of scale. This includes consolidating purchases, standardizing suppliers, and leveraging bulk buying power. Doing so lets you negotiate better terms with suppliers, reduce administrative overhead, and achieve cost savings through volume discounts.

For instance, if you consolidate spending on packaging materials by sourcing from a single supplier, you negotiate bulk discounts, streamline procurement processes, and benefit from standardized materials. This approach reduces costs through economies of scale, simplifies logistics, and enhances overall operational efficiency.

To consolidate spending, conduct a thorough spend analysis, identify opportunities for consolidation, and negotiate with suppliers for better terms. Additionally, implement procurement software to streamline procurement processes. This will give you insights into your spending behaviors and help you identify optimization opportunities. Also, create a cross-functional procurement team to promote collaboration and standardization across the organization. Moreover, ensure proper cross-functional workflows to get stakeholders involved at each stage.

5. Vendor Diversity

Vendor diversity involves engaging with various suppliers to reduce dependency on a single source. This strategy ensures increased competition, better negotiation opportunities, and improved risk management.

For instance, having vendor diversity enables you to source materials from multiple suppliers rather than relying solely on one. This creates competition among suppliers, encouraging competitive pricing and service levels to mitigate risks associated with potential disruptions from a single supplier. Hence, in the event of supply chain challenges or fluctuations, you get the flexibility to maintain production and minimize the impact on operations.

To ensure vendor diversity, adopt a global sourcing strategy and conduct thorough market research to identify potential suppliers across the globe with clear criteria for supplier selection. Additionally, actively seek partnerships with businesses that bring unique strengths to your supply chain. Moreover, it is important to also regularly reassess and diversify your supplier portfolio to ensure adaptability to changing market dynamics. Fostering open communication to build strong, collaborative relationships with various suppliers is a must

As a result, you get better pricing, quality, and innovation. It also provides a safety net if one supplier faces disruptions or fails to meet expectations.

Three-Step Process for Cost Reduction in Procurement

Before implementing these strategies, go through this strategic process each time you have to hunt down expenses for cost savings:

1. Analyze Spend

Start by conducting a comprehensive spending analysis to understand where the money goes. Use financial records, invoices, and procurement data to categorize and analyze spending patterns. In such cases, having procure-to-pay software helps a lot in getting insights and real-time visibility.

This step provides a clear overview of the organization's spending habits, allowing identification of areas for potential cost savings. It serves as a foundation for informed decision-making in subsequent cost-reduction strategies.

2. Identify the Biggest Expense

Compare across departments or suppliers to identify the largest expenses or categories and spot any unusual expenses. This step allows for targeted efforts in cost reduction.

Discuss these insights with relevant stakeholders to understand why these costs exist and their impact. Also, align the understanding of ‘savings’ with them to avoid unnecessary delays and rejections. It is advisable to align it with something measurable to make it easier to sell the business case and implement the necessary changes.

For instance, the information technology (IT) department proposes investing in new software that, in the long run, promises increased efficiency and reduced maintenance costs. However, the finance team, focused on immediate budget constraints, may interpret ‘savings’ as strictly short-term cost reductions rather than considering long-term benefits.

To align understanding, the IT team can quantify long-term savings through reduced downtime, improved productivity, and potential scalability benefits. This ensures both departments share a common definition of ‘savings’ and facilitates a collaborative decision-making process.

Additionally, you can target the smaller spend or tail-end spend as well. It is easier to cut people from making one-off purchases or buying small items on Amazon that another department may have.

3. Conduct Market Research and Maintenance

Conduct market research to understand current pricing, trends, and available alternatives for the identified major expenses. Based on your research, you can optimize these expenses without impacting the supply chain. This includes incentives such as:

- Use spending data analysis to negotiate improved terms with suppliers. Seek discounts or bundled services to reduce costs without disrupting the supply chain.

- Research alternative suppliers or vendors for the identified major expenses. Assess their offerings, pricing, and reliability to diversify options and secure more cost-effective alternatives.

