Contents

How to Improve the Expense Reconciliation Process to Close Books Faster

Mohammed Ridwan

•

•

For every expense, teams maintain extensive documents like purchase orders, goods received notes (GRN), invoices, etc. With each increasing expense, the finance team has to spend more and more time on spend management — maintaining these documents, syncing data across accounting systems, ensuring proper approval, categorizing accurately, etc.

This manual process is time-consuming and prone to errors like missing receipts, employee fraud, unrecorded expenses, data entry typos, etc.

As a result, teams have inconsistent data across company systems and spend more time fixing these issues than focusing on their core activities. So, when finance teams strive to improve budget allocations, streamline expense tracking, and enhance financial reporting, they find themselves dedicating substantial time to addressing discrepancies among different financial databases and systems.

This blog will cover improving the expense reconciliation process and replacing manual and old methods with an improved solution.

What is Expense Reconciliation?

Expense reconciliation is a process that matches the actual expenses with the corresponding book entries. It involves comparing two sets of financial records, such as bank statements, credit card statements, receipts, etc., to identify and rectify discrepancies between them.

So, for every expense, you have an entry at an external source and in the internal systems. You match them together to ensure the accuracy of financial reporting, compliance with accounting standards, and prevention of errors or fraud.

However, companies rely on outdated systems — entry-level accounting tools, spreadsheet-based solutions, or legacy ERPs, which cannot handle end-to-end reconciliation processes. These compel finance teams to spend valuable time on manual tasks like data entry and receipt management, hindering reconciliation efficiency and increasing the risk of errors in financial data.

Hence, submitting and tracking expenses becomes cumbersome for employees, while finance teams face manual verification and reconciliation challenges. Managers struggle with delayed approvals, and the overall process becomes susceptible to errors, affecting accuracy and compliance.

How to Reconcile Expenses Faster

Invest in spend management software to reconcile expenses faster. With spend management software, you can track and monitor each transaction on a centralized platform in real time.

The automated process makes reconciliation simpler and faster by providing a single source of information and enabling advanced controls. You can create customizable approval workflows and specify spending rules to suit complex hierarchies and ensure compliance with company policies.

