Contents

Ramadan Benefits in the Workplace: A Guide to the UAE and MENA Region

Leen Shami

•

•

The month of Ramadan provides HR Managers with the opportunity to take the initiative in their organization and implement a benefit program for employees and to remind them to support their Muslim colleagues during this holy month.

What are the benefits of implementing a Ramadan employee benefits program?

Employees who observe Ramadan may require special considerations in order to maintain a high level of performance.

The main goal of any corporate environment is to get the best possible results, but this can only be achieved if your team is given a supportive environment.

During Ramadan, HR managers and employers should consider implementing employee benefits programs to ensure that their employees are able to fulfill their religious commitments while feeling supported by their companies.

By doing so, you will help ensure that every member of your team has access to the resources they need to be productive and successful.

Employee benefits program

Flexible working hours

Allow employees to come in late or leave early during Ramadan, modify their hours so they can work when they feel the most energized,and be able to take part in religious activities such as prayers while still being productive at work.

Remote or hybrid work

Remote or hybrid work can provide employees with more flexibility and autonomy to manage their work and religious obligations during Ramadan, allowing them to maintain their productivity and well-being while observing the holy month's spiritual practices.

Set up dedicated prayer spaces

Having dedicated prayer spaces can help employees maintain their spiritual practices during the workday. This is particularly important during Ramadan when employees may need to perform their daily prayers. Providing these spaces can make it easier for employees to observe their religious obligations without having to leave the workplace or worry about finding a suitable location to pray.

Accommodate dietary needs

Provide employees with food options that meets all dietary needs, so they can break their fast at the office if needed.

Examples of foods that are commonly used to break the fast:

- Dates

- Dried fruits

- Ayran (yogurt drink)

- Soups

- Sambusak ( pastry filled with cheese or meat)

Inclusivity

Promote open dialogue between employees of different faiths to foster an inclusive workplace environment. Consider arranging a presentation for those who would like to learn more about Ramadan and Islam.

Gift and Bonus Programs

Corporate gift and bonus programs during Ramadan can take many forms, but the underlying purpose is to show appreciation to employees for their efforts and to strengthen the relationship between the employer and employees.

Here are some common examples of corporate gift and bonus programs during Ramadan:

Eid al-Fitr bonus

It could be an additional incentive where employers give their employees an additional payment or bonus at the end of Ramadan to celebrate Eid al-Fitr, which marks the end of the month of fasting.

Corporate gifts

Companies may offer gifts such as food hampers, prayer mats, and other religious items to their employees during Ramadan as a way to show appreciation and respect for their faith.

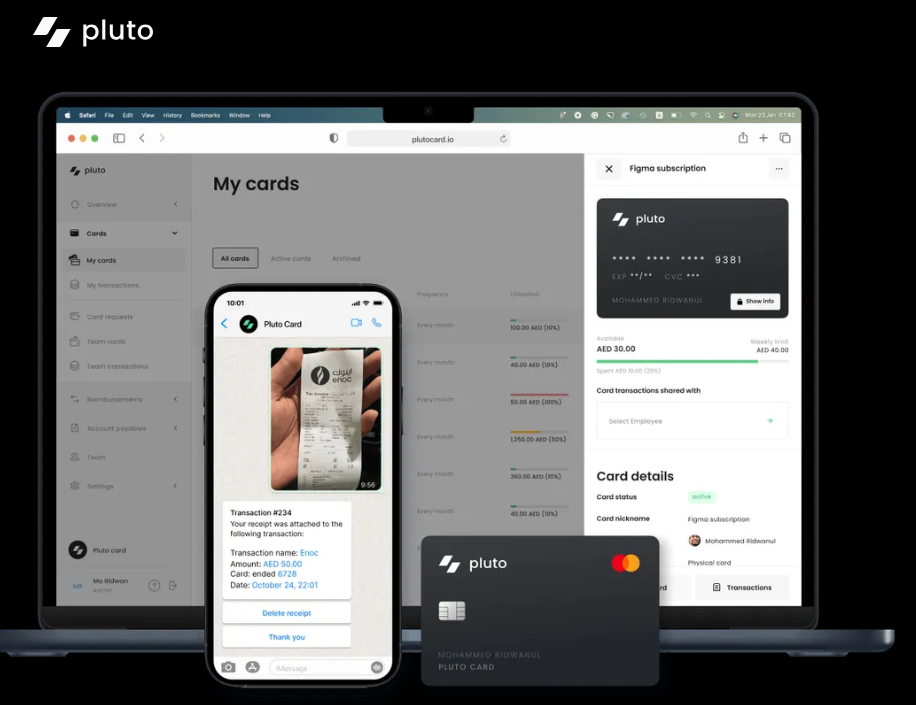

You could also delight your employees with a gift that they can use to enjoy dinner with their families. One way of doing this is by issuing Pluto corporate cards for your employees with an allocated budget on them. For e.g., you can issue a your employee a Pluto corporate card with a 500 AED spend limit to be used a restaurant of their choice.

Charitable donations

Some companies may choose to make charitable donations on behalf of their employees during Ramadan as a way to give back to the community and show solidarity with those in need.

You can add on to that by giving your employees the opportunity to pick what charity they would like the company to donate to.

It's worth noting that corporate gift and bonus programs during Ramadan should not be seen as an obligation or a substitute for fair compensation and benefits throughout the year. Rather, they are a way to show appreciation and strengthen the relationship between employer and employees.

Iftar and Suhoor Programs

Iftar and Suhoor are the two main meals that Muslims consume during Ramadan.