- Invest in automation to optimize procurement processes, reducing administrative overhead without disrupting the supply chain.

- Analyze inventory levels and adjust ordering practices based on demand forecasts to prevent overstocking or stockouts.

- Regularly monitor the expenses and supplier performance and reassess strategies to adjust optimization efforts based on changing market conditions and organizational needs.

Keep updating this information to stay informed about changes in the market. This ensures that you are well-informed about competitive pricing and industry trends. Additionally, you get the necessary data to negotiate better terms with suppliers, explore cost-effective alternatives, and adapt to market fluctuations, contributing to more strategic and informed decision-making.

How to Ensure Maximum Procurement Cost Reduction

Most companies have procurement processes running on autopilot with standard operating procedures. However, this leads to inconsistent efforts of procurement teams in reducing costs. They have to dedicate hours to analysis and optimization, which can be changed with intentional efforts to ongoing cost savings practices in procurement.

However, with traditional manual processes, getting real-time visibility and comprehensive insights is impossible. To streamline the process and consolidate the expenses, you must adopt tools that support your cost savings initiative. This means centralizing all the information to build a unified platform for complete visibility and control.

Pluto simplifies this for you. Not only do you get insights and controls, but you can also create cross-functional workflows to facilitate the collaborative procurement process. You can integrate your entire accounting and accounts payable system onto a single platform and streamline the entire process. As a result, you get real-time visibility and can optimize expenses in time.

Book a demo to know more about how Pluto fits into your business and helps you streamline your procurement process for collaborative cost-saving efforts.

•

Mohammed Ridwan

Guide to Accounts Payable Audit With Step-by-Step Process and Checklist

Your employee receives the vendor invoice and goes to the department manager and procurement department for three-way matching — invoice, purchase order, and goods receipt. Once approved, the finance department prepares to clear the payment. Finally, the accounting department makes the journal entries and updates accounting records. This is an end-to-end accounts payable process.

But it isn't as simple and straightforward. The chances of errors increase with various stakeholders involved. These range from manual data entry mistakes and invoice duplications to missed discounts, late payments, and inaccurate coding. This intricate process further results in unapproved invoices, incomplete documentation, vendor communication gaps, and mismatched purchase orders.

Hence, it becomes imperative to conduct regular checks. The inspections look into the internal processes to identify loopholes and act as an early sign. This post will discuss what an accounts payable audit is and how you can prepare for it.

{{less-time-managing="/components"}}

What is an Accounts Payable Audit?

An accounts payable (AP) audit is a type of accounting audit that investigates a company's accounts payable records, statements, and processes for potential errors, fraud, and non-compliance.

In an AP audit, auditors track AP transactions from beginning to end, including the purchase order, invoice, approval steps, payment, and reconciliation, ensuring that everything has been recorded and documented correctly.

The auditors assess the internal records and documentation for the following:

- Validity - Are all invoices and transactions verified as genuine, preventing payment for unauthorized items?

- Completeness - Are the invoices, purchase orders, and delivery receipts recorded correctly to avoid missing any payments?

- Accuracy - Is every invoice amount cross-checked against corresponding purchase orders and delivery receipts to prevent payment errors?

- Compliance - Are the accounts payable documents compliant with tax and company policies to avoid penalties and ensure ethical financial practices?

Further, the auditors inspect the internal processes for the following:

- Segregation of Duties -Are responsibilities clearly divided to prevent conflicts and maintain a system of checks and balances

- Approvals - Are transaction approval processes in place, ensuring compliance with policies and accountability?

- Access Controls - Are access controls effectively implemented to protect sensitive information, preventing unauthorized access and potential breaches?

By addressing these questions, the auditors find areas to improve and strengthen the accounts payable system. This process provides a thorough picture of financial operations, identifying weaknesses that could affect accuracy, efficiency, and compliance.