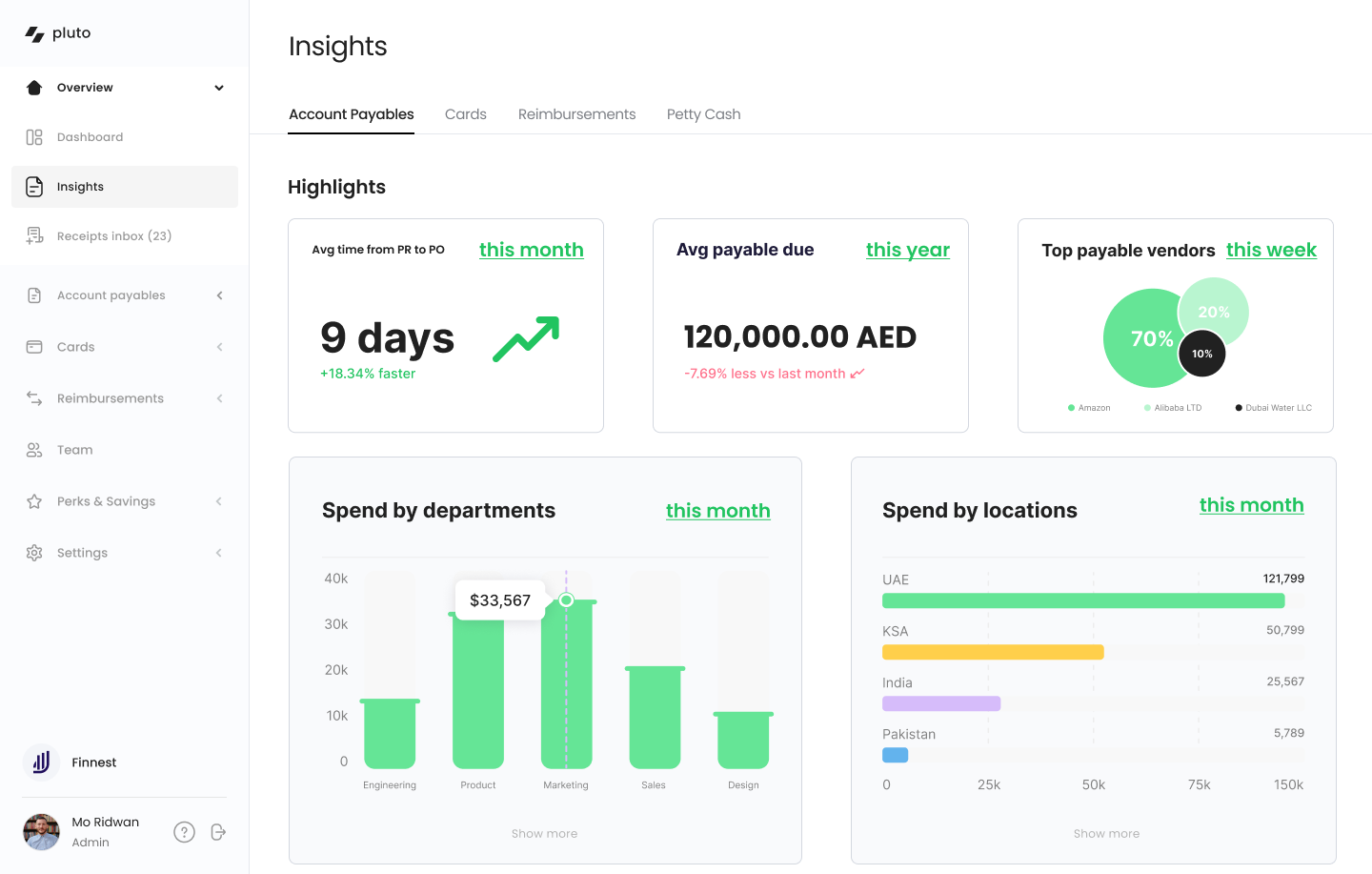

Especially with Pluto, each expense triggers the approval workflow and notifies employees to upload the receipt through WhatsApp. The accounting system integration syncs data across the financial systems to provide a consistent and accurate database.

Here is how switching to Pluto helps you reconcile efficiently and close your books of accounts ten times faster:

1. Easy to Identify Discrepancies

In a traditional manual reconciliation process, identifying discrepancies involves sifting through piles of paperwork or navigating complex spreadsheets.

With Pluto's automated system, this cumbersome task is simplified. The platform's alert system actively flags potential issues, promptly notifying users of duplicate receipts. It not only streamlines the identification of irregularities but also introduces a proactive layer of fraud prevention.

You can visualize and interact with discrepancies directly on the centralized platform, turning what used to be a tedious task into a more intuitive and efficient process.

2. Speed and Accuracy

Automation, real-time tracking, receipt capture (via optical character recognition (OCR)), approval workflows, and robust controls accelerate reconciliation cycles on Pluto.

You need not spend a minute on a manual redundant task. The platform captures and extracts invoices from emails and WhatsApp on a centralized platform. The trigger-based workflows ensure prompt approvals without any friction. Matching documents for three-way and four-way matching simplifies with all the documents on a single tool.

Therefore, the inherent accuracy of financial data, coupled with efficient discrepancy identification, ensures speed and reliability in the reconciliation process.

3. Real-Time Tracking and Visibility

Unlike conventional tracking methods, Pluto offers real-time insights through its centralized dashboard. This furnishes internal teams with immediate visibility into transactions, guaranteeing proactive adherence to company policies.

The agility provided by real-time tracking enables timely data-driven decision-making based on the latest and most accurate data.