Iftar is the meal that is eaten after breaking the fast at sunset, while suhoor is the pre-dawn meal that is eaten before the fast begins.

These meals have significant cultural and religious importance, and hosting iftar and suhoor programs can provide a sense of community and inclusivity in the workplace during Ramadan.

Importance of iftar and suhoor programs

Iftar and suhoor programs provide the opportunity for employees to come together and share in the spiritual significance of Ramadan.

These types of activities are also beneficial for team building, as they create an atmosphere of camaraderie among colleagues and foster a stronger work culture.

Its importance can be categorized into three main points:

- Connection: Sharing a meal with colleagues can help to strengthen connections and build relationships, fostering a sense of community in the workplace.

- Cultural awareness: Hosting iftar and suhoor programs can provide an opportunity for employees of different backgrounds and faiths to learn about Ramadan and its traditions.

- Appreciation: Providing meals for employees during these times shows that the company values and appreciates its employees and their religious beliefs.

Examples of iftar and suhoor programs for employees and how to host one:

- Potluck iftar: Organize a potluck iftar at the office, where employees bring their favorite dish to share with their colleagues.

- Company-sponsored iftar: Host an iftar event at a restaurant, where the company provides food and drinks for employees to break their fast [see list of recommended restaurants below].

- Virtual iftar: For remote workers or those who cannot attend in person, host a virtual iftar.

- Charity iftar: Host an iftar event where a portion of the proceeds goes to a charity or non-profit organization. (Please make sure you are in line with UAE charity regulations before doing so. Learn more here)

- Catered iftar: Hire a catering company to provide a full meal for employees to break their fast [see list of recommended catering companies below].

- Suhoor breakfast: Host a breakfast event before the start of the workday for employees who are fasting.

- Iftar meal delivery: Deliver meals to employees who are working late or unable to attend the in-person event.

- Ramadan decorations: Decorate the workplace with Ramadan-themed decorations to create a festive atmosphere.

- Ramadan trivia: Host a trivia game related to Ramadan and its traditions during the iftar or suhoor event.

- Ramadan volunteer day: Organize a volunteer day where employees can give back to the community during the month of Ramadan.

Prayer programs

Observing taraweeh and Laylat al-Qadr during Ramadan helps Muslims to deepen their faith and spirituality, and it provides an opportunity to reflect on their actions and intentions throughout the year.

An employee prayer program during Ramadan can have numerous benefits for companies and their employees, including promoting diversity and inclusion, improving morale and relationships, and fulfilling social responsibility.

Taraweeh

Taraweeh prayers are additional prayers that Muslims perform during the holy month of Ramadan after the Isha prayer. These prayers are performed in congregation and typically consist of 8 to 20 cycles of prayer, depending on the tradition.

Companies can host taraweeh prayers at a mosque or the office on specific days of the week, such as Tuesdays, to create a sense of belonging and inclusivity among employees.

Laylet al-Qadr

Laylat al-Qadr, also known as the Night of Power, is considered to be one of the holiest nights in Islam. It is believed to be the night when the first verses of the Quran were revealed to the Prophet Muhammad, and it is said to be a night of forgiveness and mercy.

With laylat al-qadr being the most important night of Ramadan, it is important for your company to offer benefits during this day, such as:

- Consider giving the following day as PTO, since most Muslims stay up all night in prayer and reflection.

- Offer a transportation stipend to the mosque in order to show the company’s support of their employees religious beliefs.

- You can do so using Pluto’s platform by offereing a one-time purchase card with a set limit that can only be used with taxis, Careems, Uber or for gas.

Ramadan email templates that can be shared with employees

There is a lot to take care of when preparing for Ramadan. We've put together some sample email templates for various corporate initiatives to make your job easier.

Email Template 1: Announcing flexible working hours during Ramadan

Subject: Ramadan Working Hours

Dear [Employee Name],

As the holy month of Ramadan approaches, we would like to inform you that we will be implementing flexible working hours during this time to accommodate those who will be observing the fast.

Our office will be open from [start time] to [end time]. We understand that some employees may need to adjust their schedules due to the early morning and evening prayers, as well as breaking their fast in the evenings.

If you need to adjust your working hours, please speak to your line manager, who will be happy to discuss the best option for you.

Our company values diversity and inclusivity, and we hope that this initiative will help our employees observe Ramadan comfortably.

We wish all our staff observing Ramadan a blessed month, and may you get the best out of this spiritual journey.

Ramadan Mubarak!

Best regards,

[Your Name]

Email Template 2: Announcing company charitable donations during Ramadan

Subject: Ramadan Charitable Donations

Dear [Employee Name],

As we approach the holy month of Ramadan, we would like to remind you that our company values generosity and charitable giving. In line with this, we have decided to make a donation to [charity name], which supports [cause].

We believe that this is a great opportunity to give back to those in need and demonstrate our commitment to making a positive impact in the community. We hope that this donation will inspire you to consider making a charitable contribution during this holy month.

Thank you for being part of our company, and we wish you a blessed Ramadan.

Best regards,

[Your Name]

Email Template 3: Inviting employees to an Iftar meal

Subject: [Company Name] invites you to an Iftar Meal

Dear [Employee Name],

We would like to invite you to an Iftar meal on [date and time], which will be held at [location]. This event is an opportunity for our employees to come together and break their fasts as a community.

Please RSVP to [email/phone number] by [RSVP deadline] to confirm your attendance. If you have any dietary requirements, please let us know, and we will do our best to accommodate them.