How to Conduct an Accounts Payable Audit

Before establishing an audit plan, you need three things to prepare for an accounts payable audit:

1. Stakeholder Input

Schedule meetings with key stakeholders such as finance managers, approvers, and document handlers. Ask for their insights on pain points, challenges, and expectations related to the accounts payable process. Document their feedback and use it to tailor the audit plan. It helps to address specific concerns and improve efficiency.

2. Documents Repository

Conduct a comprehensive review of the current document storage system. Ensure all relevant documents are organized, labeled, and stored in a secure, easily accessible location. If you are using digital AP software for the repository, validate that it has proper version control and is updated.

Checklist of Documents Required

- Vendor Invoices

- Purchase Orders

- Goods/Services Receipts

- Vendor Contracts and Agreements

- Payment Records

- Expense Reports

- Vendor Statements

- Credit Memos

- Internal Controls and Policies

- General Ledger Entries

- Tax Documents

- Bank Reconciliation Statements

- Vendor Information

- Access Logs

- Expense Allocation Documentation

- Documentation of Disputed Invoices

- Employee Authorization Forms

- Proof of Payment

- Inventory Records (if applicable)

- Regulatory Compliance Documentation

3. Access Control

Review and update access controls to restrict access to sensitive financial data. Work with IT and security teams to ensure only authorized personnel can access critical systems and repositories. Also, periodically verify user access levels and promptly revoke access for individuals who no longer require it. This helps maintain a secure and controlled environment.

4-Step AP Audit Procedure

With all the documents ready, inputs gathered, and access shared, you can initiate the AP audit procedure. It includes the following steps:

Audit Plan

Establish an audit plan to define the scope of the audit, specifying the departments and time frame under consideration. Assign audit team members and allocate necessary resources for the audit. Identify potential risks such as errors or compliance issues.

Here is what an audit plan looks like.

Audit Plan

Objective: The primary aim of this audit is to express an opinion on the fairness of XYZ Company's financial statements in accordance with Generally Accepted Accounting Principles (GAAP).

Scope: The audit will cover the financial statements of XYZ Company for the year ended December 31, 20XX, including the balance sheet, income statement, statement of cash flows, and accompanying notes.

Audit Team: The audit team will consist of the lead auditor, staff auditors, and specialists as needed. The team members will be assigned specific tasks based on their expertise and the areas to be audited.

Audit Approach: The audit will be conducted as per the auditing standards and guidelines issued by the relevant regulatory bodies. The approach will include substantive testing, tests of controls, analytical procedures, and other audit procedures as deemed necessary.

Materiality Threshold: The materiality threshold for the financial statements is set at $XXX. Any misstatements or discrepancies exceeding this threshold will be considered material.

Risk Assessment: The audit team will conduct a risk assessment to identify and assess the risks of material misstatement in the financial statements. The evaluation will consider both inherent and control risks.

Audit Procedures:

- Cash and Cash Equivalents:

- Confirm bank balances and reconciliations

- Test cash transactions and cutoff procedures

- Review bank statements and related agreements

- Revenue Recognition:

- Test sales transactions and revenue recognition policies

- Review contracts and agreements for completeness and accuracy

- Verify the accuracy of recorded revenue

- Inventory:

- Observe the physical inventory count

- Test inventory valuation methods

- Review inventory turnover and obsolescence

- Accounts Payable:

- Confirm outstanding payables with vendors

- Test completeness and accuracy of recorded payables

- Review payment terms and agreements

- Fixed Assets:

- Verify the existence and valuation of fixed assets

- Test depreciation calculations

- Review additions and disposals

Documentation: All audit procedures, findings, and conclusions will be documented in working papers, including supporting evidence and references to applicable accounting standards.

Reporting: A draft of an audit report will be prepared for management review before issuing the final report. The report will include the auditor's opinion on the financial statements and any relevant disclosures.