4. Better Data Sync for a True Picture

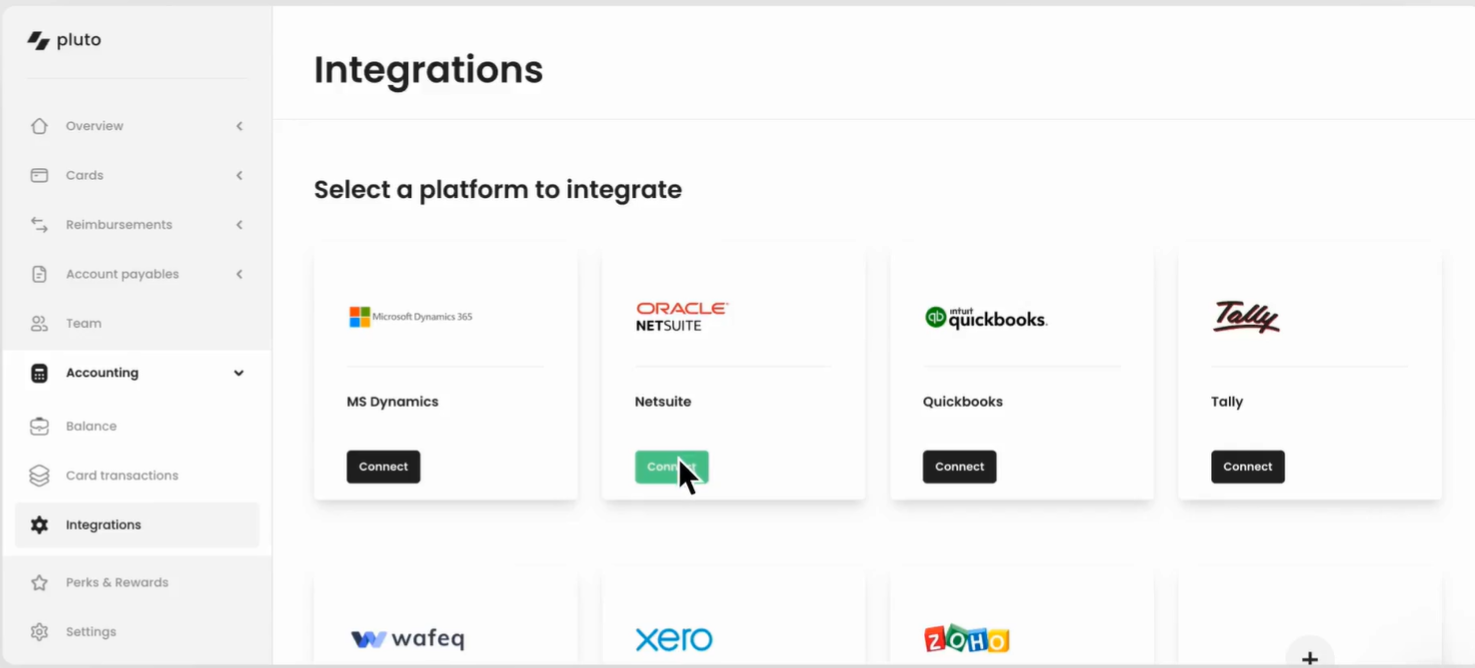

Manual data entry is prone to errors and delays, leading to discrepancies in financial records. Pluto's seamless integration with major accounting systems like Xero, Zoho, QuickBooks, Netsuite, and Dynamics ensures that the financial data is up-to-date and aligns with the organization's accounting records. This synchronization eliminates the need for manual adjustments and corrections, providing a true and accurate picture of the organization's financial status.

5. Enhanced Controls Over Processes

Building intricate approval workflows is simplified with Pluto. You can set up approval processes using simple if-then rules without the need for complex coding. Devise custom workflows that align perfectly with your company policies, creating a seamless and controlled process.

6. Traceable Audit Trail

Pluto maintains a traceable audit trail of all financial transactions and activities. It provides a comprehensive record of changes made to financial data. From the initiation of a transaction to any subsequent modifications, the traceable audit trail ensures transparency and accountability. This trail helps you avoid fraud and trackback discrepancies without friction.

Also, you can lock transactions post-approval, which adds an additional layer of security and integrity, facilitating smoother audits.

7. Save Time and Money

Automating financial processes, including procurement, expenses, and payables, significantly reduces manual steps in reconciliation.

Pluto's ability to capture general ledger and tax codes from expenses automates data entry. It reduces the time spent on routine reconciliation tasks. This efficiency allows finance teams to allocate resources more strategically, focusing on higher-value initiatives rather than repetitive manual tasks.

Timely financial insights help finance teams support decision-making processes with precision and confidence, fostering a data-driven financial ecosystem.

Internal Controls Strengthen Expense Reconciliation

Expense reconciliation burdens finance teams with time-consuming manual efforts and the constant threat of challenges like duplicate receipts and policy violations. These complexities lead to prolonged reconciliation cycles, hindering financial efficiency.

However, the actual progress happens when you strengthen internal control over financial reporting (ICFR), which is the anchor for successful automation in finance.

When you embrace ICFR strategically, it bolsters internal controls, protects against risks and fraud, and sets the stage for smooth automation. The impact goes beyond just easing manual work; it promotes precision, reliability, and transparency in financial workflows.

In simple terms, ICFR mitigates risks tied to financial inaccuracies. Read how to improve your ICFR framework for enhanced reconciliation processes.

Find out how much your business can save with Pluto

Discover your savings with Pluto's Cost Saving Calculator and take control of your expenses. Unlock cost-efficiency now!

Calculate NowLearn how Pluto is helping Keyper to eliminate petty cash spending and optimize spend management

Read More

Mohammed Ridwan, COO of Pluto

At Pluto Card, our mission is to assist businesses of all scales make well-informed choices. To uphold our standards, we follow editorial guidelines to guarantee that our content consistently aligns with our high-quality benchmarks.

Get started with a free account

Let Pluto do all the heavy lifting, so your finance team and employees can focus on things that actually matter and add to your bottom line. Get started with a free account today.

You may also be interested

•

Mohammed Ridwan

Top 6 Spend Management Software for Businesses in the UAE (2023)

Managing business spend is a key concern for most companies. The use of spreadsheets, paper receipts, paper vouchers and handwritten notes makes processes inefficient, time-consuming, and resource-intensive. It also reduces the finance team’s visibility over the company’s spend.

The lack of control over spend causes stress within finance teams, who lag behind due to lack of visibility. Moreover, the cash chaos leads to unspoken internal resentment wherein CFOs think that their teams aren’t providing the necessary key financial insights they require.

A spend management platform can solve this problem. But not every software offers the same functionalities and benefits. You need to select the one that has a good UX and in-depth offerings, enables more reporting, is flexible and scalable, integrates with your ERP, supports the complexities of your business, and has robust security. It should also fit into your organizational structure.