We hope that this event will be an enjoyable experience for everyone and that it will help to strengthen our company culture.

Thank you for your hard work and dedication, and we wish you a blessed Ramadan.

Best regards,

[Your Name]

Corporate gifting list

- Sabr prayer mats (https://www.thesabrmat.com/)

- Bateel dates (https://bateel.com/)

- Ramadan themed candles (https://silsal.com/)

- Kitchen gift set (https://sittisoap.com/)

- Olive oil (https://almisk.ae/)

Iftar or suhoor restaurant list

- Asateer Tent at Atlantis the Palm

- Sufra

- The Majlis

- Allo Beirut

- Hutong

- Terrace on the Corniche at St. Regis Abu Dhabi

- The Royal Majlis

- Eunoia By Carine

- Bombay Bungalow

- Brasserie Boulud

- Ibn AlBahr

- Al Falak Ballroom

- Karam Al Bahr

Company catering list

- Ogram

- Blast catering

- Eat catering

- The Majlis

- Dish

Conclusion

Ultimately, providing Ramadan benefits demonstrates an employer and HR's commitment to promoting diversity and religious freedom in the workplace.

It also helps create a sense of community among employees that can lead to increased morale, collaboration, communication, and overall productivity.

By offering an employee benefits program during the holy month of Ramadan, employers can show their dedication to creating a supportive and inclusive environment for all of their employees, regardless of faith or background.

Ramadan benefits can thus be an important part of workplace culture, helping to create a positive atmosphere in which everyone feels welcome, respected, and valued.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Leen Shami, Content Marketing Lead

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Top 7 Accounts Payable Automation Software

An invoice has landed in your inbox. As soon as it arrived, a team member cleared the payment. Later, when another team member came across it, they made the payment again. This is a common scenario of duplicate payments that results in cash leakage. Invoices are not consolidated. There is no proper approval workflow, and stakeholders lack visibility.

Overall, managing accounts payable (AP) becomes a nightmare.

An automation tool solves these bottlenecks and provides a centralized platform for invoice management and accounts payable. An accounts payable automation software automates invoice capture and retrieval to consolidate all the information on a unified platform. You get real-time visibility and control over your payables.

As a result, you establish better vendor relationships and supply chain management without impacting cash flows.

This post will cover 7 AP automation software to help you choose the right automation partner.

{{less-time-managing="/components"}}

Top 7 accounts payable automation software

Here are the top 7 AP automation software. You can pick one of these to automate your accounts payable based on your company size and needs.