Fieldwork

With the audit plan in place, the audit team moves on to a detailed examination of the accounts payable process. Simultaneously, it also engages with key stakeholders to get valuable insights into the practical aspects of the AP process. In this stage, it ascertains the effectiveness of internal processes in safeguarding against potential risks. It performs the following assessments:

- Verify completeness and accuracy of invoices, purchase orders, and payment records

- Match invoices with purchase orders and delivery receipts

- Check for discrepancies in amounts or quantities

- Evaluate the adherence of the approval process to established policies

- Confirm proper authorization before payment processing

- Review vendor master file for accuracy and up-to-date information

- Implement checks to identify and rectify duplicate payments

- Ensure compliance with internal policies, industry regulations, and legal requirements

- Review accruals and prepaid expenses for accurate reflection of the financial statements

- Verify the accuracy of data entry in the financial system

However, an audit team struggles the most with finding the proper documents. Either the internal team fails to provide the specific invoices, purchase requests, and purchase orders, or it gets lost in the pile of documents. This slowdown in the audit process increases the risk of oversight and incomplete scrutiny, compromising accuracy and thoroughness.

The best way to fix this leak is to go for accounts payable automation.

With AP automation, you streamline approvals and payments and create a centralized hub for bookkeeping. Instead of manual record-keeping, the tool automatically captures and extracts all necessary documents. Its integration capabilities ensure consistent data across the organization, simplifying data management and retrieval.

Audit Report

Finally, the audit team prepares a detailed audit report, including an executive summary, methodology, findings, and recommendations. The report provides a comprehensive overview, detailing identified issues and areas of strength.

To read an audit report and implement it effectively, follow these steps:

- Involve the audit committee, executive director, and senior financial staff in reviewing the report.

- Identify significant issues, such as financial conflicts of interest, and address them promptly. Classify minor concerns, such as operational inefficiencies and technological deficiencies, for resolution over several months.

- Consider the list of best practices and custom recommendations provided by the auditors. Use them to plan and prioritize your organization's next steps.

- Evaluate the "scope, nature, and timing" of the audit conducted by the audit team to assess the auditors' efficiency in utilizing resources without redundancy. Explore ways to make the audit process more efficient for the next cycle.

Regardless of the audit cycle, continuously assess and improve auditing procedures. Explore options such as accounts payable automation, process optimizations, and strategic partnerships.

Follow-up

During this stage, the audit team monitors the implementation of recommended changes. It involves continuous communication with stakeholders to address concerns or questions arising from the audit report. The team also ensures that the proposed improvements are effectively integrated into the organization's processes.

Preparing for Your Next Accounts Payable Audit

To make your next audit easier for the auditors and the internal team, address past findings and consider adopting accounts payable automation for efficiency. By addressing previous audit issues, you proactively improve your internal processes by resolving identified issues. It builds a culture of accountability and responsibility, laying the groundwork for a more efficient and effective audit process in the future.

An AP automation software becomes a central hub for the documentation, streamlining the intricate process. Automated document capture and retrieval ensure swift access, minimizing errors. Also, it highlights areas for improvement, enabling the team to address issues beforehand.

As a result, audits become more streamlined, faster, and less stressful, ensuring strict adherence to rules and optimal functionality. We have curated a list of top AP automation software to help you pick the right one. Check the top 7 accounts payable automation solutions that simplify the accounts payable process and audits.

•

Mohammed Ridwan

How Corporate Fleet Cards Help Modern Transport & Logistic Businesses

Companies use petty cash for managing driver and transport expenses, including maintenance, repairs, and small purchases, by allocating a small amount of physical cash to drivers. Drivers submit receipts for reconciliation, and they manually track these small transactions.

However, tracking numerous trivial transactions becomes time-consuming, and discrepancies emerge during reconciliation. There's always a risk of misuse or theft, demanding strict security measures. Moreover, negotiating favorable terms with vendors for minor, recurring transactions becomes challenging. They must carefully budget and maintain a sufficient petty cash fund, which strains their overall cash flow.

Overall, the manual process raises efficiency concerns, necessitating a balance between control and practicality in managing day-to-day vehicle-related expenses.