To help you choose the most suitable one for your organization, this article will cover the top 7 spend management software to manage your corporate spending.

- {{finance-teams-time="/components"}}

What Is Spend Management Software?

A spend management software is a tool that helps manage corporate spend, i.e., all non-payroll expenses. It does this by:

- Simplifying capture, storage, and retrieval of receipts and documents to reduce the risk of misplaced receipts

- Deploying approval workflows to ensure that business spending follows the company's approval hierarchy

- Providing real-time visibility into business expenses, helping to identify any irregularities

- Generating alerts when an expenditure violates company policies

- Automating employee reimbursement processes to reduce delays in employees getting paid

- Maintaining a complete audit log, including spending approvals and changes

- Easily sync with your ERP/accounting tool for streamlined month-end close

- Managing petty cash expenses by tracking and recording small, miscellaneous expenses in real-time

- Facilitating payment capabilities to handle outgoing financial transactions

- Integrating corporate cards for real-time expense tracking and control spending

- Facilitating procurement processes for the purchase of goods and services

- Handling invoice management to ensure timely payment and record-keeping to foster healthy vendor relations

Hence, spend management software provides financial visibility and control.

Top 7 Spend Management Software

These are the top 7 spend management software to consider:

1.Pluto

Pluto is a spend management platform for enterprises that transforms your finance processes with automation to provide more visibility and control. It brings together the spenders, savers, and sourcers of your business to offer a complete revolution from a chaotic spend management system to a seamless collaborative workflow. It is the fastest way to manage your finances, including account payables and employee reimbursement.

Key Features:

- Custom approval workflows that adapt to the company's hierarchy for timely and accurate approvals

- Facilitate intricate multi-layer workflows to adapt to complex hierarchies to support seamless purchase requests and automate purchase orders

- Unlimited corporate cards with budget controls to maintain expenses within corporate policies

- Offers zero-balance cards, which get funded once the expense is approved.

- Card-specific policies to make branch & subsidiary-level reimbursements easy

- Ability to add comments and document the conversation along with other transaction details to maintain a comprehensive audit log

- View-only access available for external accountants to review financial data without making changes

- Automated receipt capture through OCR, with the ability to support bulk upload via WhatsApp and emails

- Alerts in case of duplicate receipt uploads to avoid fraud and compliance issues

- Custom expense reports to overview business expenses and spending trends

- Integration with accounting platforms like Netsuite for advanced general ledger (GL) coding, tax tracking, vendor syncing, etc.

- Secure document storage with a 5-year audit log and bank-grade encryption

Pricing:

Pros:

- Enables branch & subsidiary-level spend tracking (not offered by other platforms)

- WhatsApp integration to make receipt upload easy

- Offers up to 2% cashback on all non-AED transactions

- Independent PCI DSS Level 1 Certification

Cons:

- Slightly longer on-boarding due to corporate card offering

- Integrates with all other major ERPs except Tally

2.Procurify

Procurify simplifies spend management by accelerating the approval and reconciliation process. It helps to track the business spending with real-time tracking and breaking down data silos. With a core focus on simplifying invoice payments and management, it helps businesses in vendor and spend management.

Key Features:

- Ability to approve requests based on attached receipts and leave comments for clarification

- Custom budgets for different departments or projects

- OCR to auto-extract invoice data with a dedicated centralized invoice box and automatic matching with purchase orders

- Detailed reports based on different departments, categories, or other relevant parameters

- Tailored expense request forms to capture specific information relevant to the organization's needs

- Compatibility with multiple currencies, streamlining international expenses

- Storage of all expense-related documents, including receipts, invoices, and expense reports

- Integration with ERP to sync expense data

Pricing:

It has standard all-in-one pricing of $2000/month. But custom pricing quotes are provided for add-ons like more users, more domains, NetSuite integration, on-premise training, implementation services, and on-premise hybrid implementation.

Pros:

- Easy to make amendments, for instance, to invoice amounts, which helps when raising a PO before receiving the invoice

- Responsive support team when handling technical issues

Cons:

- Does not offer corporate cards in UAE

- Only supports procurement based spending

- Poor reporting capabilities—lacks functionality

3. Spendesk

Spendesk combines approvals, corporate cards, expense reimbursements, and invoice management to automate the spend management process. Specifically designed for finance teams, it offers real-time expense tracking and offers custom workflows for complete control. By consolidating all payments, it provides a spend management solution that enhances financial transparency.

Key Features:

- 100% digital expense reports

- OCR technology to capture and extract key details from receipts

- Expense claim history, available anytime, anywhere, for quick and accurate reporting

- A mobile app for quick reimbursement requests by snapping a photo of receipts

- Real-time expense monitoring to spot errors and missing receipts and stay compliant

- Automates categorization of expenses and VAT account

- Detects duplicate invoices and errors to support three-way matching

- Tracks all purchase orders and invoices with the ability to schedule payments

Pricing:

Request the sales team for a custom quote. A free trial is available.