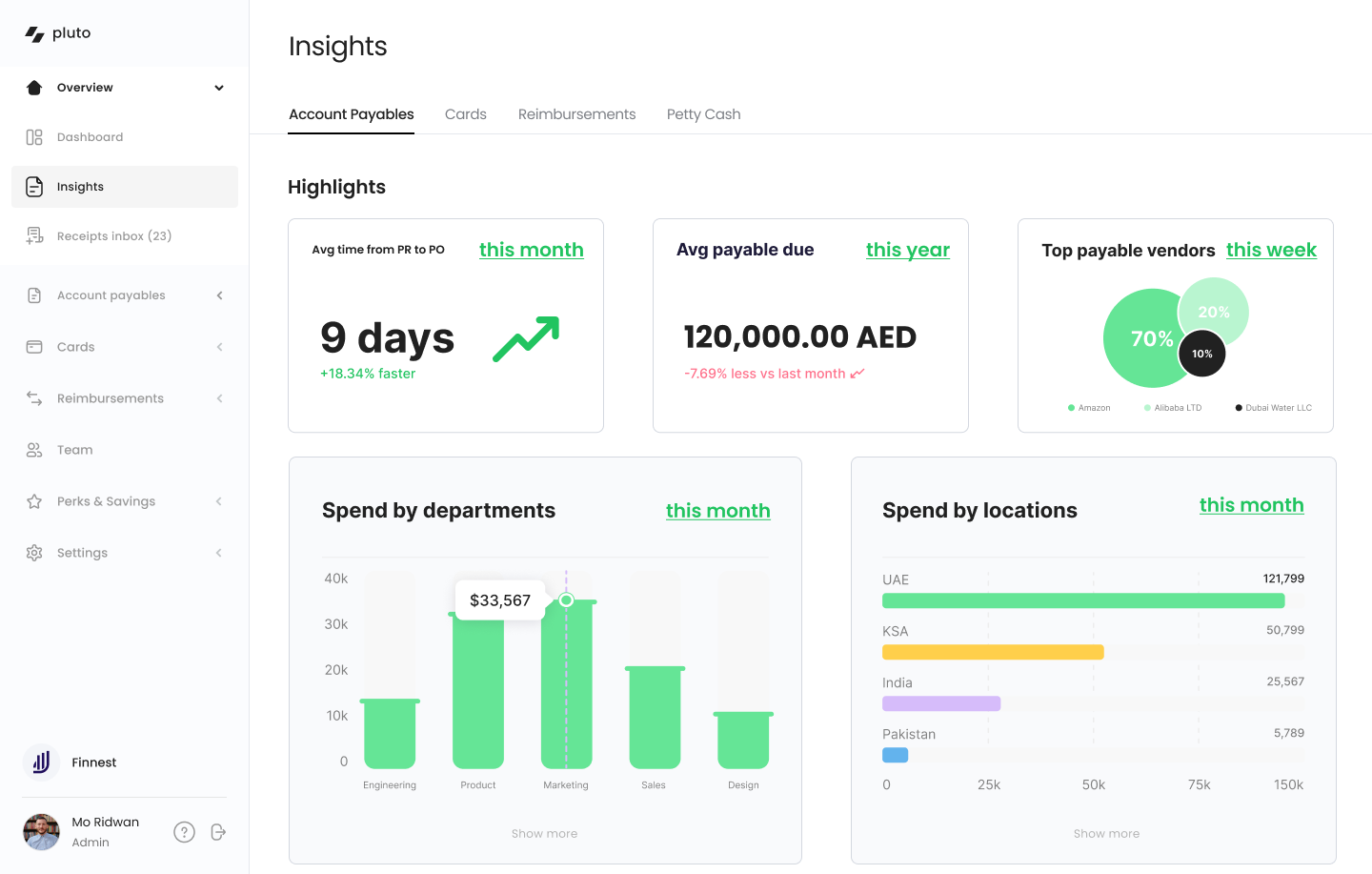

1. Pluto

Pluto is an accounts payable software that transforms your AP processes by simplifying bill processing. From enabling GRN matching to setting fully customizable multi-layer approval workflows, it is the best AP automation software to manage your vendor payments.

Key Features:

- Facilitates three-way GRN matching with purchase orders and item-based matching

- Offers a flexible approval engine capable of managing intricate hierarchies without requiring technical expertise

- Enables multi-layer invoice approvals with policies to align with your company's structure

- Ability to upload invoices easily via WhatsApp images and emails to speed up the receipt capture process

- Facilitates optical character recognition (OCR) technology to retrieve invoice information, including tax and general ledger (GL) codes

- Offers a centralized dashboard to gather bills in one place and track the status to avoid double payments

- Consolidates approved invoices in a single window to highlight pending bills and avoid delays

- Raises alerts for upcoming payments, enables scheduling payments in advance and automates invoices

- Allows you to seamlessly carry out bulk local and international wire transfers for easy payment clearing through their treasury partners.

- Enables you to split payments for different tax and GL codes, departments, etc.

- Provides vendor-specific corporate cards to control budgets and detect irrelevant expenses

- Supports ERP integration to synchronize your vendors, purchase orders, and bills

- Integrates with accounting software such as Oracle, NetSuite, Zoho, Quickbooks, Wafeq, Xero, etc.

- Provides a complete audit trail of the process to ensure visibility at each step

- Shows real-time analytics to facilitate deep insights for supporting budget control

Pricing:

Pros:

- Free to get started!

- Enables branch and subsidiary-level spend tracking (not offered by other platforms)

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 certification for advanced security

- SSO/SAML Capabilities for Enterprises

- Better Forex rates than most local banks

Cons:

- Integrates with all other major ERPs except Tally

- Slightly longer on-boarding due to corporate card offering

{{less-time-managing="/components"}}

2. Tipalti

Tipalti is an automation tool that supports end-to-end AP processes. It streamlines accounts payables and facilitates global payments in local currencies for various recipients, from suppliers to freelancers. The cloud-based platform helps finance teams manage payments without losing visibility and control.

Key Features:

- Supports supplier onboarding and vetting to ensure supplier reliability and trustworthiness

- Integrates with ERP and accounting systems to help with reconciliation reporting

- Uses OCR to scan, capture, match, and process invoice data to reduce manual errors

- Provides built-in approval workflows and payment scheduling

- Offers invoice processing, including two-way and three-way purchase order matching and approval to avoid overpayments

- Assists AP processes for subsidiaries and entities

Pricing:

Starts at $129 per month per user for the platform fee and charges for additional features separately

Pros:

- Can manage supplier bank account details in a secure environment

Cons:

- Cannot use it for prepayment invoices on inventory purchases with the ERP system

- High foreign currency exchange fees

- Tax forms can be difficult to fill out and very difficult if you do not speak English

3. Airbase

Airbase manages global AP processes. It focuses on ensuring compliance and syncing with your accounting tool to streamline payment. It is an automation solution for small to midsize businesses (SMBs) and large enterprises with 100-5,000 employees.

Key Features:

- Offers OCR to populate details, including GL category, date, amount, and purpose

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Has a centralized dashboard with all key information about the invoice to avoid friction

- Accepts invoices from email or vendor portal across all subsidiaries

- Offers automated approval workflows based on multiple parameters, such as vendor, amount, GL category, etc.

- Enables three-way invoice matching to ensure compliance and reduce wasted spend

- Real-time audit trail with receipts, notes, and documentation for transparency

Pricing:

Request a custom quote

Pros:

- Intuitive and easy to use; no training or previous knowledge required

Cons:

- The mobile app is slow and takes time to load pages

- SSO-based login is not smooth

- Not suitable for complex branch-level approvals and expenses

4. Ramp

Ramp is an accounts payable solution for managing payments and business expenses. It automates bill entries, approvals, and payments while offering complete visibility and control. By tracking each AP step from data recording to approvals, it simplifies payment processing and takes the burden off teams.