A better alternative to petty cash is a fleet card.

This post will explore corporate fleet cards, their benefits for transport and logistics, and strategies to overcome potential fuel card challenges for improved spend management.

What Is Meant by Fleet Card?

A fleet card, also known as a fuel or gas card, is a specialized payment card used by businesses to cover expenses related to their vehicle fleets. It is issued by fuel companies or financial institutions specifically for fuel purchases, maintenance, and other vehicle-related expenses.

What Can Fleet Cards Be Used For?

The fleet cards are primarily used for fuel purchases, maintenance, and repairs. They facilitate seamless payments for routine servicing, tolls and parking fees, and purchasing vehicle-related products.

You get cards with custom spending limits and advanced controls, such as real-time transaction monitoring mechanisms, category-specific restrictions, and automated alerts for enhanced security and streamlined expense management.

Drivers purchase fuel, maintenance, and other vehicle-related expenses at authorized locations with the cards, and you enjoy complete visibility on a centralized dashboard for each transaction.

What Are the Benefits of a Corporate Fleet Card?

Switching from manual petty cash management to a fleet card yields the following benefits:

- Simplifies payment processes by reducing the complexity of cash handling

- Improves tracking and monitoring of all vehicle-related expenses

- Minimizes the risk of theft or misuse, providing enhanced security measures

- Automates the expense management and reconciliation process, eliminating manual record-keeping and ensuring accuracy with reduced likelihood of errors

- Promotes compliance by enabling you to set controls and restrictions on card usage according to company policies

- Enhances budgeting by providing detailed reports and insights into the spending patterns for a structured and controlled approach to managing vehicle-related costs

- Streamlines transactions with vendors, offering an efficient payment method for small, frequent transactions

Should I Use a Fuel Card or a Credit Card?

Fuel cards and credit cards share similarities in providing a convenient payment method for expenses. Both can be used at gas stations and offer detailed transaction records for monitoring expenditures. Moreover, both cards come with features such as spending controls, reporting tools, and rewards programs.

However, here are some differences between the two:

- Fuel cards restrict card usage to fuel and maintenance-related purchases, providing greater control and limiting potential misuse.

- Fuel cards come with fuel discounts or rewards programs at specific gas stations, providing potential cost savings that credit cards do not generally offer.

- While credit cards provide transaction records, fuel cards offer more detailed reporting on vehicle-related expenses like fuel consumption, maintenance costs, and odometer tracking.

- Fleet cards partner with fuel providers, service centers, and other vendors, allowing businesses to negotiate favorable terms and discounts for bulk purchases or regular transactions. For instance, a fleet card's partnership with a fuel station yields discounted fuel prices, facilitating substantial cost savings.

So, for transport and logistics businesses, corporate fleet cards offer specialized controls for fuel and maintenance, streamlined reporting, and potential fuel-related discounts.

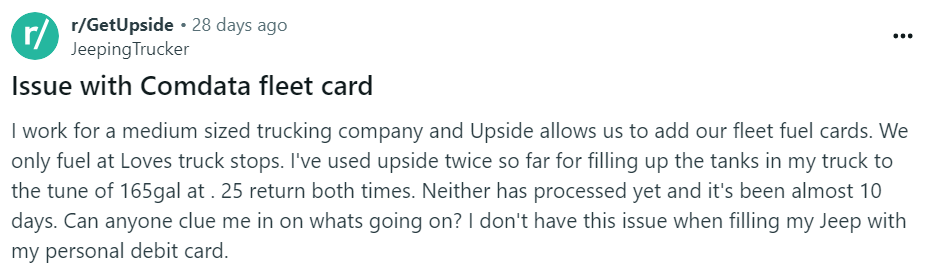

What Are the Risks of Fuel Cards?