Pros:

- Single purchases are straightforward and simple

- Easy to integrate with an SSO provider, making login easy and secure for users

- Handy drag-and-drop receipt functionality

Cons:

- Virtual cards are glitchy, with merchants rejecting transactions that have already gone through

- Some basic features are not included in the basic option where they should have been (i.e., memorizing accounting patterns for vendors).

- Corporate cards have defects (especially for travel expenses)

4. Airbase

Airbase simplifies expense reporting with AI and ML. It ensures quick, hassle-free, and smart corporate expense management. It is an automation solution for SMBs and large enterprises. It packages various modules such as AP automation and corporate cards to ease the spend management process for accounting teams and employees.

Key Features:

- OCR to populate details, including GL category, date, amount, and purpose

- Ensures compliance by sending reminders and, if needed, locking cards until policies are met

- Reminders to upload receipts, eliminating the need to chase employees for receipts

- Custom approval workflows and budget limits for physical cards

- Real-time alerts for suspicious activity, enabling quick responses to potential fraudulent purchases

- Supports onboarding with a self-service vendor portal and custom questionnaires

- Facilitates payments and approvals, including multi-subsidiary support, international currency, and real-time GL sync

- Real-time audit trail with receipts, notes, and documentation for transparency.

Pricing:

Request the sales team for a custom quote.

Pros:

- Intuitive and easy to use; no training or previous knowledge required

- Seamless approval workflows

Cons:

- Poor reporting capabilities

- The mobile app is slow and takes time to load pages

- SSO-based login sometimes takes a few tries

- Not suitable for complex branch-level approvals and expenses

5. Coupa

Coupa is a cloud-based automation platform to manage business spending, ranging from procurement to expense management. It facilitates supply chain optimization by providing visibility and control. It streamlines expenses, reduces risk, and ensures compliance by automating reporting, simplifying reimbursements, and offering mobile tracking.

Key Features:

- Offers virtual payment cards for pre-approved expenses, speeding up the reconciliation

- OCR technology and integration with accounting software eliminates manual data entry

- Provides expense reports with intelligent algorithms to prevent fraud and ensure compliance

- A centralized view of all expense spending, enabling accurate assessment

- Enables visibility and control over travel expenses before they occur, ensuring budget control

- Simplifies procurement by offering a centralized area for comparing items from various suppliers and managing punchouts and hosted catalogs

- Provides real-time visibility into purchase orders, order lifecycle, and order line availability

- SmarterTrip feature to automate expense tracking based on the user's location, including mileage and receipt capture

Pricing:

Request the sales team for a custom quote.

Pros:

- Several categories and filters in the analytics section to streamline data

- Chat option enables approver and claimant to discuss issues with receipts

- Enables setting up of customized approval chains and including additional new approvers

Cons:

- Lots of unnecessary notifications, making it difficult to select the ones that need action or comment

- Low receipt searchability, making retrieval time-consuming

- Inconsistent syncing of remit-to address from NetSuite

- Complex to implement and not intuitive, forcing admins to spend more time resolving employees' queries

- Slow customer service

- Very expensive

6.BILL

BILL simplifies expense tracking by providing real-time visibility and customization to manage expenses. It is a spend management solution for SMBs to control payables, receivables expenses, and all corporate expenses. It allows businesses to combine a scattered spend management process into a single platform with seamless syncing.

Key Features:

- Provides credit limits ranging from $500 to $5 million to control spending within constraints

- Makes it easier to monitor spending with real-time visibility into the business finances

- Custom approval workflows to speed up the approval process with minimal friction

- Multiple payment options, including ACH, credit card, check, international wire transfers

- Automates purchase order workflows with the ability to sync and automate two-way matching and three-way matching

- Ability to do quick coding and sync with accounting systems to streamline expense reconciliation

- Enables automated receipt matching, categorization, and expense reporting, reducing administrative workload

- Offers security features, including the ability to freeze and create corporate cards instantly

- Notifies administrators of each employee's transactions, ensuring timely oversight

Pricing:

Bill provides a free trial and essentials pack starting at $45 for six standard user roles. Its team and corporate pack are for $55 and $79, respectively. Enterprises need to request a custom quote.

Pros:

- One-click swift payments

- Minimum training required

- Easy-to-use mobile app

Cons:

- Customer support is difficult to initiate, slow, and unresponsive

- Frequent changes in the interface create confusion for users

How to Choose the Right Spend Management Software

To pick the right software, understand your organization's unique needs.

- What are your goals—cutting costs, enhancing compliance, or making expense processing more efficient?

- What issues do you face with expenses now—a time-consuming process, too many errors, or poor vendor relationships?

- How many employees will use the software, and should it be scalable to accommodate future hires?