Key Features:

- Uses artificial intelligence (AI) to extract key details from invoices to offer accuracy and eliminate data-entry errors

- Identifies duplicate invoices and helps with two-way matching to purchase orders

- Offers custom approval workflows to minimize errors and ensure timely payments

- Provides a unified dashboard with visibility into the status of invoices

- Consolidates multiple payment options, such as check, card, same-day ACH, or international wire

- Integrates with accounting solutions, such as QuickBooks, Xero, Oracle NetSuite, Sage, etc. for auto-sync bill pay transactions

- Supports international payment processing in multiple currencies

- Tracks vendor data and transactions for easy reporting and data-driven decisions

Pricing:

Three pricing packages—free or basic features, $15 per user per month for Ramp Plus, and custom quote for enterprises with features like enterprise ERP integration, custom implementation, and local card issuance

Pros:

- Works with multiple subsidiaries

- Offers cash back on credit card purchases made using VISA cards

Cons:

- Can’t unmatch an incorrectly matched invoice (invoice to credit card)

- Approval routing can only be set on the vendor level, not the department level

- Limitations in syncing repayments

5. Bill

Bill is an accounts payable solution for SMBs to control payables, receivables, expenses, and all corporate expenses. It allows businesses to streamline scattered AP processes into a single platform and gain more control over their finances.

Key Features:

- Enables custom approval workflows for minimal hassle

- Automates purchase order workflows with the option for automated two-way and three-way matching

- Automates receipt matching, categorization, and expense reporting, decreasing administrative tasks

- Syncs with all major accounting systems like QuickBooks, Sage, Intacct, and NetSuite

- OCR auto-populates invoices for data entry

- Provides bulk payments of approved invoices with payment choices, such as ACH, credit cards, checks, and international wire transfers

- Offers audit trail of any changes or actions related to the invoice on a single page

Pricing:

Provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

6. Procurify

Procurify streamlines AP reconciliation, offering a straightforward solution for financial operations. From catalog management to custom user controls, it helps to track the procurement process in real time. Its no-code configuration allows for a prompt deployment in under six weeks, making it a suitable choice for mid-market to enterprise organizations.

Key Features:

- Creates, tracks, and maintains an audit trail of all procurement transactions for transparency and compliance

- Ensures that requested items are approved against budgets before procurement

- Integrates with trusted vendors through punchout catalogs to streamline the ordering process

- Syncs bills and completes bill payments directly with platforms like QuickBooks Online, NetSuite, and other major accounting systems

- Supports OCR technology to extract data from invoices

Pricing:

Starts at $2000/month with a custom pricing tier

Pros:

- Ability to upload different invoices in the same PO and group invoices

Cons:

- Doesn’t offer payment services, so you need to carry out payments on a different platform

- Physical inventory has to be tracked outside Procurify

7. ZipHq

Ziphq is an end-to-end procure to pay software designed to streamline the entire procurement process, from purchase order to payment. It caters to businesses of all sizes — startups, mid-size companies, and enterprises with no-code configuration and deployment in under six weeks.

Key Features:

- Offers vendor cards to automate recurring and one-time payments

- Centralizes purchasing workflows, providing real-time visibility into the AP process

- Facilitates automatic purchase order matching, ensuring invoice accuracy and timely payments

- Provides automated, no-code workflows, referencing all stakeholders in the approval chain

- Allows employees to comment on invoices and tag stakeholders, ensuring everyone has the context and visibility needed

- Automates renewal planning with workflows initiated well ahead of deadlines, enabling stakeholders to make informed decisions

- Supports vendor payments in 140+ countries and 40+ currencies

- Integrates with ERP, ensuring quick and easy reconciliation, even for complex, multi-subsidiary operations

Pricing:

Pros:

- Provides various customization options to configure internal processes

Cons:

- Localized to the USA market

- Takes over five days to settle vendor payments

- Can’t bulk upload documents

How to choose the right accounts payable automation software?

User-friendliness

Select software that is adaptable and user-friendly, with intuitive trigger-based workflows and a clean interface, ensuring ease of use without excessive reliance on support for basic tasks.

Versatile payment capabilities

Choose a solution that supports a broad spectrum of payment methods, including the ability to issue vendor-specific cards for secure and speedy payments, a feature not commonly found in many platforms.

Accurate Invoice Processing

Opt for software with OCR technology to enhance invoice processing speed and accuracy, capable of handling invoices from various sources and integrating them into a centralized database for reduced manual entry.

Efficient Approval Workflows

The software should include a straightforward, no-code workflow builder that can handle complex hierarchies, essential for large organizations with intricate approval processes.

Seamless System Integration

Ensure the software integrates well with existing accounting systems to automate data entry and maintain synchronized records, which is crucial for effective financial management.

Advanced Reporting Features

Reporting functionality that offers insights into spending patterns and department-specific expenditures is vital. The software should provide a robust reporting dashboard with options for deeper analytics.

Choosing the right accounts payable automation software

Implementing accounts payable software will support your procurement process only when you carefully pick an option that provides flexibility, visibility, and security without losing on functionality.

Imagine software that makes it easy to clear payments but doesn’t settle payments for days on the vendor’s end. Contrarily, consider an option your legal or IT team is skeptical of implementing.

That is why, at Pluto, we focus on simplifying processes and cutting all the chaos without risking security, flexibility, or functionality. We simplify accounts payable by syncing with your payment gateways for faster payments at better forex rates than banks. You get a PCI DSS Level 1 certified solution that provides you with bank-grade security.

So, book a demo and learn more about how you can optimize your entire procurement process.

•

Vlad Falin

5 Strategies For Cost Reduction in Procurement To Improve Bottom Line

It’s challenging to always be on your toes, looking for ways to cut costs. Be it negotiation or automating manual, time-consuming processes, your main focus is always to optimize expenses and improve the bottom line. This comprises 36% of CPOs whose top priority is delivering bottom-line savings.