Fuel cards, tailored for fleet management, are designed to address the unique needs of companies in the transport and logistics sector. However, organizations face the following challenges when switching to corporate fleet fuel cards:

1. Gas Station Availability Issues

Fuel cards encounter challenges related to gas station availability that limit refueling options. As a result, drivers can not find suitable gas stations, leading to increased travel time and delays in delivery schedules.

3. Location-Dependent Acceptance

The acceptance of corporate fleet cards varies by location, leading to constraints and inconveniences for companies operating in areas where certain cards are not widely accepted.

Drivers will encounter difficulties during interstate routes if you offer a nationwide delivery service and the fleet card is only accepted at specific gas stations or regions. It complicates expense management and hinders the company's ability to streamline fuel-related transactions.

3. Management Complexity

The specialized design of fuel cards introduces an administrative burden when managed separately. For instance, a company using distinct fuel cards for different vehicles finds consolidating expenses difficult, leading to increased administrative efforts and potential operational inefficiencies.

As a result, administrators have a hard time reconciling statements, accurately tracking expenses, and ensuring compliance. This burden increases processing times and errors in financial reporting.

4. Reward Limitations

While crafted to suit industry needs, fuel cards encounter limitations in cashback offers. Consider a scenario where a company's preferred fuel card provides cashback benefits only at select stations, restricting potential cost savings for the entire fleet.

Why Should You Switch to Pluto Corporate Fleet Cards?

Pluto fleet cards don't restrict the use of cards at their discretion. Instead, they facilitate advanced controls and real-time visibility. From issuing budgeted fuel cards to creating vendor-specific cards, you can set rules that align with your company's needs and policies. Then, with each transaction, you track all fleet expenses from a single dashboard and get real-time data without manual effort.

So, you set cards and add controls, and you are good to go! Drivers can spend them at convenient gas stations while you enjoy complete visibility and control. Each transaction appears on the dashboard and notifies drivers to upload the receipt directly from WhatsApp. Once uploaded, you can approve the expense, and the data syncs with your accounting software to help you close your books ten times faster.

Here are the top six benefits of switching to Pluto corporate fleet cards:

1. Unrestricted Access Anywhere

Unlike traditional restrictions, Pluto corporate fleet cards liberate your drivers. There are no limitations on locations or specific fuel stations. Enjoy the convenience of using cards at the most budget-friendly and strategically located gas stations, repair shops, or truck stops that welcome Mastercard.

2. Easy Cashback

Pluto corporate fleet cards make cashback benefits straightforward. With up to 2% unlimited cashback on over 100+ currency spends, enjoy seamless cost savings without intricate conditions or restrictions.

3. Smart Budgeting

Pluto fleet cards, functioning as debit cards, provide smart budgeting without blocking cash flow. Drivers can request limit increases in seconds, ensuring operational flexibility with swift approvals. This distinctive feature sets Pluto apart, seamlessly blending budget management and uninterrupted cash flow for efficient fleet operations.

4. Driver-Friendly Controls

Provide drivers with budgeted fuel cards and set spending rules. Real-time data and advanced controls give you complete transparency of fleet expenses, enabling strategic decision-making.

5. Grow With Ease

Whether you have hundreds or thousands of drivers, the streamlined process of issuing corporate fleet cards and setting controls remains hassle-free, supporting your scalability with ease.

6. Eliminate Fraud

Lock or freeze cards instantly from the Pluto app, ensuring proactive measures against fraud. Enable company policies to ensure in-policy transactions, eliminating the risk of unauthorized spending.

Enhance End-to-End Spend Management

Pluto eliminates the need for separate investments in corporate fleet cards, offering an all-in-one spend management solution.

Pluto's comprehensive platform facilitates both corporate purchase cards and fleet cards, streamlining your financial operations. Enjoy the same benefits as traditional corporate fleet cards but with enhanced functionality, all within a unified platform. With Pluto, you get unparalleled efficiency in managing corporate expenses, ensuring a seamless and integrated approach to financial control.

Transform your spend management today. Book a demo and discover how Pluto can optimize your financial processes and elevate your business operations.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use

.png)