- Do you have specific industry rules or in-house policies the software must follow?

Consider these eight factors:

Ease of Use

The software should require minimal training or support with a not-too-steep learning curve. Admins shouldn’t have to spend hours training their employees.

Automation

Choose software with features like automated approval workflows, expense categorization, and notifications. This will improve not only visibility but also accuracy and speed. You will have complete control over finances without having to do tedious manual tasks.

Security

Pick software that complies with security and is certified. It should provide data encryption, role-based access control, and regular security updates.

ERP Integration

The software should integrate with existing financial and accounting systems. This provides a unified view of your financial data without any disruptions. You shouldn’t have to sync data from multiple sources, which can add up to the manual tasks.

Document Capture and Retrieval

Pick a software that has simple document capture and retrieval capabilities. Attaching or retrieving receipts, invoices, and other relevant documents should not take more than a minute. OCR-based software that detects the information to auto-populate expense reports is better than that requiring manual entry.

Budget Control

Select software that enables specifying budgets for different projects, departments, or expense categories. It should be able to monitor the set budgets and raise alerts in case of breach. It should also allow you to modify these budgets at your discretion, ensuring funds reach the right place at the right time.

Multiple Payment Options

The software should allow you to configure custom payment options to suit your business needs. This includes credit cards, ACH, or other payment methods.

Scalability and Flexibility

Select software that can accommodate increased usage for growing businesses. It must also be flexible enough to adapt to changing needs, such as new expense categories, compliance requirements, and organizational structures.

The Spend Management Solution for Your Team

Investing in a spend management tool like Pluto is a smart decision that can improve your financial visibility. From set-up to integration and managing intricate workflows, Pluto handles all aspects of spend management.

- It seamlessly integrates with your current processes, ensuring a smooth transition.

- It offers flexibility to handle complex operations, catering to the needs of both small and large teams.

- Its automation capabilities reduce manual tasks and enhance accuracy for better expense management.

Pluto is the only independently audited PCI DSS Level 1 provider in the UAE, ensuring the highest security standards for enterprises.

Pluto offers a spend management tool that adapts to your evolving needs and provides freedom from financial chaos.

If you want to see how Pluto can transform your spend management into a simpler process, book a demo today.

Disclaimer: The comparisons and rankings of spend management software competitors in this article are based primarily on reviews found online. While we strive to provide accurate and up-to-date information, these reviews are subjective and reflect the opinions of the users who posted them. The information presented is intended for general informational purposes and should not be considered as a definitive guide for choosing a software provider. We encourage readers to conduct their own research and consider their specific needs before making a decision.

•

Vlad Falin

Employee Expense Reimbursement Management: Types & Policies

Business expense reimbursement is one area of spend management that business owners do not always give its due. And yet, nearly every organization will have to reimburse employees for their expenses at some point.

Part of the problem is that these expenses can vary significantly, from buying office supplies to traveling or even medical costs. If your business deals with many types of expense reimbursements, you might wonder what you need to cover and how you should handle it.

If you’ve had trouble working out your organization's different business expense reimbursements, or you want to learn more about repayments, you’ve come to the right place.

Today, we’ll take a look at the different types of business expense reimbursements and even share some tips to help you streamline your expense reimbursement process.

{{reimburse-employees="/components"}}

What is expense reimbursement?

A business expense reimbursement is simply the act of paying back an employee for expenses incurred while performing a job for your organization.

Technically, almost any type of expense can qualify as a business expense for the purpose of reimbursement, depending on the reimbursement policies of the business. But to give you a clearer idea, here are some common examples of reimbursable expenses:

- Business travel costs

- Meals and entertainment

- Employee education or training

- Medical expenses

- Gas expenses for a company-issued or private vehicle

- Business supplies or tools

- And other miscellaneous business-related expenses

You could handle these expense reimbursements individually, meaning you review each expense separately, or you could create a policy for employee expense reimbursement.

{{effortlessly-manage-banner="/components"}}

Do I Need to Have an Expense Reimbursement Policy?

You are not required to have an expense reimbursement policy, and in some cases, reimbursing expenses is not even mandatory to begin with. Though that largely depends on the legal framework of your country.

However, since it is customary in the UAE and the MENA region to reimburse employees for expenses, then it would be wise to create guidelines and policies to help you organize and streamline that process.

Creating a policy for reimbursements helps set the right expectations for employees about what qualifies for repayment and enables you to streamline your expense reimbursement process.

With an expense reimbursement policy, your employees will know precisely what they can be reimbursed for, how to request said reimbursement, and how long it would take to receive the funds.

Whether you have a business reimbursement policy or not, you need to have a clear picture of which expenses your employees might incur for your business and how you would go about reimbursing them.

- Is the expense tax deductible?

- Is this a common type of business expense in your industry?

- Do you have a policy in place for this expense?

- Are there any types of emergency purchases that an employee might need to make?