Hence, in this post, we will discuss the top 5 procurement cost reduction strategies. We’ll also discuss the process of getting started and ways to improve the procure-to-pay process to ensure procurement cost savings

5 Cost-Saving Strategies in Procurement

Here are the top 5 cost reduction techniques in procurement that you can implement in the short and long run:

1. Reduction in Maverick Spending

Maverick spending refers to expenses beyond the established policy and procurement process. It involves unauthorized purchasing that is either not approved or doesn't adhere to the pre-approved vendors or negotiated contracts.

Such expenses impact financial and operational efficiency, leading to budget overruns and supplier relationship strain. For instance, an employee purchases office supplies from a non-approved vendor. It can lead to higher costs due to a lack of negotiated discounts and impact the organization's ability to leverage consolidated spending for better terms and conditions.

To reduce maverick spending, you must actively communicate procurement policies to avoid such expenses. You must monitor all the transactions and address any such instances. This requires greater visibility into the spending at each stage and an analysis of how company resources are being used. You will also need to set spending controls based on the company policies to avoid constant monitoring.

As a result, you gain better control over the procurement process, negotiate better contracts with preferred suppliers, and leverage volume discounts without disrupting the supply chain. This will help you maintain compliance with established procurement policies and save costs by avoiding unauthorized expenses.

2. Contract Management

Contract management involves reassessing the existing contracts and negotiating supplier agreements. This includes negotiation, execution, and ongoing monitoring to ensure cost optimization.

To ensure strong contract management practices, regularly revisit contract terms, assess performance metrics, and proactively identify areas for improvement. Prioritize negotiation preparation by investing in training for procurement professionals, ensuring they possess the skills to secure favorable terms and adapt agreements to evolving business needs.

Contract management aids in maximizing the value of agreements, minimizing risk, and ensuring that suppliers deliver as per the agreed terms. It also promotes better relationship management and identifies opportunities for cost optimization.

3. Request Specification

Request specification involves creating clear and detailed specifications for the goods or services that the organization intends to procure. This involves detailing purchase requests and understanding the needs of the teams to deliver what they need and not spend money on unnecessary features and misfit products. This helps ensure suppliers understand the exact requirements, leading to more accurate quotes and better value for money.

To ensure detailed request specifications, involve all the stakeholders in the approval process and get buy-in from each of them. Follow a standardized approval workflow to raise purchase requests. This ensures consistency and gets the maximum information possible. However, it is important to implement customized workflows to suit your business hierarchies.

This reduces the risk of feature overlap and better consolidates the purchases for negotiating more favorable deals. Moreover, the specificity of needs lowers the chances of cost overruns or disputes during the procurement process.

4. Spending Consolidation

Consolidating spending means automating procurement processes to achieve economies of scale. This includes consolidating purchases, standardizing suppliers, and leveraging bulk buying power. Doing so lets you negotiate better terms with suppliers, reduce administrative overhead, and achieve cost savings through volume discounts.

For instance, if you consolidate spending on packaging materials by sourcing from a single supplier, you negotiate bulk discounts, streamline procurement processes, and benefit from standardized materials. This approach reduces costs through economies of scale, simplifies logistics, and enhances overall operational efficiency.

To consolidate spending, conduct a thorough spend analysis, identify opportunities for consolidation, and negotiate with suppliers for better terms. Additionally, implement procurement software to streamline procurement processes. This will give you insights into your spending behaviors and help you identify optimization opportunities. Also, create a cross-functional procurement team to promote collaboration and standardization across the organization. Moreover, ensure proper cross-functional workflows to get stakeholders involved at each stage.

5. Vendor Diversity

Vendor diversity involves engaging with various suppliers to reduce dependency on a single source. This strategy ensures increased competition, better negotiation opportunities, and improved risk management.

For instance, having vendor diversity enables you to source materials from multiple suppliers rather than relying solely on one. This creates competition among suppliers, encouraging competitive pricing and service levels to mitigate risks associated with potential disruptions from a single supplier. Hence, in the event of supply chain challenges or fluctuations, you get the flexibility to maintain production and minimize the impact on operations.

To ensure vendor diversity, adopt a global sourcing strategy and conduct thorough market research to identify potential suppliers across the globe with clear criteria for supplier selection. Additionally, actively seek partnerships with businesses that bring unique strengths to your supply chain. Moreover, it is important to also regularly reassess and diversify your supplier portfolio to ensure adaptability to changing market dynamics. Fostering open communication to build strong, collaborative relationships with various suppliers is a must

As a result, you get better pricing, quality, and innovation. It also provides a safety net if one supplier faces disruptions or fails to meet expectations.

Three-Step Process for Cost Reduction in Procurement

Before implementing these strategies, go through this strategic process each time you have to hunt down expenses for cost savings:

1. Analyze Spend

Start by conducting a comprehensive spending analysis to understand where the money goes. Use financial records, invoices, and procurement data to categorize and analyze spending patterns. In such cases, having procure-to-pay software helps a lot in getting insights and real-time visibility.

This step provides a clear overview of the organization's spending habits, allowing identification of areas for potential cost savings. It serves as a foundation for informed decision-making in subsequent cost-reduction strategies.

2. Identify the Biggest Expense

Compare across departments or suppliers to identify the largest expenses or categories and spot any unusual expenses. This step allows for targeted efforts in cost reduction.

Discuss these insights with relevant stakeholders to understand why these costs exist and their impact. Also, align the understanding of ‘savings’ with them to avoid unnecessary delays and rejections. It is advisable to align it with something measurable to make it easier to sell the business case and implement the necessary changes.

For instance, the information technology (IT) department proposes investing in new software that, in the long run, promises increased efficiency and reduced maintenance costs. However, the finance team, focused on immediate budget constraints, may interpret ‘savings’ as strictly short-term cost reductions rather than considering long-term benefits.

To align understanding, the IT team can quantify long-term savings through reduced downtime, improved productivity, and potential scalability benefits. This ensures both departments share a common definition of ‘savings’ and facilitates a collaborative decision-making process.

Additionally, you can target the smaller spend or tail-end spend as well. It is easier to cut people from making one-off purchases or buying small items on Amazon that another department may have.

3. Conduct Market Research and Maintenance

Conduct market research to understand current pricing, trends, and available alternatives for the identified major expenses. Based on your research, you can optimize these expenses without impacting the supply chain. This includes incentives such as:

- Use spending data analysis to negotiate improved terms with suppliers. Seek discounts or bundled services to reduce costs without disrupting the supply chain.

- Research alternative suppliers or vendors for the identified major expenses. Assess their offerings, pricing, and reliability to diversify options and secure more cost-effective alternatives.

- Invest in automation to optimize procurement processes, reducing administrative overhead without disrupting the supply chain.

- Analyze inventory levels and adjust ordering practices based on demand forecasts to prevent overstocking or stockouts.

- Regularly monitor the expenses and supplier performance and reassess strategies to adjust optimization efforts based on changing market conditions and organizational needs.

Keep updating this information to stay informed about changes in the market. This ensures that you are well-informed about competitive pricing and industry trends. Additionally, you get the necessary data to negotiate better terms with suppliers, explore cost-effective alternatives, and adapt to market fluctuations, contributing to more strategic and informed decision-making.

How to Ensure Maximum Procurement Cost Reduction

Most companies have procurement processes running on autopilot with standard operating procedures. However, this leads to inconsistent efforts of procurement teams in reducing costs. They have to dedicate hours to analysis and optimization, which can be changed with intentional efforts to ongoing cost savings practices in procurement.

However, with traditional manual processes, getting real-time visibility and comprehensive insights is impossible. To streamline the process and consolidate the expenses, you must adopt tools that support your cost savings initiative. This means centralizing all the information to build a unified platform for complete visibility and control.

Pluto simplifies this for you. Not only do you get insights and controls, but you can also create cross-functional workflows to facilitate the collaborative procurement process. You can integrate your entire accounting and accounts payable system onto a single platform and streamline the entire process. As a result, you get real-time visibility and can optimize expenses in time.

Book a demo to know more about how Pluto fits into your business and helps you streamline your procurement process for collaborative cost-saving efforts.

•

Mohammed Ridwan

How Corporate Fleet Cards Help Modern Transport & Logistic Businesses

Companies use petty cash for managing driver and transport expenses, including maintenance, repairs, and small purchases, by allocating a small amount of physical cash to drivers. Drivers submit receipts for reconciliation, and they manually track these small transactions.

However, tracking numerous trivial transactions becomes time-consuming, and discrepancies emerge during reconciliation. There's always a risk of misuse or theft, demanding strict security measures. Moreover, negotiating favorable terms with vendors for minor, recurring transactions becomes challenging. They must carefully budget and maintain a sufficient petty cash fund, which strains their overall cash flow.

Overall, the manual process raises efficiency concerns, necessitating a balance between control and practicality in managing day-to-day vehicle-related expenses.

A better alternative to petty cash is a fleet card.

This post will explore corporate fleet cards, their benefits for transport and logistics, and strategies to overcome potential fuel card challenges for improved spend management.

What Is Meant by Fleet Card?

A fleet card, also known as a fuel or gas card, is a specialized payment card used by businesses to cover expenses related to their vehicle fleets. It is issued by fuel companies or financial institutions specifically for fuel purchases, maintenance, and other vehicle-related expenses.

What Can Fleet Cards Be Used For?

The fleet cards are primarily used for fuel purchases, maintenance, and repairs. They facilitate seamless payments for routine servicing, tolls and parking fees, and purchasing vehicle-related products.

You get cards with custom spending limits and advanced controls, such as real-time transaction monitoring mechanisms, category-specific restrictions, and automated alerts for enhanced security and streamlined expense management.

Drivers purchase fuel, maintenance, and other vehicle-related expenses at authorized locations with the cards, and you enjoy complete visibility on a centralized dashboard for each transaction.

What Are the Benefits of a Corporate Fleet Card?

Switching from manual petty cash management to a fleet card yields the following benefits:

- Simplifies payment processes by reducing the complexity of cash handling

- Improves tracking and monitoring of all vehicle-related expenses

- Minimizes the risk of theft or misuse, providing enhanced security measures

- Automates the expense management and reconciliation process, eliminating manual record-keeping and ensuring accuracy with reduced likelihood of errors

- Promotes compliance by enabling you to set controls and restrictions on card usage according to company policies

- Enhances budgeting by providing detailed reports and insights into the spending patterns for a structured and controlled approach to managing vehicle-related costs

- Streamlines transactions with vendors, offering an efficient payment method for small, frequent transactions

Should I Use a Fuel Card or a Credit Card?

Fuel cards and credit cards share similarities in providing a convenient payment method for expenses. Both can be used at gas stations and offer detailed transaction records for monitoring expenditures. Moreover, both cards come with features such as spending controls, reporting tools, and rewards programs.

However, here are some differences between the two:

- Fuel cards restrict card usage to fuel and maintenance-related purchases, providing greater control and limiting potential misuse.

- Fuel cards come with fuel discounts or rewards programs at specific gas stations, providing potential cost savings that credit cards do not generally offer.