Types of expense reimbursements

Traveling and accommodation

One of the most common types of reimbursement requests is for travel expenses. Gas has been a particular pain point for many businesses in the MENA region due to the rising costs of fuel. Other examples of travel expenses include moving to and from an airport or travel terminal, travel tickets, public and private transportation expenses, car rentals, and lodging.

Office supplies and communication

If your organization relies heavily on digital work, you might need to reimburse your employees for supplies like laptops, tablets, software purchases or subscriptions, training materials, and more.

Also, if your team needs to move around frequently and you need to maintain communication at all times, reimbursing them for their cell phone plans might be necessary. In particular, this applies to teams in sales, marketing, and business development.

Food and entertainment

Business trips typically cover employee meals as reimbursable expenses. As long as the expenses are incurred in the interest of the business, they’re reimbursable.

Other expenses

Medical expenses, such as health insurance, insurance premiums, and tuition, are another form of employee expense that is often reimbursed by companies. If your business deals with these types of expenses, make sure you have a clear policy for handling them.

8 tips to simplify your expense reimbursements

1. Learn what you need to reimburse

Although the legalities of employee reimbursements vary from country to country, it’s traditionally customary for employers to reimburse their employees for expenses incurred on behalf of the company.

It is important to note, however, that your employees cannot claim reimbursements for every purchase made, only those that are specifically tied to your business in some form.

While the specific type of expenses you have to reimburse will vary from industry to industry, you should have a general idea of what costs an employee might have to cover out of pocket in the process of working for you.

- Do they need to travel around in their own vehicle?

- Do you need them to be communicated at all times?

- What kind of equipment do they require?

- Are there any health risks associated with their job?

These types of questions can help you figure out which expenses you will have to deal with. Clear guidelines about what is and isn’t reimbursable will help reduce instances of fraudulent reimbursement requests.

2. Use a spend management platform

With the right expense management software, you would be able to automate and optimize end-to-end workflows throughout your process.

For instance, with a spend management platform like Pluto, employees can use a mobile app to record expenses as they incur them.

In this way, your employees no longer have to save receipts or wait before entering their expenses. Plus, Pluto can automatically assign reports to the right reviewer, making the review and approval process more efficient.

Not only that, but Pluto can also tag the receipt so the categorization of the expense is much easier and reporting is real-time.

In addition to providing digital copies of relevant documents, Pluto can notify your finance team of approvals and deadlines.

3. Spend management platforms enhance collaboration

Pluto’s expense management solutions come with an employee portal so that your finance team can collaborate seamlessly with your employees.

This allows you to save time when you need to discuss any irregularities with their expense reports. Additionally, your employees can use Pluto to check the status of their reimbursement requests.

The finance team can also use Pluto to manage costs more efficiently due to its analytical capabilities, real-time reporting and instantaneous spend limit settings.

4. Create a Thorough Expense Reimbursement Policy

When creating your reimbursement policy, you’ll want to make sure that it covers as many angles as possible.

One way to do so is to invite stakeholders from multiple different departments, such as HR, finance, legal, and procurement, to a brainstorming session, as their knowledge will make it easier to draft the policy.

5. Crafting your reimbursement policy

It’s also critical to consider the following when drafting your expense reimbursement policy:

- The specific type of expenses that can be reimbursed

- The process your employees need to follow to submit their expenses, including any proof and supporting documentation

- Whether any allowances will be given for expenses, and how to manage any excess

- The specific time an employee has to submit their expense report

- How the approval process will be handled

- When and how your employees are reimbursed

6. Promote the adoption of the policy

One way to help employees adopt the policy more quickly is by making it readily available to them. The policy should be emailed to your employees or posted on your internal networks.

Employees should be informed when they will receive their payment from the company. You should set up a transparent and clear process to communicate what can be expected in terms of expense reimbursement.

7. Be extra clear about deadlines and payments.

Be sure to let them know how they will receive the payment, such as via direct deposit or check, as well as how they will receive recorded confirmation of the payment made (such as a statement on their paycheque). You can complete this step easily with the help of an online payroll solution.

It is important to keep things running smoothly when it comes to paying employees. By processing reimbursements timely and reliably, you can easily prevent frustration caused by late payments.

Having your employees pay out of their own pockets and not receiving payment back sooner rather than later can cause unnecessary ill feelings toward your company. When you handle reimbursements well, it reflects back on you as a respectable and considerate employer who cares about employees.

8. Make sure your employees follow the deadlines you set

You need to provide employees with deadlines for submitting expense reports, such as one week before their next pay date, so they can be reimbursed and get approval for their claims.

Make sure the expense reports comply with the policy guidelines by giving yourself enough time to review them. By doing so, you can consult with the employee if there are any discrepancies, missing or incomplete documentation, or expenses that do not fall within the policy.

It’s important to submit expense reports on time since certain business expenses are tax deductible.

Optimize your expense reimbursement management process

It’s not enough to know what your expenses are and to create a policy for their reimbursement.

You also need to make sure that your reimbursement process is organized and efficient.

Otherwise, you run the risk of creating bottlenecks if you get slammed by more requests than you can handle. You can avoid this by optimizing the process used to submit reports and their attachments, ensuring all reports are reviewed in a timely manner and processing reimbursements as quickly as possible.

Having put all of this in place, it’s now time for the audit. The importance of audits is particularly important for enterprises and mid-size firms where employees incur large expenses. Auditing your expense reports also helps you identify loopholes in your policy and reduce instances of fraudulent claims.

You can also use audits to analyze your business expenses and identify areas for reduction.

Ensure there is an organized system for expense reimbursement requests

You should ensure that the system your employees need to use to submit their expense reports is easy to use and understand.

Pluto allows the employee to submit all necessary supporting documentation, such as their receipt, the total amount of the purchase, a description of the goods or services purchased, and the date of the transaction.

Use a corporate card or direct deposits to remove the need for reimbursements

A corporate p card is a great way to prevent employees from paying out-of-pocket for business expenses.

You can track your expenses more efficiently and effectively with corporate cards, which provide spending limits that prevent employees from abusing their privileges.

Consider issuing corporate cards only to your regular travelers, or try direct deposits if you’re concerned about the cost.

Alternatively, you can also use direct deposits of reimbursement funds to eliminate the reimbursement process.

Two benefits result from this: One great perk of following either process is that your finance teams will have better visibility into the reimbursement process, making auditing employee expenses easier.

Key Takeaways

- The best way to deal with business expense reimbursements is to have a rock-solid reimbursement policy in place. This way, you can reimburse employees for their costs on your terms.

- Another great way to manage your expenses is to make use of a corporate card to eliminate the reimbursement process altogether, though this might not be feasible for all cases.

- As in many situations, your best option will most likely come in the form of digitization. Using a spend management platform like Pluto, will not only give you much better visibility over your employee spending but also streamline the reimbursement process for you.

•

Leen Shami

We got funded!

We're thrilled to announce that Pluto closed US$6M in Seed funding in February, led by Global Founders Capital.

With GFC being the lead investors, we've had participation from several of the world's leading investment firms and entrepreneurs. Soma Capital, Graph Ventures, Adapt Ventures, Ramp, Thejo Kote (Founder of Airbase), Shaan Puri, and William Hockey (Co-founder of Plaid) were some of the few who participated.

With our Seed round, we aim to get closer to achieving our mission; to streamline company expenses for MENA businesses.

The problem

Company spending in the MENA region is problematic, time-consuming, and frustrating. Managing company spending in MENA today is difficult, time-consuming, and frustrating, as today, companies only get a single debit or credit card.

OTPs

Today, employees all share one company credit card, which usually leads to an OTP being sent to the CFO, financial leader, or founder of the company. Most bank OTPs last from 2 to 10 minutes before they’re expired. So, if an employee doesn’t get the OTP in time, they won’t be able to complete the transaction.

Overspending

When a company credit card is issued, you cannot control spending. This means there is no way to set limits on the card to avoid being overcharged by recurring subscriptions or employees going over budget.

No visibility

You cannot get real-time visibility or instant reports on business expenses with company credit cards. This makes making informed decisions about allocating resources in real-time more challenging.

Petty cash

Banks have no ideal solution for petty cash management. Companies typically maintain a cash vault at their offices, distribute loose cash to employees, and spend countless hours collecting and matching invoices.

The solution

Introducing Pluto Card: a corporate card & spend management platform that allows MENA companies to simplify and control their business expenses.

With Pluto's software, managers can issue their employees virtual cards with spend and control limits, cards that get canceled after a one-time purchase, and cards with a recurring daily, weekly, or monthly budget.

Employees can request expenses from their managers and submit reimbursement requests by dragging and dropping receipts onto the software. This happens in real-time, where managers can view employee requests as they happen, see what is being spent and where, and gain insight into instantaneous expense reports, helping them make informed decisions.

Pretty straightforward.

Want to see Pluto in action? Sign up and get a private demo here.

Modern finance teams save time & money with Pluto.

Get started today

Join 2000+ finance professionals keeping up to date with the latest news & releases.

© Pluto Card is a Pluto Financial Services Inc. company 2024

The product and services mentioned on this webpage belong to Pluto Technologies Ltd (Pluto), a company incorporated under the laws of Dubai International Financial Centre (DIFC), Dubai holding commercial license number CL5294. Pluto is a financial technology provider and not a bank. Pluto provides certain facilities for the utilization of payment services through Nymcard Payment Services LLC under the applicable payment network and Bank Identification Number Sponsorship of Mashreq Bank PSC. This is pursuant to the license by Visa® Inc and is available for the residents of UAE subject to Terms and Conditions of use