- While credit cards provide transaction records, fuel cards offer more detailed reporting on vehicle-related expenses like fuel consumption, maintenance costs, and odometer tracking.

- Fleet cards partner with fuel providers, service centers, and other vendors, allowing businesses to negotiate favorable terms and discounts for bulk purchases or regular transactions. For instance, a fleet card's partnership with a fuel station yields discounted fuel prices, facilitating substantial cost savings.

So, for transport and logistics businesses, corporate fleet cards offer specialized controls for fuel and maintenance, streamlined reporting, and potential fuel-related discounts.

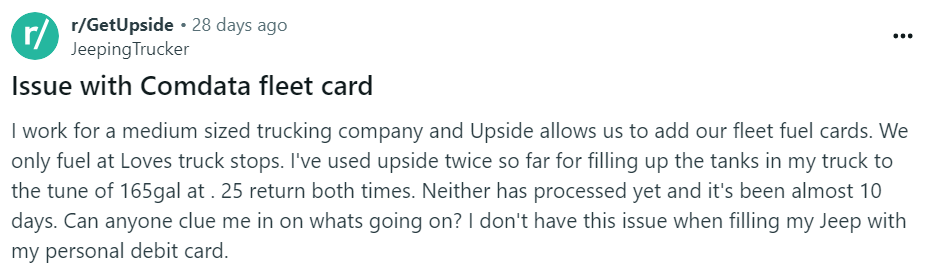

What Are the Risks of Fuel Cards?

Fuel cards, tailored for fleet management, are designed to address the unique needs of companies in the transport and logistics sector. However, organizations face the following challenges when switching to corporate fleet fuel cards:

1. Gas Station Availability Issues

Fuel cards encounter challenges related to gas station availability that limit refueling options. As a result, drivers can not find suitable gas stations, leading to increased travel time and delays in delivery schedules.

3. Location-Dependent Acceptance

The acceptance of corporate fleet cards varies by location, leading to constraints and inconveniences for companies operating in areas where certain cards are not widely accepted.

Drivers will encounter difficulties during interstate routes if you offer a nationwide delivery service and the fleet card is only accepted at specific gas stations or regions. It complicates expense management and hinders the company's ability to streamline fuel-related transactions.

3. Management Complexity

The specialized design of fuel cards introduces an administrative burden when managed separately. For instance, a company using distinct fuel cards for different vehicles finds consolidating expenses difficult, leading to increased administrative efforts and potential operational inefficiencies.

As a result, administrators have a hard time reconciling statements, accurately tracking expenses, and ensuring compliance. This burden increases processing times and errors in financial reporting.

4. Reward Limitations

While crafted to suit industry needs, fuel cards encounter limitations in cashback offers. Consider a scenario where a company's preferred fuel card provides cashback benefits only at select stations, restricting potential cost savings for the entire fleet.

Why Should You Switch to Pluto Corporate Fleet Cards?

Pluto fleet cards don't restrict the use of cards at their discretion. Instead, they facilitate advanced controls and real-time visibility. From issuing budgeted fuel cards to creating vendor-specific cards, you can set rules that align with your company's needs and policies. Then, with each transaction, you track all fleet expenses from a single dashboard and get real-time data without manual effort.

So, you set cards and add controls, and you are good to go! Drivers can spend them at convenient gas stations while you enjoy complete visibility and control. Each transaction appears on the dashboard and notifies drivers to upload the receipt directly from WhatsApp. Once uploaded, you can approve the expense, and the data syncs with your accounting software to help you close your books ten times faster.

Here are the top six benefits of switching to Pluto corporate fleet cards:

1. Unrestricted Access Anywhere

Unlike traditional restrictions, Pluto corporate fleet cards liberate your drivers. There are no limitations on locations or specific fuel stations. Enjoy the convenience of using cards at the most budget-friendly and strategically located gas stations, repair shops, or truck stops that welcome Mastercard.

2. Easy Cashback

Pluto corporate fleet cards make cashback benefits straightforward. With up to 2% unlimited cashback on over 100+ currency spends, enjoy seamless cost savings without intricate conditions or restrictions.

3. Smart Budgeting

Pluto fleet cards, functioning as debit cards, provide smart budgeting without blocking cash flow. Drivers can request limit increases in seconds, ensuring operational flexibility with swift approvals. This distinctive feature sets Pluto apart, seamlessly blending budget management and uninterrupted cash flow for efficient fleet operations.

4. Driver-Friendly Controls

Provide drivers with budgeted fuel cards and set spending rules. Real-time data and advanced controls give you complete transparency of fleet expenses, enabling strategic decision-making.

5. Grow With Ease

Whether you have hundreds or thousands of drivers, the streamlined process of issuing corporate fleet cards and setting controls remains hassle-free, supporting your scalability with ease.

6. Eliminate Fraud

Lock or freeze cards instantly from the Pluto app, ensuring proactive measures against fraud. Enable company policies to ensure in-policy transactions, eliminating the risk of unauthorized spending.

Enhance End-to-End Spend Management

Pluto eliminates the need for separate investments in corporate fleet cards, offering an all-in-one spend management solution.

Pluto's comprehensive platform facilitates both corporate purchase cards and fleet cards, streamlining your financial operations. Enjoy the same benefits as traditional corporate fleet cards but with enhanced functionality, all within a unified platform. With Pluto, you get unparalleled efficiency in managing corporate expenses, ensuring a seamless and integrated approach to financial control.

Transform your spend management today. Book a demo and discover how Pluto can optimize your financial processes and elevate your business operations.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use